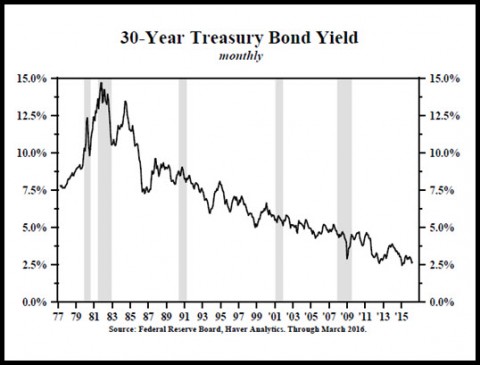

[U.S. Treasury Bonds have been in a bull market for 35 years as interest rates have fallen from a high of nearly 15% in 1981. Investors who have stuck with long-term U.S. debt have reaped very substantial capital gains as a result. But with yields on the 30-year at a current 2.63%, how much lower can they go? Our friend Doug Behnfield, a Colorado-based financial adviser whose thoughts have been featured here many times before, believes there is still room for further gains. He explains why below in a letter to his clients that focused on two of his favorite investment vehicles: closed-end municipal bond funds and long-term zero-coupon bonds. This is must reading for anyone eager to understand how these vehicles work. For our part, we see long-term U.S. rates falling over the next 2-3 years to an epochal low of 1.64%. If this comes to pass, holders of long-term Treasury debt will do very well indeed. RA]

‘Thoughts on Duration’. How is that for an intriguing title? One purpose of this comment is to attempt to explain how bonds work so that you can understand what causes the bond price to change when interest rates go up or down if you don’t already. Another purpose is to explain how closed-end municipal bond funds and zero coupon bonds (Strips) work because they represent the vast majority of fixed income exposure in your portfolio. It is likely that we are entering the final phase of “The Great Bull Market in Bonds” that began 35 years ago. If that is the case, our asset allocation can be expected to change dramatically over the next couple of years. As interest rates approach a low enough level that finally makes the risk/reward equation for long-duration bonds substantially less appealing, our focus is bound to change. Hopefully, that makes this topic more interesting.

Few Understand Price Changes

Bond duration is a financial term that refers to how long it takes to get your original investment back via distributions. One really important thing about duration is that it is also a measure that is used to determine how much a particular bond or bond fund will change in price for a given change in market interest rates. Very few people understand that. The longer the duration, the more price sensitivity the bond has to interest rate movements. It is complicated enough that most investors just throw up their hands when faced with the term.

What makes duration so critical is that (particularly for people living on interest income) it measures the amount of time you have locked in rates. The most common advice from the Financial Services Industry on choosing the appropriate maturities for a bond portfolio has tended toward an allocation that has proven to be way too short-term. It has been a contrarian’s dream. Rather than the popular view that long duration bonds should be avoided because of “interest rate risk”, the reality has actually turned out to be that long-term bonds have provided “interest rate reward”! Not only have long duration bonds locked in the higher rates of the past, they have also provided capital appreciation. Bond investors have been well advised to stick with as much duration as possible ever since the yield on 30 year Treasury bonds hit 15.25% back in 1981. (See chart below)

(Click on charts/tables for a clearer picture)

(Click on charts/tables for a clearer picture)

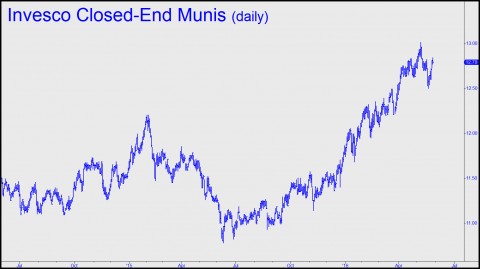

Closed-end municipal bond funds and long-term zero-coupon bonds are two of the longest duration fixed income vehicles available and because of that, they have been among the best performers. Because they are so long-duration, they have gone up more in price than bonds of shorter maturity.

