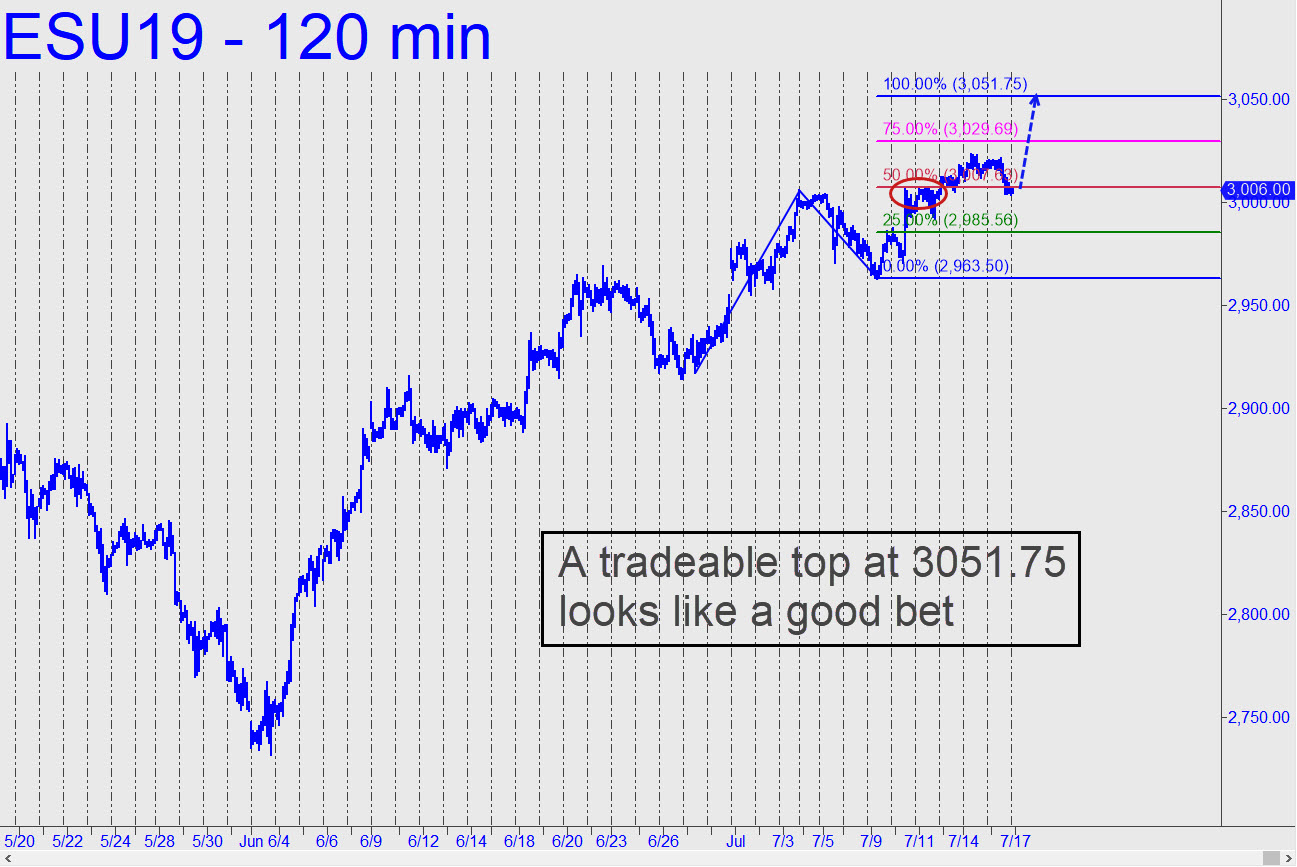

I have significantly higher targets outstanding, but for trading purposes and to get a precise handle on the near-term, I’d suggest focusing on the relatively minor Hidden Pivot at 3051.75 shown in the inset. The pattern could set up two trading opportunities: a mechanical buy on a pullback to the green line (2985.50, stop 2963.25); and a short from 3051.75, stop 3053.25. We’ll consider a ‘reverse’ (rABC) for the second trade if and when 3051.75 is reached, but it would require a small pattern created at the presumptive tail-end of the rally to provide a good entry signal. Tune to the chat room for further guidance in real time if you care. _______ UPDATE (Jul 17, 8:07 p.m. ET): The mechanical trade triggered at 2989.50 and carries theoretical risk per contract of $1100. If two or more subscribers are aboard and let me know in the chat room, I’ll establish a tracking position. Half of the position should be exited at 3007.63, worked o-c-o with the stop-loss. _______ UPDATE (Jul 18, 5:47 p.m.): The ‘mechanical’ trade advised above triggered in the final moments of Wednesday’s session and is showing a theoretical gain of $900 per contract at the moment. The futures are at 3003.50, slightly shy of the midpoint pivot at 3007.63 where I’d suggested exiting half. However, you should do so now, cashing out 75% of the original position in order to nail down a nice gain. Assuming one contract remains from an original four, use the 3051.75 target to exit, making your offer one-cancels-other with a stop-loss at 2963.25. If the trade concludes as planned, the total profit on the position would be $6000. Several subscribers reported doing the trade. Please keep me apprised in the Trading Room.______ UPDATE (6:06 p.m): Moments after I sent out that last update, the futures upticked above 3007.63 (to 3008.75 so far), mooting my advice. Officially I will record the exit on three contracts at 3003.50. In practice, however, anyone who followed my original guidance would have made an additional $200 per contract. The remaining contract (or 25% of the original position) should still be held for a shot at 3051.75, using the stop-loss advised._______ UPDATE (Jul 19, 9:47 a.m.): Raise the stop loss on the remaining 25% of the position to 2971.00, o-c-o with a closing offer at 3047.00.

