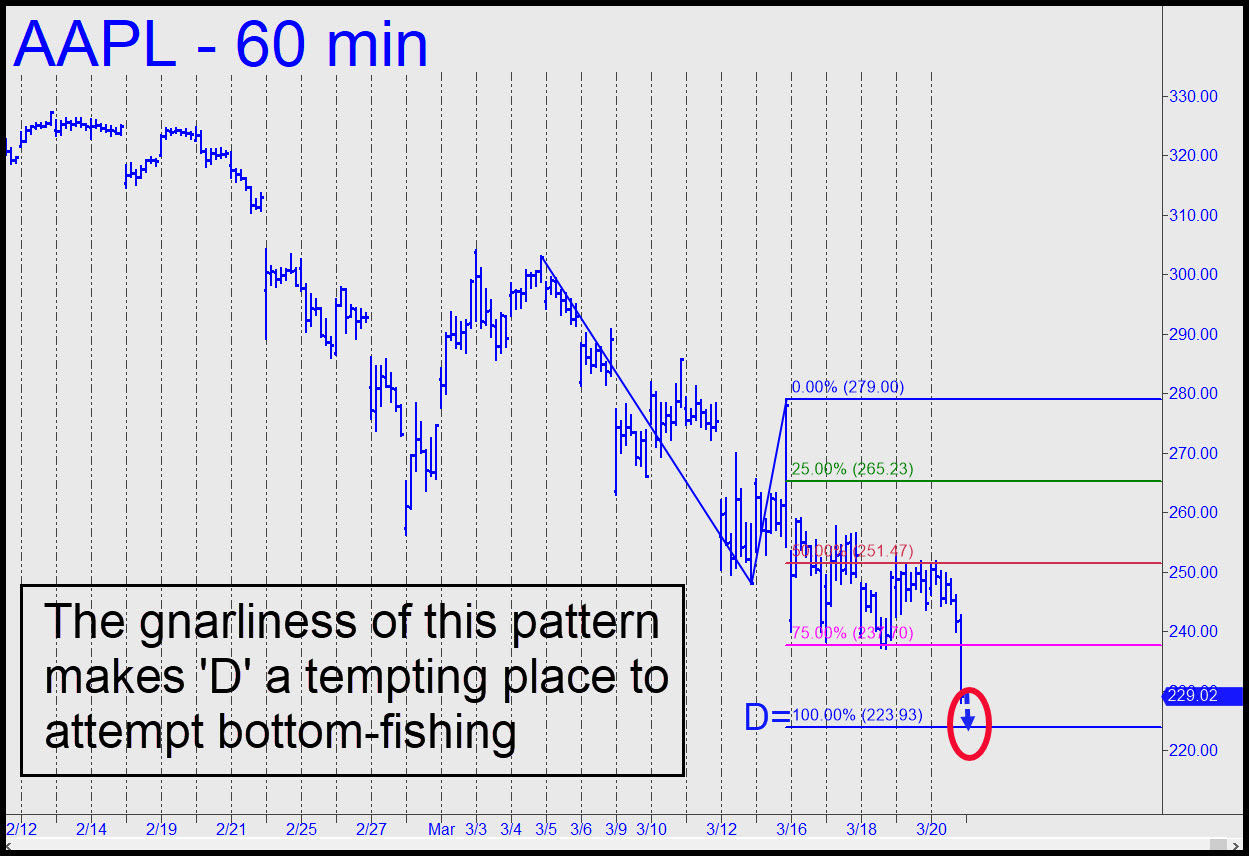

I am recommending bottom-fishing if AAPL gets within a 10-15 cents of the 223.93 target shown in the chart. Buy two options expiring March 27 at the lowest out-of-the-money strike at which calls are priced under 1.00. This trade is suitable for rookies because the target, which comes from a gnarly pattern that is just my style, looks likely to work precisely. You can interpolate my instructions, perhaps increasing the size of the bet, if you know what you are doing. Check back before Monday’s opening in any event, since I might be able to refine my instructions. That is impossible now, since Tradestation is not currently showing Friday’s closing bid/ask data for AAPL options. I have not made the 223.90 price target publicly viewable, but be aware that moles from Goldman, Morgan Stanley et al. seem to be aware of them and could front-run us. _______ UPDATE (Mar 23, 9:15 a.m.): Better get used to it. AAPL popped a $17 rally from 221.25 that would have offered an excellent bottom-fishing opportunity — except that the low occurred at 4:30 a.m., and the move was over by 8:30, an hour before options open. Trend and target, as you will have observed, are as easy to nail as shooting fish in a barrel, but we can only make money on them if they occur at the ‘correct’ time of day. There will be other opportunities. ______ UPDATE (Mar 23, 5:46 p.m.): AAPL relapsed to a target that worked even more precisely for bottom-fishing. With apologies, here’s the chart that I mistakenly thought I’d posted in the Trading Room in timely fashion. Under ordinary circumstances, the precise completion of a pattern that has taken more than two weeks to play out would augur a strong bounce lasting at least 2-3 days. We shall see, but in any event, I’d suggest trading the stock with a bullish bias during the night session. _______ UPDATE (Mar 24, 4:07 p.m.): The collective mood lifted somewhat on Tuesday — a combination of fiscal and monetary stimulus plus some well-phrased words from Trump that held out the promise of America’s getting back to work as soon as possible: “Our country wasn’t built to be shut