Closed-end Municipal Bond Funds

Closed-end municipal funds differ in many ways from open-ended municipal funds and individual municipal bonds. They are called “closed end” because this type of fund raises money during an initial public offering and after that, investors cannot add or remove assets directly from the fund. The fund managers retain the initial amount raised, say, $1 billion, and they only make income and capital gains distributions to shareholders. Because they do not accept subscriptions or redemptions, investors must buy or sell shares of the fund in an arms-length transaction on a stock exchange when they want get in or out. There are a number of significant advantages and disadvantages to this structure:

- Closed-end fund managers do not have to make buy and sell decisions based on public sentiment and therefore can remain fully invested. Liquidity is a minor concern when compared to open-ended funds where the manager has to buy when the public is sending money in and sell when the public wants out. Bob Farrell’s Rule #5 of his “Market Rule to Remember” is: “The public buys the most at the top and the least at the bottom.”

- Shareholders of closed-end funds do not experience “dilution” during bull markets because there is no provision for adding money directly into the fund. This is big. Open-ended funds typically get large inflows during periods of strong performance, causing the manager to buy when prices are high.

- Closed-end funds can focus entirely on very long-term bonds because their mandate is exclusively “maximum current income”. They do not have to perform versus a benchmark or predict where interest rates are going. They just have to monitor credit quality, maturities and call provisions. The managers of open-ended funds rely on relative performance to retain assets in their fund because relative performance often determines whether the public is adding to or reducing their holdings in the fund. The tendency is for the manager to adhere to a benchmark made up of shorter duration bonds. As a result, open-ended funds tend to experience far less upside performance during bull markets.

- Because there are few liquidity considerations for closed-end fund managers, they usually employ leverage as a means of increasing income. During most of economic history, the slope of the yield curve has generally been positive. A positively sloped yield curve just means that short-term rates are lower than long-term rates. This means that closed-end funds can borrow at low short-term rates and invest the proceeds at higher long-term rates resulting in a greater current yield. In addition, during bull markets, the gains are also enhanced by leverage. It is very important to be aware that leverage can negatively impact returns also, particularly in cases where the yield curve inverts (short-term rates go above long-term rates) or when the price of bonds are declining.

- Closed-end funds trade on the stock exchanges at prices that are often at a discount to the Net Asset Value (NAV) of the fund. They can also trade at premiums. Open-ended funds are always priced at their NAV. Buying closed-end funds at a discount to their NAV adds to the yield that the investor receives.

- The entire universe of closed-end municipal bond funds represents a total of $90 billion in Net Asset Value. This is a ‘drop in the bucket’ of the total market for municipal bonds (which is $3.7 trillion). Because closed-end funds typically represent the longest-duration way to invest in a managed and diversified portfolio of municipal bonds, it is entirely likely that they will go to significant premiums if sentiment gets extremely bullish along the lines of Rule#5. A price move from discounts to premiums would also add to the total return.

Zero (0%) Coupon Bonds

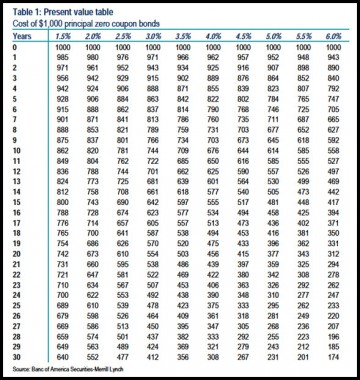

A good example of a 0% coupon bond is an old-fashioned U.S. Savings bond. Remember those? Your grandmother would buy you a $100 Savings bond shortly after you were born that came due when you turned 20. Back in the good old days, they paid about 6% so Grandma only had to spend about $30. That’s because $30 invested at 6% compounded semi-annually grows to $100 in 20 years. (See graph.)

This graph means a lot to me. Stan Salvigsen published the first one I ever saw in 1982 when long-term Treasury bonds were yielding about 14%. Back then the scale for yield (horizontal axis) went from 16% down to 8%. Ah, those were the days! Merrill Lynch had just created a product called a Treasury Investment Growth Receipt (TIGR), which was a synthetic 0% coupon Treasury bond. What they did was buy a bunch of 30-year Treasury bonds, put them in a trust, and separately register the coupon and principal payments. By 1986, the U.S. Treasury began issuing these separate future interest and principal payments in response to the enormous demand, particularly from pension funds. As it turned out, Treasury Strips became the benchmark investment vehicle for funding actuarial liabilities. It is the only bond investment where you know exactly how much money your original investment will be worth 20 or 30 years down the road.

