(Test) A homebuilder friend of mine who is also a stock-market junkie and savvy trader emailed me a dismal-looking chart of Lennar Tuesday with this bearish note: “The homies have spoken. Get short [the stock market] or miss the down move.” This guy can boast of months when he made more money presciently trading the shares of Lennar, Beazer, D.R. Horton, Pulte et al. than he did from his high-powered construction job. He even managed to tune out habitually upbeat talk in the board room and executive washroom for long enough to clean up on last year’s collapse in lumber prices. And that is why I do not take his trading tips lightly. However, in this case the evidence he presents is so seductive that I am inclined do the opposite — i.e., embrace the seemingly absurd possibility of an imminent upsurge in residential construction. The very idea flouts my gut feeling that America will be in recession before the year ends.

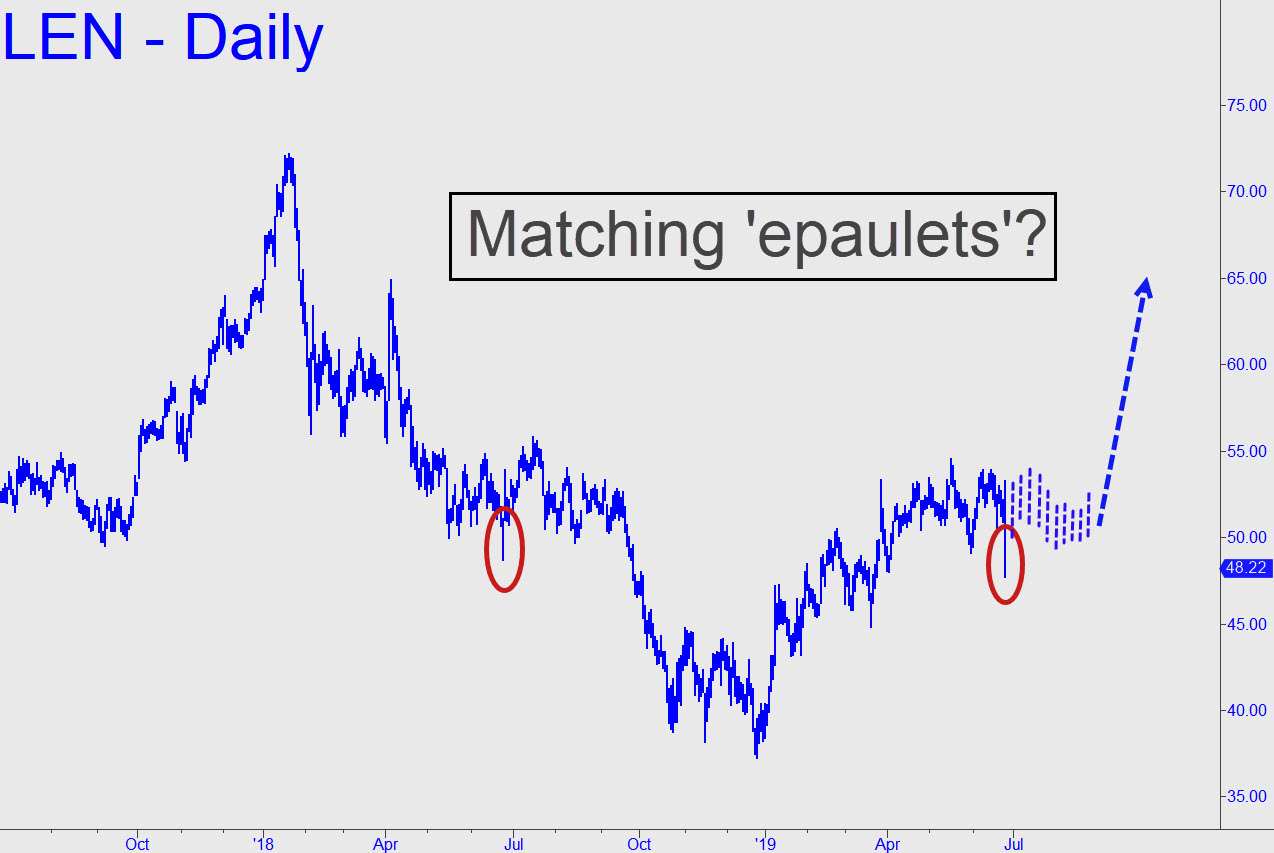

Matching Epaulets

And yet, study Lennar’s chart (inset) and you can easily imagine a reverse head-and-shoulders pattern taking shape with the power to launch Lennar, and presumably other ‘homies’, significantly higher within the next four to six weeks. I have never put much store in H&S patterns because they are virtually everywhere a trader wants to see them. But this one, with drooping epaulets that look like perfectly matched earrings, is so alluring as to confound the skeptic. We’ll probably know by mid-July whether the chart was warning of trouble or throbbing with opportunity. In the meantime, if we get another month of declining home sales, don’t scoff at the possibility of a trampoline bounce-from-nowhere in this statistic. _______ UPDATE (Jul 1, 7:27 p.m.): If bulls are going to turn the stock around, their best opportunity will come at 46.22, a midpoint Hidden Pivot support shown in this chart.