I have significantly higher targets outstanding, but for trading purposes and to get a precise handle on the near-term, I’d suggest focusing on the relatively minor Hidden Pivot at 3051.75 shown in the inset. The pattern could set up two trading opportunities: a mechanical buy on a pullback to the green line (2985.50, stop 2963.25); and a short from 3051.75, stop 3053.25. We’ll consider a ‘reverse’ (rABC) for the second trade if and when 3051.75 is reached, but it would require a small pattern created at the presumptive tail-end of the rally to provide a good entry signal. Tune to the chat room for further guidance in real time if you care. _______ UPDATE (Jul 17, 8:07 p.m. ET): The mechanical trade triggered at 2989.50 and carries theoretical risk per contract of $1100. If two or more subscribers are aboard and let me know in the chat room, I’ll establish a tracking position. Half of the position should be exited at 3007.63, worked o-c-o with the stop-loss. _______ UPDATE (Jul 18, 5:47 p.m.): The ‘mechanical’ trade advised above triggered in the final moments of Wednesday’s session and is showing a theoretical gain of $900 per contract at the moment. The futures are at 3003.50, slightly shy of the midpoint pivot at 3007.63 where I’d suggested exiting half. However, you should do so now, cashing out 75% of the original position in order to nail down a nice gain. Assuming one contract remains from an original four, use the 3051.75 target to exit, making your offer one-cancels-other with a stop-loss at 2963.25. If the trade concludes as planned, the total profit on the position would be $6000. Several subscribers reported doing the trade. Please keep me apprised in the Trading Room.______ UPDATE (6:06 p.m): Moments after I sent out that last update, the futures upticked above 3007.63 (to 3008.75 so far), mooting my advice. Officially I will record the exit on three contracts at 3003.50. In practice, however, anyone who followed my original guidance would have made an additional $200 per contract. The remaining contract (or 25% of the original position) should still be held for a shot at 3051.75, using the stop-loss advised._______ UPDATE (Jul 19, 9:47 a.m.): Raise the stop loss on the remaining 25% of the position to 2971.00, o-c-o with a closing offer at 3047.00.

ESU19 – Sep E-Mini S&P (Last:3007.25)

Posted on July 16, 2019, 8:24 pm EDT

Last Updated July 19, 2019, 9:45 am EDT

Posted on July 16, 2019, 8:24 pm EDT

Last Updated July 19, 2019, 9:45 am EDT