A Lock on Rates

The graph above tells you how much you will earn in total if you receive a specific rate of interest, including an assumption that the rate compounds semi-annually for a specific number of years. When you own a long-term coupon-paying bond, you have no idea what your total return will be because the rate that each of your coupons reinvest at is unknown. To reiterate; a 0% coupon bond not only locks in a rate of interest on your initial investment; it also locks in the reinvestment rate on each of the coupons that you would normally be receiving every six months. Because the coupons on a conventional long-term bond can represent an even larger amount of money than the original investment, the reinvestment rate is a major unknown input in total return. As a result of locking in the reinvestment rate, 0% coupon bonds have a much longer duration than normal coupon-paying bonds and so they change in price in the secondary market much more in response to changes in interest rates.

But the real beauty of the 0% coupon graph is that you can calculate your return on long-term bonds over a short period of time based on assumptions of changes in market rates. For example, a 30-year 4% zero coupon bond costs $308 (see graph). In order to calculate how much it will be worth in 2 years, you have to move up 2 rows and pick a column that corresponds with what you expect rates to be. If rates have dropped to 3%, then the bond will be worth $437, which is a total return of about 42%. If, on the other hand, rates have risen to 5%, then the bond will only be worth $255, which is a loss of about 17%. If rates just stay at 4%, then the bond will be worth $333, which is a total return of 8.11%. That makes sense because 8.11% is 2 years at 4% plus a little compounding. The graph allows you to visualize how bonds react in price to changes in interest rates and this seems to be one of the biggest sources of confusion when it comes to investing in long-term bonds.

Leveraging Small Changes in Yields

In the 2 years ending March 19, the November 2043 0% coupon Treasury bond (Strip) had a total return of 38.7% ($338 to $469) because rates declined from about 3.5% to just under 2.6% on 30-year Treasury bonds. The July 2049 San Diego School District G.O. 0% Coupon municipal bond is up 70.6% in the last 2 years ($167 to $285) because rates dropped from 5.4% to 3.82%. These bonds are very long term and the perception of credit risk has declined in municipal bonds in general and California in particular. In the same two years, the UBS Universe of leveraged closed-end municipal bond funds had a total return (exclusive of dividend reinvestment) of 26.3% and that was attributable both to declining interest rates and a narrowing of the discounts to NAV. Our favorite closed-end municipal funds still have a current yield right around 6%. Keep in mind that the interest portion of the closed-end municipal funds and that of the 0% coupon CA municipals are Federally tax-exempt, whereas the interest portion of the Treasury Strip return is state tax-exempt. Those numbers are fairly exciting (even if this whole commentary is somewhat tedious).

What is most important is the outlook for rates going forward, and there are several factors suggesting that “The Great Bull Market in Bonds” can continue for another couple of years.

- While the U.S. Treasury 30-year bond currently yields 2.58%, German 30-year bunds yield 0.71% and 30-year Japanese government bonds pay 0.42%. Shorter-term yields are actually negative in many countries that do not offer the quality and stability of our country. At some point, Treasury bond yields should converge with those offered in countries like Germany and Japan. At this point in time, it seems more likely that our rates will decline over the intermediate-term rather than theirs rising.

- Inflation remains very low in the U.S. and around the world. The “Shelter” component of the CPI appears to be reversing to the downside, an event that would send inflation lower still.

- GDP growth has stalled in the last 6 months.

- Corporate earnings have declined for 4 quarters in a row.

- The stock market appears to have lost its upward momentum over the last year as well and may very well be at the beginning stages of a bear market.

All of these conditions suggest lower rates on the highest quality government bonds going forward.

“There is no place else to live if you desire the high end American lifestyle.”

I find this hard to believe. You’re duped by weather, mate. I hope it doesn’t bite you in butt.