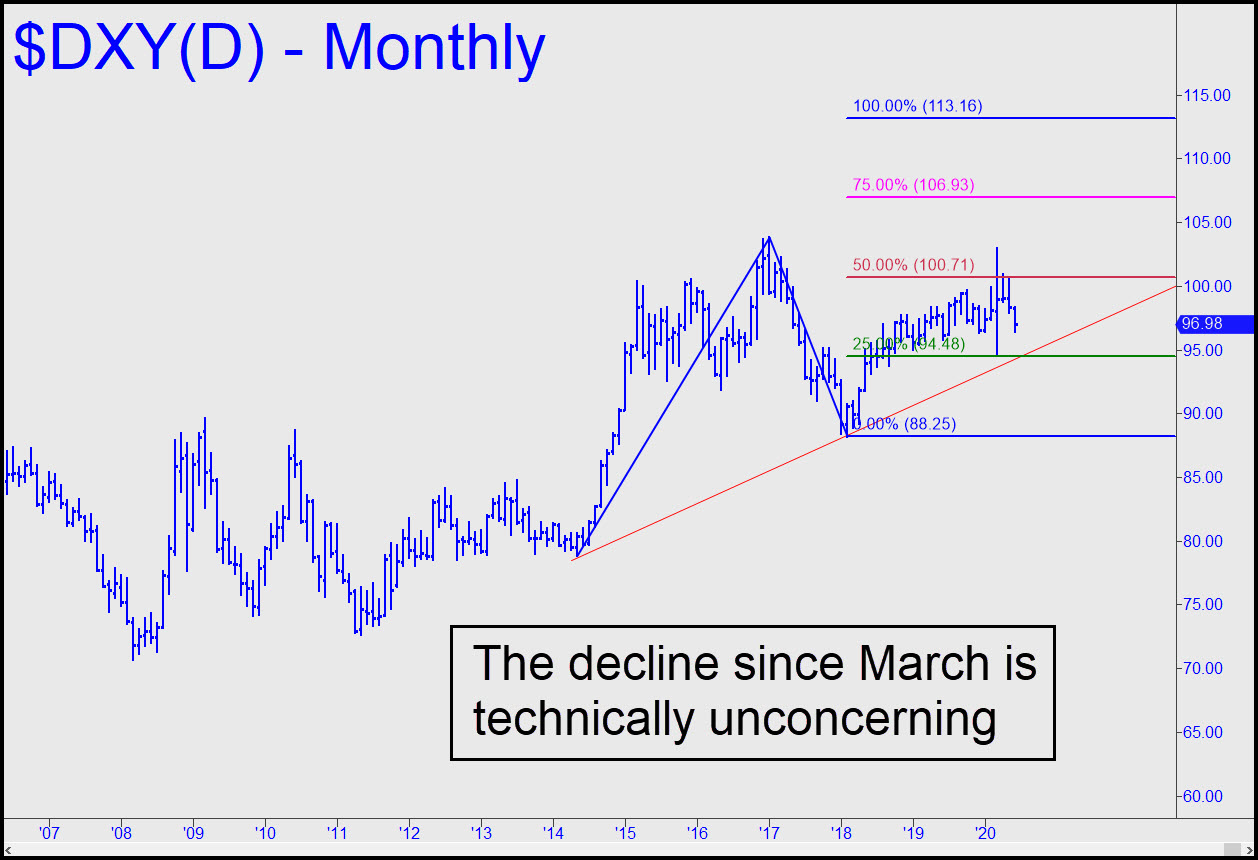

I have not updated my perennially bullish outlook for the dollar for a long time, and you can see why in the chart. DXY has come of March’s 103 high with a so-far 6.3% sell-off that has done no technical damage to the long-term uptrend. Actually, a further selloff of 3.6% would come down to a trendline that is likely to evince good support. Pivoteers may also notice that a pullback to the green line would trip a strong ‘mechanical’ buy signal that is about as textbook as such trades get. ‘Mechanical’ trades work best when speculators get too far ahead of themselves in either direction. The pullback to the green line is Mr. Market’s way of reminding them that overconfidence seldom pays off.

I have not updated my perennially bullish outlook for the dollar for a long time, and you can see why in the chart. DXY has come of March’s 103 high with a so-far 6.3% sell-off that has done no technical damage to the long-term uptrend. Actually, a further selloff of 3.6% would come down to a trendline that is likely to evince good support. Pivoteers may also notice that a pullback to the green line would trip a strong ‘mechanical’ buy signal that is about as textbook as such trades get. ‘Mechanical’ trades work best when speculators get too far ahead of themselves in either direction. The pullback to the green line is Mr. Market’s way of reminding them that overconfidence seldom pays off.

The bullish outlook also implicitly raises a question that seems not to be troubling traders at the moment — namely, what kind of moron would be buying the euro and other currencies in preference to dollars? Indeed, the rally in the euro is as stupid and groundless as the one in U.S. stocks at the moment. No currency will supersede the dollar, simply because it is the only currency big enough to facilitate the quadrillion dollar shell game that makes paper-shufflers rich. Also, the world will continue to prefer to pay for real things, most particularly crude oil, with a currency that is in practically infinite supply. If you read anything suggesting that the dollar has entered a bear market, save your time energy, since it was written by some bozo with poor comprehension of the currency market’s underlying dynamics. _______ UPDATE (Jul 21, 7:18 p.m.): I road-mapped a potentially nasty correction months ago, and so it has been. But the dollar will generate a ‘mechanical’ buy at 94.48, stop 88.25 if it falls to the green line. That would also touch a trendline stretching back to 2014. The confluence of these technical factors makes a good case that the dollar’s four-month correction is near an end — and a good thing, too, since a further fall would support the dumb argument that the euro is strong because euroland is coming out of the pandemic while the U.S. and its economy are still mired in Covid. In reality, euroland’s terminally sclerotic economy is going nowhere unless its trading partners recover as well.