A hundred years from now, historians researching the early years of this century may need to fast-forward to get to the good stuff – assuming there is any good stuff to be found. Global news nowadays seems increasingly to resemble the sordid swill that was always a staple of local-news round-ups: Bodies of Six Boys Found in Scoutmaster’s Basement. Town Claims Fracking Caused Birth Deformities. Bed Bug Plague ‘Out of Control’. Mother Suffocates Twins after Hearing Voices. From a global-news perspective, the item-of-the-hour is Dennis Rodman’s trip to North Korea. We’ll give the Washington Post credit for recognizing the silliness of the story with a tongue in-cheek headline that captures the banality of Kim Jong-un’s lunatic existence: As Dennis Rodman Visits, North Korea Pledges ‘Bitter Hatred’ for the U.S. So much for basketball diplomacy. In a better world, Disney would transform the DMZ into a theme park based on the “new and improved” 42nd Street, and Mr. Kim would die of cancer, consumption, or – wouldn’t it be ironic – Lou Gehrig’s Disease.

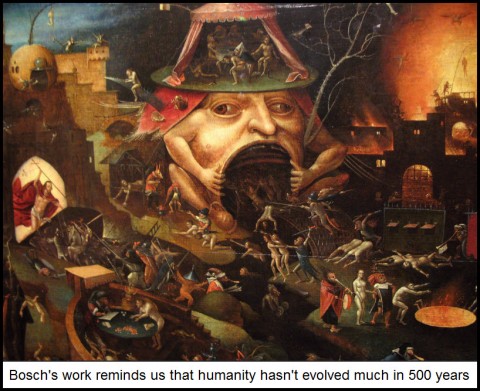

We welcome the comic relief that the day’s headlines bring us nonetheless, since the alternative is to talk about how the Dow Industrials rallied 175 points yesterday on whatever it was that Helicopter Ben said. Recall that just a couple of days ago, the news media told us that a 200-point selloff in the Dow reflected concern over Italy’s recent election, which was said to have been anti-austerity and anti-status quo. And now, in the wake of an equally overdone and meaningless rally on Wall Street, we are being told that “investors” were pleasantly surprised by the Federal Reserve’s apparent decision to stay loose. As though a politically feasible alternative even existed. We leave it to that politically insufferable moron-cum-Nobelist Paul Krugman to interpret the latest non-twist in Fed policy as somehow being economically beneficial to us all. In reality, we should be embarrassed and ashamed that Western Civilization has embraced easing as its main religion. The crackpot belief that central bank purchases of sovereign debt can restore prosperity is the central tenet of this age. This is the madness of tulipomania gone global, is all.

***

If you’d like to learn more about our low-risk option strategies, and also about the camouflage trading technique we use to reduce entry risk to a bare minimum, try a free subscription to Rick’s Picks by clicking here. You’ll get access to timely trading “touts” that are updated in real time, as well as admission to Rick’s Saloon & Betting Parlor, where veteran traders from around the world gather 24/7 to talk shop.

Gold, energy, utility markets are all at breakout or breakdown stages. My guess is breakout. I can only assume they breakout with equities.

Anyone playing the expected sharp move? If so, how?

I read that Gold could hit 2400 from here very fast. I might straddle these sectors or wait till the market tells me which way it is headed. This is going to be a big week. If so there goes my assumption on a low VIX.

I also saw the 60-minute piece on China’s real estate bubble. With all those sold apartments with zero occupancy I must conclude it will turn out very badly. I have changed my position on China, and now think it’s possible they lead the world markets down. In any event I am guessing it doesn’t show up till May/June. Strange reversal of fortune, US leading in the recovery while everyone else falters.