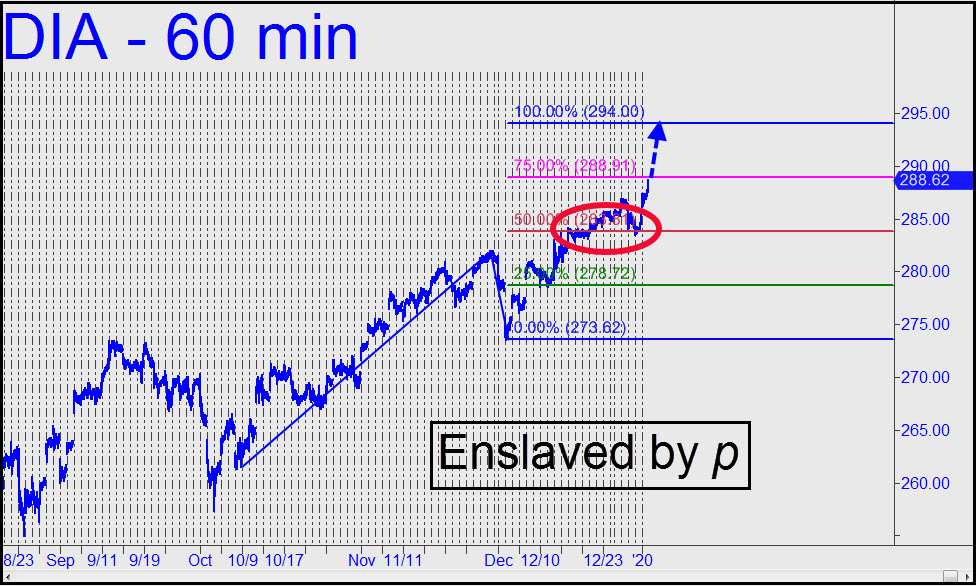

The pattern in the chart is so pretty that it can work for you no matter how you use it. Whether you’re eager to get long or short, DIA looks nearly certain to achieve the Hidden Pivot resistance at 294.00 and then to produce a tradeable pullback precisely from it. Why? For two weeks traders were the unwitting slaves of the midpoint pivot at 283.81. That validated the pattern and its target. When buyers finally broke free of p‘s gravity this morning, the surge all but clinched a run-up to 294.00. Buy out-of-the-money puts for under 0.50 when DIA gets there, but stay tuned to the Trading room for real-time guidance if you’re eager to trade with the trend in the meantime. _______ UPDATE (Jan 5, 10:06 p.m. EST): The 294.00 rally target remains viable, but be prepared for more selling first. It would take a 292.80 print to generate a bearish impulse leg on the hourly chart. _______ UPDATE (Jan 7, 9:57 p.m.): Dow index futures have sold off hard tonight on news of an Iranian missile attack, exceeding a 282.56 target for DIA that is the lowest I could have projected using Hidden Pivot levels. I am embarrassed to say that the 288.63 top on Jan 2 was the most egregious missed opportunity that I can recall in a long, long while. I must have been asleep at the wheel. Here’s the chart, which makes a short at exactly 288.47 practically glow in the dark. _______ UPDATE (Jan 8, 9:25 p.m.): After plummeting 4.47 points, DIA has rebounded to the 288.47 Hidden Pivot noted above. If it can close above it for two consecutive days, look for more upside to the 291.78 target shown in this chart. ______ UPDATE (Jan 12, 10:23 p.m.): A relapse to x=285.62 (shown in the chart linked just above) would trigger an enticing ‘mechanical’ buy there, stop 283.56. We’ll look for a cheaper way to play if the opportunity arises. _______ UPDATE (Jan 13, 5:28 p.m.): Using the same chart, I am now recommending a ‘mechanical’ buy on a pullback to p=287.67, stop 286.29. This implies $550 of initial risk on four round lots, but you can use an rABC setup alternatively to cut the risk by as much as 85%. Ask how in the Trading Room if the opportunity materializes. _______ UPDATE (Jan 14, 10:27 p.m.): DIA went no lower than 287.84 before taking off, narrowly denying us a winning entry. Cancel the trade, but you can continue to use the 291.78 target however it suits you.

The pattern in the chart is so pretty that it can work for you no matter how you use it. Whether you’re eager to get long or short, DIA looks nearly certain to achieve the Hidden Pivot resistance at 294.00 and then to produce a tradeable pullback precisely from it. Why? For two weeks traders were the unwitting slaves of the midpoint pivot at 283.81. That validated the pattern and its target. When buyers finally broke free of p‘s gravity this morning, the surge all but clinched a run-up to 294.00. Buy out-of-the-money puts for under 0.50 when DIA gets there, but stay tuned to the Trading room for real-time guidance if you’re eager to trade with the trend in the meantime. _______ UPDATE (Jan 5, 10:06 p.m. EST): The 294.00 rally target remains viable, but be prepared for more selling first. It would take a 292.80 print to generate a bearish impulse leg on the hourly chart. _______ UPDATE (Jan 7, 9:57 p.m.): Dow index futures have sold off hard tonight on news of an Iranian missile attack, exceeding a 282.56 target for DIA that is the lowest I could have projected using Hidden Pivot levels. I am embarrassed to say that the 288.63 top on Jan 2 was the most egregious missed opportunity that I can recall in a long, long while. I must have been asleep at the wheel. Here’s the chart, which makes a short at exactly 288.47 practically glow in the dark. _______ UPDATE (Jan 8, 9:25 p.m.): After plummeting 4.47 points, DIA has rebounded to the 288.47 Hidden Pivot noted above. If it can close above it for two consecutive days, look for more upside to the 291.78 target shown in this chart. ______ UPDATE (Jan 12, 10:23 p.m.): A relapse to x=285.62 (shown in the chart linked just above) would trigger an enticing ‘mechanical’ buy there, stop 283.56. We’ll look for a cheaper way to play if the opportunity arises. _______ UPDATE (Jan 13, 5:28 p.m.): Using the same chart, I am now recommending a ‘mechanical’ buy on a pullback to p=287.67, stop 286.29. This implies $550 of initial risk on four round lots, but you can use an rABC setup alternatively to cut the risk by as much as 85%. Ask how in the Trading Room if the opportunity materializes. _______ UPDATE (Jan 14, 10:27 p.m.): DIA went no lower than 287.84 before taking off, narrowly denying us a winning entry. Cancel the trade, but you can continue to use the 291.78 target however it suits you.

DIA – Dow Industrials ETF (Last:289.28)

Posted on January 2, 2020, 6:36 pm EST

Last Updated January 14, 2020, 10:26 pm EST

Posted on January 2, 2020, 6:36 pm EST

Last Updated January 14, 2020, 10:26 pm EST