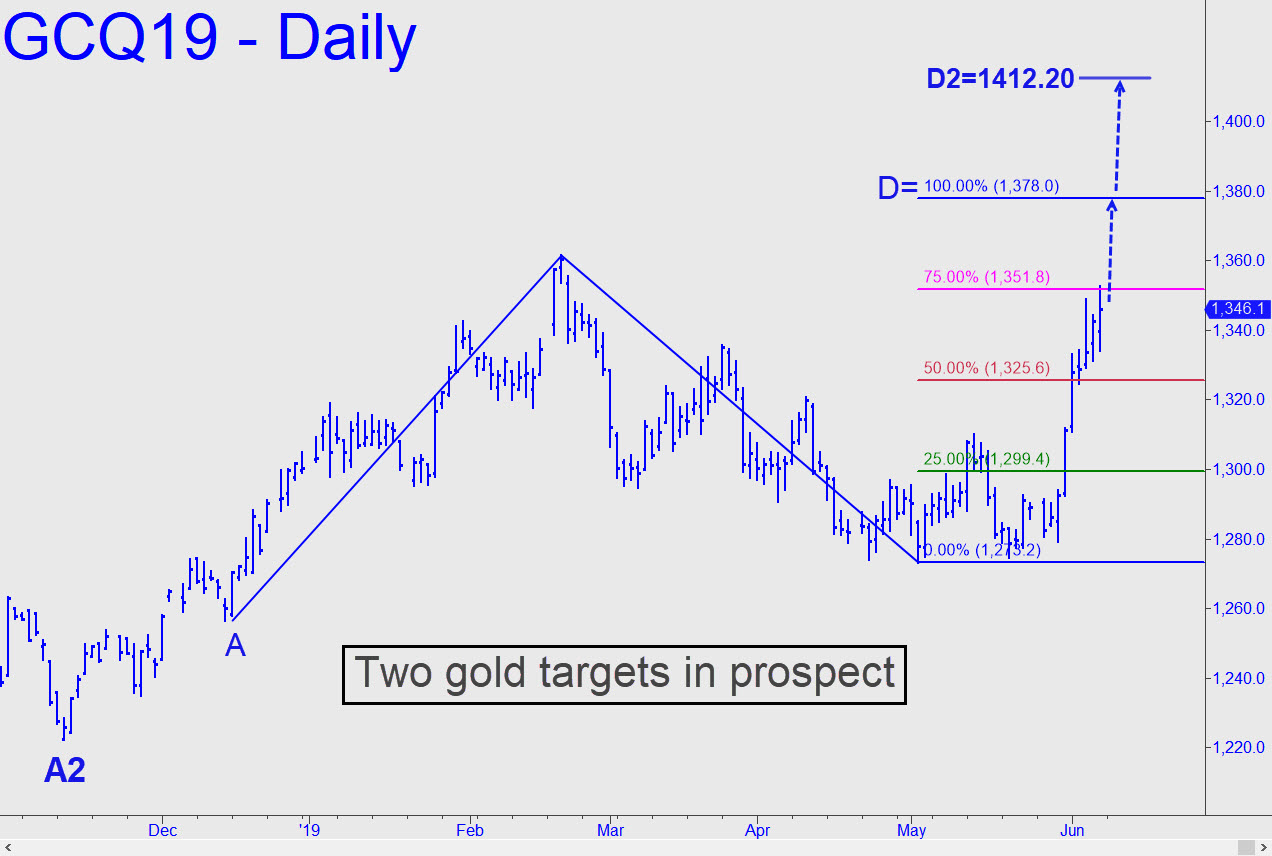

We’ve been using the 1412.20 target shown in the chart to stay on the right side of the trend. It’s not quite a done deal, however, because the rally pulled back to the midpoint pivot at 1325.60 for a day before getting second wind. This suggests, if not weakness, then a mild hesitancy. It will not likely prevent the futures from achieving D=1378.00, but we’ll let price action at that ‘hidden resistance’ determine the odds of the higher target being achieved. Please note that a pullback to the red line would trigger a mechanical buy, stop 1308.10. A somewhat less risky bet would be to place our bid at the green line (1299.40), stop 1273.10. _______ UPDATE (Jun 11, 5:55 p.m. ET): If you bought at the red line (1325.60), exit half now for a profit of $560 per contract. Offer one of the two contracts remaining at 1347.30, o-c-o with a stop-loss at 1325.50 on two. _______ UPDATE: The rally has hit 1348.90 so far, allowing a profitable exit at 1347.30 on the third of four contracts (or multiple thereof) originally bought for 1325.60. The theoretical gain on this trade now totals $3290, plus an additional paper gain of $2170 for the contract still held. _______ UPDATE (Jun 14, 9:50 a.m.): I’m heartened to have heard from numerous subscribers who actually did the gold trade. At this point it’s a straightforward play for 1412.20 on the final contract (or final 25% of your position). With a $6000 profit to cushion you, you can afford to give this one a generous stop-loss. An impulsive stop using the hourly chart would take you out at 1337.20.

We’ve been using the 1412.20 target shown in the chart to stay on the right side of the trend. It’s not quite a done deal, however, because the rally pulled back to the midpoint pivot at 1325.60 for a day before getting second wind. This suggests, if not weakness, then a mild hesitancy. It will not likely prevent the futures from achieving D=1378.00, but we’ll let price action at that ‘hidden resistance’ determine the odds of the higher target being achieved. Please note that a pullback to the red line would trigger a mechanical buy, stop 1308.10. A somewhat less risky bet would be to place our bid at the green line (1299.40), stop 1273.10. _______ UPDATE (Jun 11, 5:55 p.m. ET): If you bought at the red line (1325.60), exit half now for a profit of $560 per contract. Offer one of the two contracts remaining at 1347.30, o-c-o with a stop-loss at 1325.50 on two. _______ UPDATE: The rally has hit 1348.90 so far, allowing a profitable exit at 1347.30 on the third of four contracts (or multiple thereof) originally bought for 1325.60. The theoretical gain on this trade now totals $3290, plus an additional paper gain of $2170 for the contract still held. _______ UPDATE (Jun 14, 9:50 a.m.): I’m heartened to have heard from numerous subscribers who actually did the gold trade. At this point it’s a straightforward play for 1412.20 on the final contract (or final 25% of your position). With a $6000 profit to cushion you, you can afford to give this one a generous stop-loss. An impulsive stop using the hourly chart would take you out at 1337.20.

GCQ19 – August Gold (Last:1331.20)

Posted on June 9, 2019, 5:06 pm EDT

Last Updated June 14, 2019, 12:44 pm EDT

Posted on June 9, 2019, 5:06 pm EDT

Last Updated June 14, 2019, 12:44 pm EDT