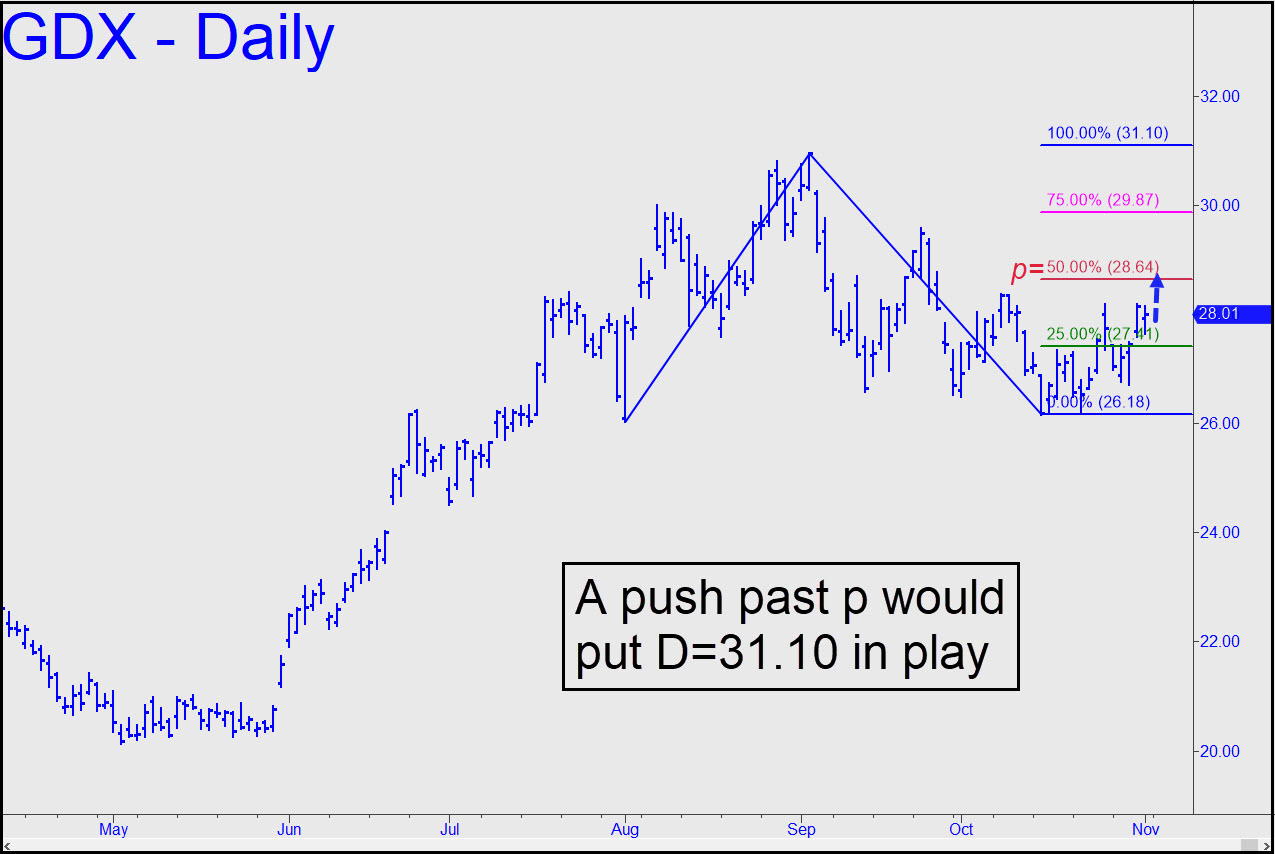

We gutted it out last week to stay long through a swoon that left GDX little changed from a week earlier. The partial profit we took on half the position gives us 200 shares with an adjusted cost basis of 26.77. Friday’s punk performance lagged physical gold, which was up nearly $5 at one point. GDX never went ‘green’, but it is not likely sit still if bullion’s rally resumes or picks up steam in the week ahead. In any event, offer 100 shares to close for 28.60, o-c-o with a stop-loss on the position at 26.78. If GDX takes out the 26.18 point ‘C’ low of the pattern, we’ll look to re-enter at the first good opportunity. _______ UPDATE (Nov 7, 10:54 p.m.): We were stopped out at 26.78 for no loss or gain. GDX has yet to break down as badly as gold futures, although this will come as scant consolation to those who’ve held a long position in this vehicle. I’ll recommend waiting for a washout down to this 25.22 target before buying. We can adjust if GDX reverses without falling that far. ______ UPDATE (Nov 13): I’ve asked for help crowdsourcing an opportune ‘buy’ point for this banana slug. If you’re keen to trade it, please leave an actionable idea of your own in either of the chat rooms. ______ UPDATE (Nov 17, 7:44 p.m.): Bears’ unimpressive struggle to push GDX lower is starting to seem pathetic. This is ostensibly bullish, but I have little enthusiasm for simply taking a flier. If there’s good interest in this stock in the chat room, I’ll happily contribute to the discussion and vet actionable ideas. ______ UPDATE (Nov 18): There was just one mention of GDX in the two chat rooms today — by ‘Johnfed’, a new subscriber who already looks like a guy to watch. He reports being long in GDX. How about you?

We gutted it out last week to stay long through a swoon that left GDX little changed from a week earlier. The partial profit we took on half the position gives us 200 shares with an adjusted cost basis of 26.77. Friday’s punk performance lagged physical gold, which was up nearly $5 at one point. GDX never went ‘green’, but it is not likely sit still if bullion’s rally resumes or picks up steam in the week ahead. In any event, offer 100 shares to close for 28.60, o-c-o with a stop-loss on the position at 26.78. If GDX takes out the 26.18 point ‘C’ low of the pattern, we’ll look to re-enter at the first good opportunity. _______ UPDATE (Nov 7, 10:54 p.m.): We were stopped out at 26.78 for no loss or gain. GDX has yet to break down as badly as gold futures, although this will come as scant consolation to those who’ve held a long position in this vehicle. I’ll recommend waiting for a washout down to this 25.22 target before buying. We can adjust if GDX reverses without falling that far. ______ UPDATE (Nov 13): I’ve asked for help crowdsourcing an opportune ‘buy’ point for this banana slug. If you’re keen to trade it, please leave an actionable idea of your own in either of the chat rooms. ______ UPDATE (Nov 17, 7:44 p.m.): Bears’ unimpressive struggle to push GDX lower is starting to seem pathetic. This is ostensibly bullish, but I have little enthusiasm for simply taking a flier. If there’s good interest in this stock in the chat room, I’ll happily contribute to the discussion and vet actionable ideas. ______ UPDATE (Nov 18): There was just one mention of GDX in the two chat rooms today — by ‘Johnfed’, a new subscriber who already looks like a guy to watch. He reports being long in GDX. How about you?

GDX – Gold Miners ETF (Last:27.18)

Posted on November 3, 2019, 5:05 pm EST

Last Updated December 9, 2019, 12:00 pm EST

Posted on November 3, 2019, 5:05 pm EST

Last Updated December 9, 2019, 12:00 pm EST