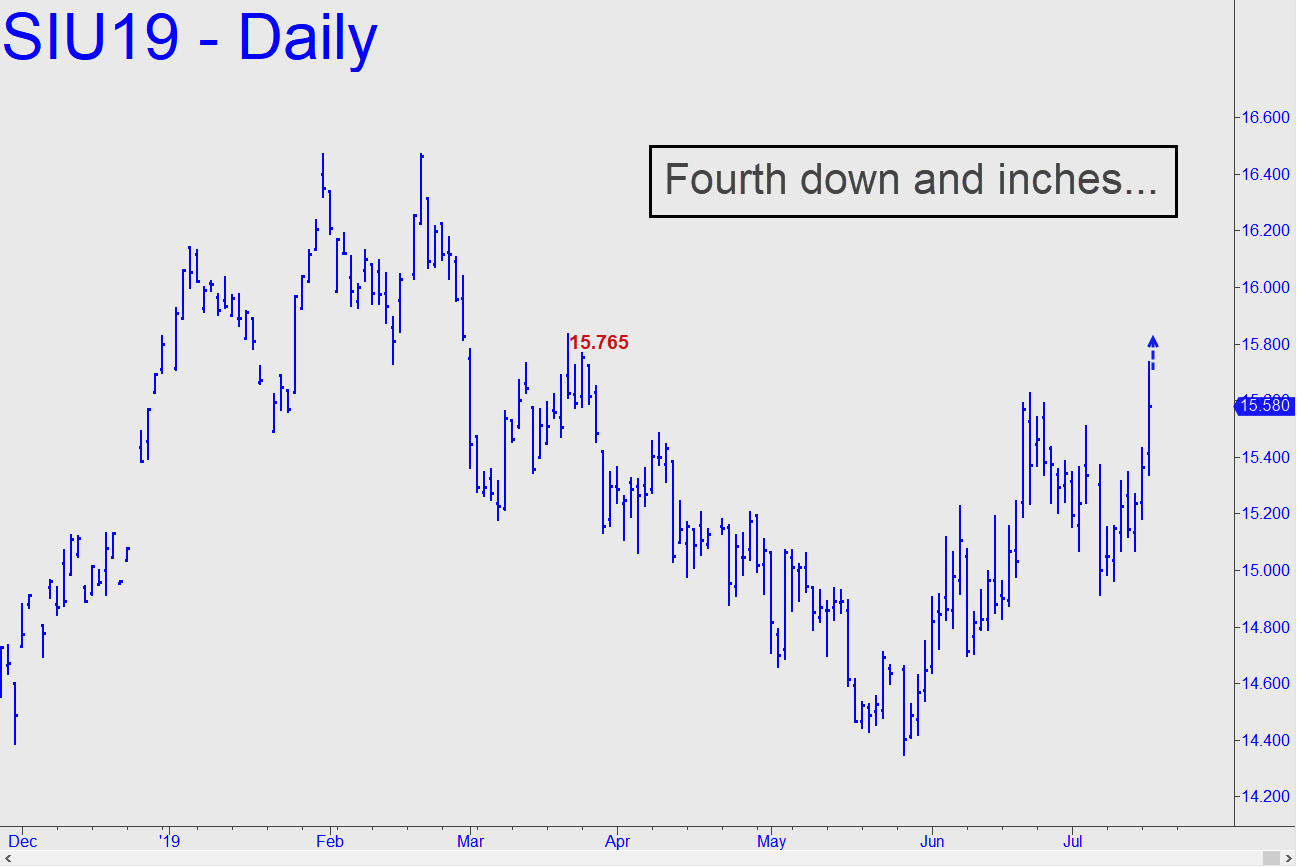

The top of September Silver’s spike on Tuesday fell three cents shy of an important ‘external’ peak recorded back in March. Recall that healthy rallies generate fresh impulse legs with each new thrust. This rally has failed to do so, at least so far, but bulls still deserve the benefit of the doubt because the futures ended the session above the midpoint of their intraday range. If they are going to impulse above the 15.765 peak, however, the sooner the better, since the longer it takes and the more labored the effort, the less underlying strength there is to be inferred. Regardless, bulls are certain to meet resistance at 15.840, a Hidden Pivot target on the daily chart that comes from A=14.700 on June 10. There is an additional resistance a nickel lower, at 15.835, from the peak just above our ‘external’ benchmark (see inset). _______ UPDATE (Jul 17, 8:13 p.m. ET): Buyers surpassed the 15.840 resistance with such ease that a test of resistance at 16.470, where September Silver double topped earlier this year, seems all but inevitable. If the rally exceeds them as easily, it would greatly strengthen the case that a powerful new bull market has begun. More immediately, look for a short-term finishing stroke to 16.190, the Hidden Pivot target of the pattern shown in this chart. _____ UPDATE (Jul 18, 9:48 p.m.): Buyers easily exceeded the 16.190 ‘hidden’ resistance and now appear all but certain to hit the next at 16.555. An easy move past it would put the September contract on course for a shot at a 17.867 peak recorded last June.

The top of September Silver’s spike on Tuesday fell three cents shy of an important ‘external’ peak recorded back in March. Recall that healthy rallies generate fresh impulse legs with each new thrust. This rally has failed to do so, at least so far, but bulls still deserve the benefit of the doubt because the futures ended the session above the midpoint of their intraday range. If they are going to impulse above the 15.765 peak, however, the sooner the better, since the longer it takes and the more labored the effort, the less underlying strength there is to be inferred. Regardless, bulls are certain to meet resistance at 15.840, a Hidden Pivot target on the daily chart that comes from A=14.700 on June 10. There is an additional resistance a nickel lower, at 15.835, from the peak just above our ‘external’ benchmark (see inset). _______ UPDATE (Jul 17, 8:13 p.m. ET): Buyers surpassed the 15.840 resistance with such ease that a test of resistance at 16.470, where September Silver double topped earlier this year, seems all but inevitable. If the rally exceeds them as easily, it would greatly strengthen the case that a powerful new bull market has begun. More immediately, look for a short-term finishing stroke to 16.190, the Hidden Pivot target of the pattern shown in this chart. _____ UPDATE (Jul 18, 9:48 p.m.): Buyers easily exceeded the 16.190 ‘hidden’ resistance and now appear all but certain to hit the next at 16.555. An easy move past it would put the September contract on course for a shot at a 17.867 peak recorded last June.

SIU19 – September Silver (Last:16.075)

Posted on July 16, 2019, 5:00 pm EDT

Last Updated July 18, 2019, 9:49 pm EDT

Posted on July 16, 2019, 5:00 pm EDT

Last Updated July 18, 2019, 9:49 pm EDT