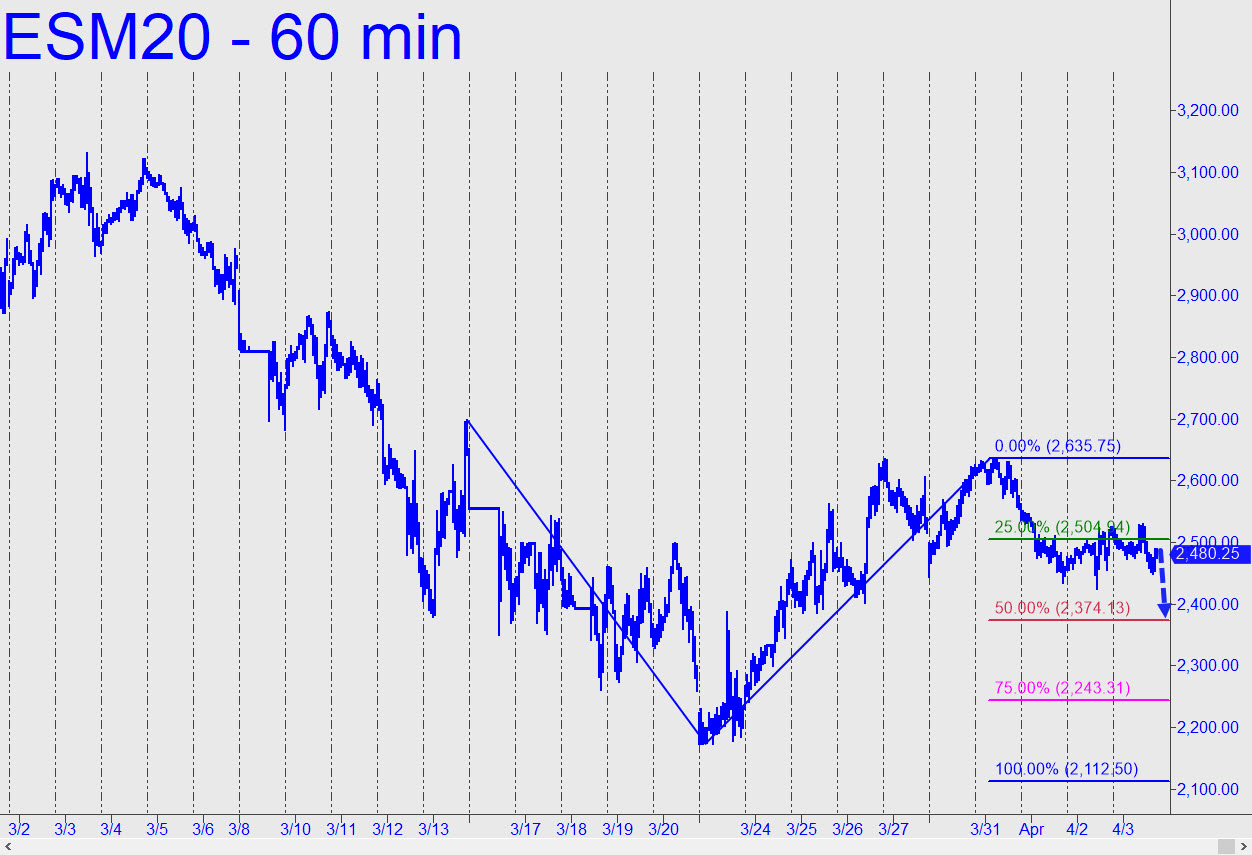

The bounce from the March 23 low has recovered a third of the initial, 1196-point drop, but it failed at last week’s peak to trigger a theoretical buy signal at 2572 by 10 points. That wouldn’t turn me bullish if it happens, since I expect the broad averages to fall to 1500 or lower on the next leg down. However, it would bring a neutral-to-slightly bullish bias to my swing- and day-trades. The futures in the meantime could fluctuate over a 600-point range (!) without saying much. That is the distance between the 2174 bottom and the midway point between the green-line trigger line and the midpoint Hidden Pivot resistance at 2971. This level is instinctual with me and unrelated to any rules we use to trade or forecast. More immediately, a midpoint support at 2374.13 that I flagged last week is still my minimum downside target for the near term. Here’s a chart that shows it.

The bounce from the March 23 low has recovered a third of the initial, 1196-point drop, but it failed at last week’s peak to trigger a theoretical buy signal at 2572 by 10 points. That wouldn’t turn me bullish if it happens, since I expect the broad averages to fall to 1500 or lower on the next leg down. However, it would bring a neutral-to-slightly bullish bias to my swing- and day-trades. The futures in the meantime could fluctuate over a 600-point range (!) without saying much. That is the distance between the 2174 bottom and the midway point between the green-line trigger line and the midpoint Hidden Pivot resistance at 2971. This level is instinctual with me and unrelated to any rules we use to trade or forecast. More immediately, a midpoint support at 2374.13 that I flagged last week is still my minimum downside target for the near term. Here’s a chart that shows it.

ESM20 – June E-Mini S&Ps (Last:2480.25)

Posted on April 5, 2020, 5:15 pm EDT

Last Updated April 5, 2020, 1:26 pm EDT

Posted on April 5, 2020, 5:15 pm EDT

Last Updated April 5, 2020, 1:26 pm EDT