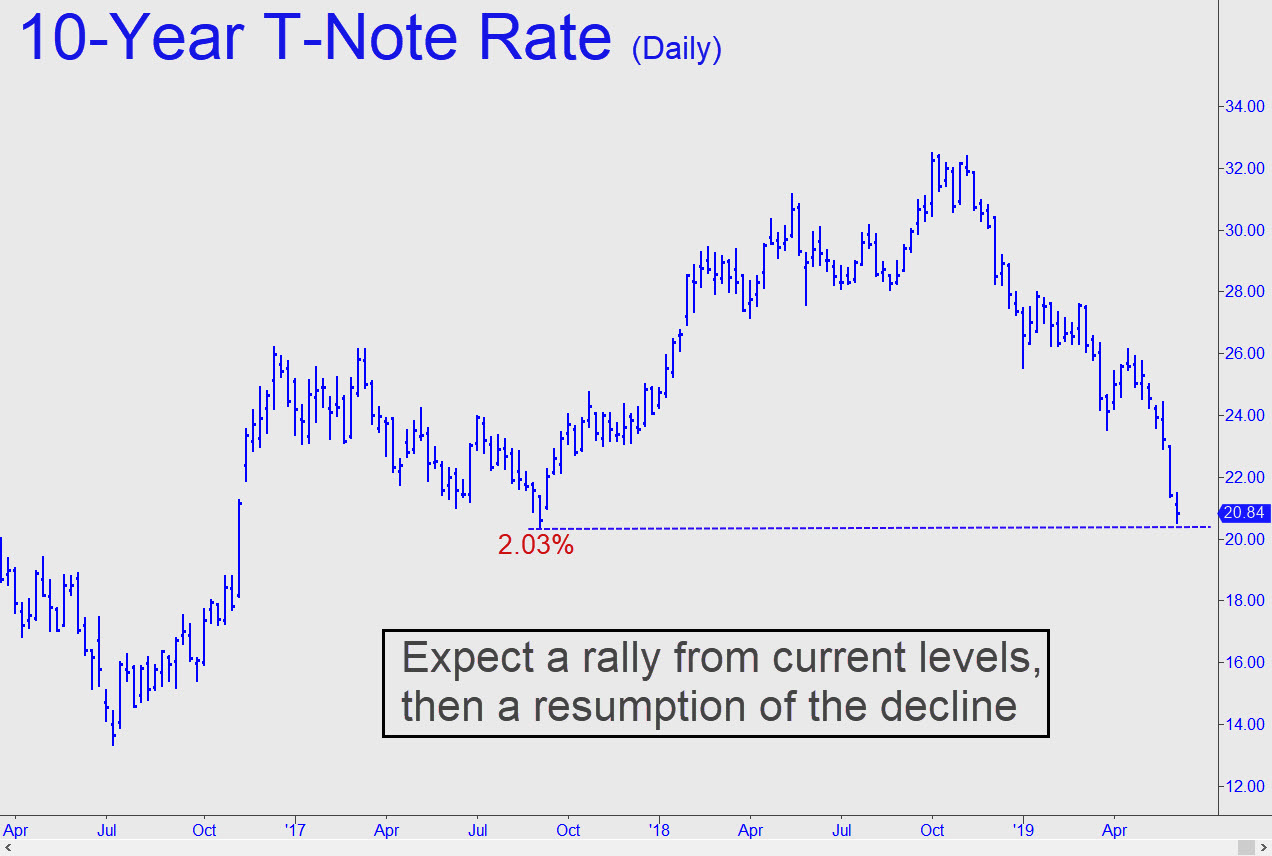

Rates on the Ten-Year T-Note are positioned to rally in the way we might expect of a ‘counterintuitive’ trade set-up. Yields have come down to test the support of a 2.03% low made in 2017, and it should hold for at least a short while. But because the weakness of the last two weeks somewhat exceeded the 2.11% target we’d been using as a minimum downside objective, any bounce from these levels, or perhaps from slightly below 2.03%, is likely to be merely corrective of the larger downtrend begun last autumn. There could be a ‘CI’ trade in the offing (see chart inset), so stay tuned if you’re interested. _______ UPDATE (Jun 20, 11:33 p.m. ET): Assuming the 1.97% low holds, a rally in yields to 2.28% would trip the ‘CI’ buy signal noted above. Here’s the chart. ______ UPDATE (Jul 2, 5:43 p.m.): The rally in Ten-Year rates was short-lived and now they appear headed down to at least 1.944%. Any lower would put a 1.87% target in play.

Rates on the Ten-Year T-Note are positioned to rally in the way we might expect of a ‘counterintuitive’ trade set-up. Yields have come down to test the support of a 2.03% low made in 2017, and it should hold for at least a short while. But because the weakness of the last two weeks somewhat exceeded the 2.11% target we’d been using as a minimum downside objective, any bounce from these levels, or perhaps from slightly below 2.03%, is likely to be merely corrective of the larger downtrend begun last autumn. There could be a ‘CI’ trade in the offing (see chart inset), so stay tuned if you’re interested. _______ UPDATE (Jun 20, 11:33 p.m. ET): Assuming the 1.97% low holds, a rally in yields to 2.28% would trip the ‘CI’ buy signal noted above. Here’s the chart. ______ UPDATE (Jul 2, 5:43 p.m.): The rally in Ten-Year rates was short-lived and now they appear headed down to at least 1.944%. Any lower would put a 1.87% target in play.

TNX.X – Ten-Year Note Rate (Last:1.97%)

Posted on June 9, 2019, 5:07 pm EDT

Last Updated August 1, 2019, 10:01 pm EDT

Posted on June 9, 2019, 5:07 pm EDT

Last Updated August 1, 2019, 10:01 pm EDT