down,” he said, with perfect timing. DaBoyz aren’t going to waste this opportunity to short-squeeze AAPL to perhaps 270-280 this week. They’ll be well on their way if they can pop the stock above 257.61, generating a bullish impulse leg on the hourly chart. _______ UPDATE (Mar 25, 8:33 p.m.): A short-covering panic on the opening bar pushed AAPL 39 cents above the bullish threshold noted above, creating a bullish impulse leg on the hourly chart. That means the current, nasty pullback is merely corrective. Plan accordingly, but tune to the chat room if you want real-time guidance. _______ UPDATE (Mar 26, 8:31 p.m.): AAPL is all but certain to achieve the 262.96 target shown in this chart. Once past it DaBoyz will be looking to distribute the stock to imbeciles all the way up to $280. I don’t expect them to succeed quite that well, but a rally to at least $270, a price objective I drum-rolled earlier, seems very do-able._______ UPDATE Mar 29, 9:35 p.m.): Buyers spent the whole week flailing around without reaching 262.96, but I doubt they’re ready to give up. They’ll have plenty of help from Buffet and DaBoyz, who need only lift their offers to excite feverish demand. _______ UPDATE (Mar 31, 7:47 p.m.): The stock spiked this morning to within 47 cents of the target I drum-rolled here five days ago (see above). The subsequent plunge more than tripled the price of the 250 puts and amounts to about $12 at the moment. Here’s the chart. _______ UPDATE (Apr 1, 9:34 p.m.): When the stock drops below c=236.54 on Thursday, causing bulls to jump ship, AAPL will have a chance to rally without profit-takers to slow it down. This is the dynamic behind ‘counterintuitive’ trades, but I am suggesting that you spectate unless you are an expert with this kind of set-up. I expect the rally to fail, but it will be interesting to see how far it gets. If it lasts for less than two days, brace for a test of lows near 212 recorded last week. Here’s the chart. _______ UPDATE (Apr 2, 11:40 p.m.): How coy and utterly charming! AAPL took its expected short-squeeze leap not from slightly below c=236.54, but from slightly (i.e., 36 cents) above it.

