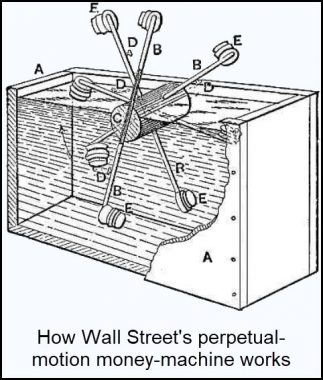

We’re living in interesting times, especially investors. The stock market is in its steepest climb in years, reminiscent of dot-com mania; and yet, individual shareholders have been withdrawing their money at the fastest pace in decades. Do the little guys know something that portfolio managers don’t? Wall Street’s geniuses have been raking in outlandish fees for targeting a handful of high-flying stocks with Other People’s Money (OPM). The perpetual-motion machine works simply because, try as the little guys might to get off the speeding train, their cash remains tied up in the game anyway. For instance, if one makes payments to a mortgage lender or a life insurance company, the cash doesn’t just sit idle; DaBoyz keep it working 24/7, whether in FAANG stocks, Bolivian reverse floaters, repos, junk paper — you name it. Give the feather merchants a dollar and in just a few months’ time they will multiply it tenfold. Just imagine the leverage they extracted from Trump’s trillion-dollar stimulus — the one that some evidently still believe was “tax reform.”

We’re living in interesting times, especially investors. The stock market is in its steepest climb in years, reminiscent of dot-com mania; and yet, individual shareholders have been withdrawing their money at the fastest pace in decades. Do the little guys know something that portfolio managers don’t? Wall Street’s geniuses have been raking in outlandish fees for targeting a handful of high-flying stocks with Other People’s Money (OPM). The perpetual-motion machine works simply because, try as the little guys might to get off the speeding train, their cash remains tied up in the game anyway. For instance, if one makes payments to a mortgage lender or a life insurance company, the cash doesn’t just sit idle; DaBoyz keep it working 24/7, whether in FAANG stocks, Bolivian reverse floaters, repos, junk paper — you name it. Give the feather merchants a dollar and in just a few months’ time they will multiply it tenfold. Just imagine the leverage they extracted from Trump’s trillion-dollar stimulus — the one that some evidently still believe was “tax reform.”

Brace for More Insanity

The money multiplier was on steroids last week as stocks reversed a stumble on Tuesday and began ratcheting higher. The move turned explosive on Friday when we learned that the economy created more jobs than expected. The funny thing is, most major news outlets had actually predicted the number would come in significantly above official estimates. Can you believe that this con-game, which is as old as the stock market, actually worked, and that it worked so beautifully? We’re all suckers, it would seem, since we are desperate to believe the con. And who cares whether most of the jobs were at the low end of the food chain? Distribution hubs in the Sunbelt were busing in workers like lettuce-pickers in order to handle the Christmas shopping crush. By and large, these are the kinds of jobs that caused investors to go crazy on Friday.

The insanity looked primed to reach a crescendo soon as news continues to unfold on several fronts. A story headlined Traders Are Already Bracing for a Wild Week Ahead led Bloomberg’s commentary over the weekend. Europe and the U.S. are expected to talk down stimulus because the economy supposedly is too strong already. Wild-eyed investors are in the mood to believe it this time — as opposed to several months ago, when they were still having stimulus withdrawal pains. That’s what cycles are all about, and who even cares about the numbers? At the moment, traders are already so stoked over meaningless tariff tweets that any actual progress in the U.S.-China talks could cause the broad averages to go parabolic. Fortunately, the wildest, wackiest price moves still produce swing highs and lows that are predictable within pennies. If you’re skeptical that this is possible, please join us in the Rick’s Picks Trading Room where you can see for yourself. If you don’t subscribe, get a free, two-week trial by clicking here.