I am recommending bottom-fishing if AAPL gets within a 10-15 cents of the 223.93 target shown in the chart. Buy two options expiring March 27 at the lowest out-of-the-money strike at which calls are priced under 1.00. This trade is suitable for rookies because the target, which comes from a gnarly pattern that is just my style, looks likely to work precisely. You can interpolate my instructions, perhaps increasing the size of the bet, if you know what you are doing. Check back before Monday’s opening in any event, since I might be able to refine my instructions. That is impossible now, since Tradestation is not currently showing Friday’s closing bid/ask data for AAPL options. I have not made the 223.90 price target publicly viewable, but be aware that moles from Goldman, Morgan Stanley et al. seem to be aware of them and could front-run us. _______ UPDATE (Mar 23, 9:15 a.m.): Better get used to it. AAPL popped a $17 rally from 221.25 that would have offered an excellent bottom-fishing opportunity — except that the low occurred at 4:30 a.m., and the move was over by 8:30, an hour before options open. Trend and target, as you will have observed, are as easy to nail as shooting fish in a barrel, but we can only make money on them if they occur at the ‘correct’ time of day. There will be other opportunities. ______ UPDATE (Mar 23, 5:46 p.m.): AAPL relapsed to a target that worked even more precisely for bottom-fishing. With apologies, here’s the chart that I mistakenly thought I’d posted in the Trading Room in timely fashion. Under ordinary circumstances, the precise completion of a pattern that has taken more than two weeks to play out would augur a strong bounce lasting at least 2-3 days. We shall see, but in any event, I’d suggest trading the stock with a bullish bias during the night session. _______ UPDATE (Mar 24, 4:07 p.m.): The collective mood lifted somewhat on Tuesday — a combination of fiscal and monetary stimulus plus some well-phrased words from Trump that held out the promise of America’s getting back to work as soon as possible: “Our country wasn’t built to be shut down,” he said, with perfect timing. DaBoyz aren’t going to waste this opportunity to short-squeeze AAPL to perhaps 270-280 this week. They’ll be well on their way if they can pop the stock above 257.61, generating a bullish impulse leg on the hourly chart. _______ UPDATE (Mar 25, 8:33 p.m.): A short-covering panic on the opening bar pushed AAPL 39 cents above the bullish threshold noted above, creating a bullish impulse leg on the hourly chart. That means the current, nasty pullback is merely corrective. Plan accordingly, but tune to the chat room if you want real-time guidance. _______ UPDATE (Mar 26, 8:31 p.m.): AAPL is all but certain to achieve the 262.96 target shown in this chart. Once past it DaBoyz will be looking to distribute the stock to imbeciles all the way up to $280. I don’t expect them to succeed quite that well, but a rally to at least $270, a price objective I drum-rolled earlier, seems very do-able._______ UPDATE Mar 29, 9:35 p.m.): Buyers spent the whole week flailing around without reaching 262.96, but I doubt they’re ready to give up. They’ll have plenty of help from Buffet and DaBoyz, who need only lift their offers to excite feverish demand. _______ UPDATE (Mar 31, 7:47 p.m.): The stock spiked this morning to within 47 cents of the target I drum-rolled here five days ago (see above). The subsequent plunge more than tripled the price of the 250 puts and amounts to about $12 at the moment. Here’s the chart. _______ UPDATE (Apr 1, 9:34 p.m.): When the stock drops below c=236.54 on Thursday, causing bulls to jump ship, AAPL will have a chance to rally without profit-takers to slow it down. This is the dynamic behind ‘counterintuitive’ trades, but I am suggesting that you spectate unless you are an expert with this kind of set-up. I expect the rally to fail, but it will be interesting to see how far it gets. If it lasts for less than two days, brace for a test of lows near 212 recorded last week. Here’s the chart. _______ UPDATE (Apr 2, 11:40 p.m.): How coy and utterly charming! AAPL took its expected short-squeeze leap not from slightly below c=236.54, but from slightly (i.e., 36 cents) above it.

AAPL – Apple Computer (Last:244.89)

Posted on March 22, 2020, 5:09 pm EDT

Last Updated April 2, 2020, 11:39 pm EDT

Posted on March 22, 2020, 5:09 pm EDT

Last Updated April 2, 2020, 11:39 pm EDT