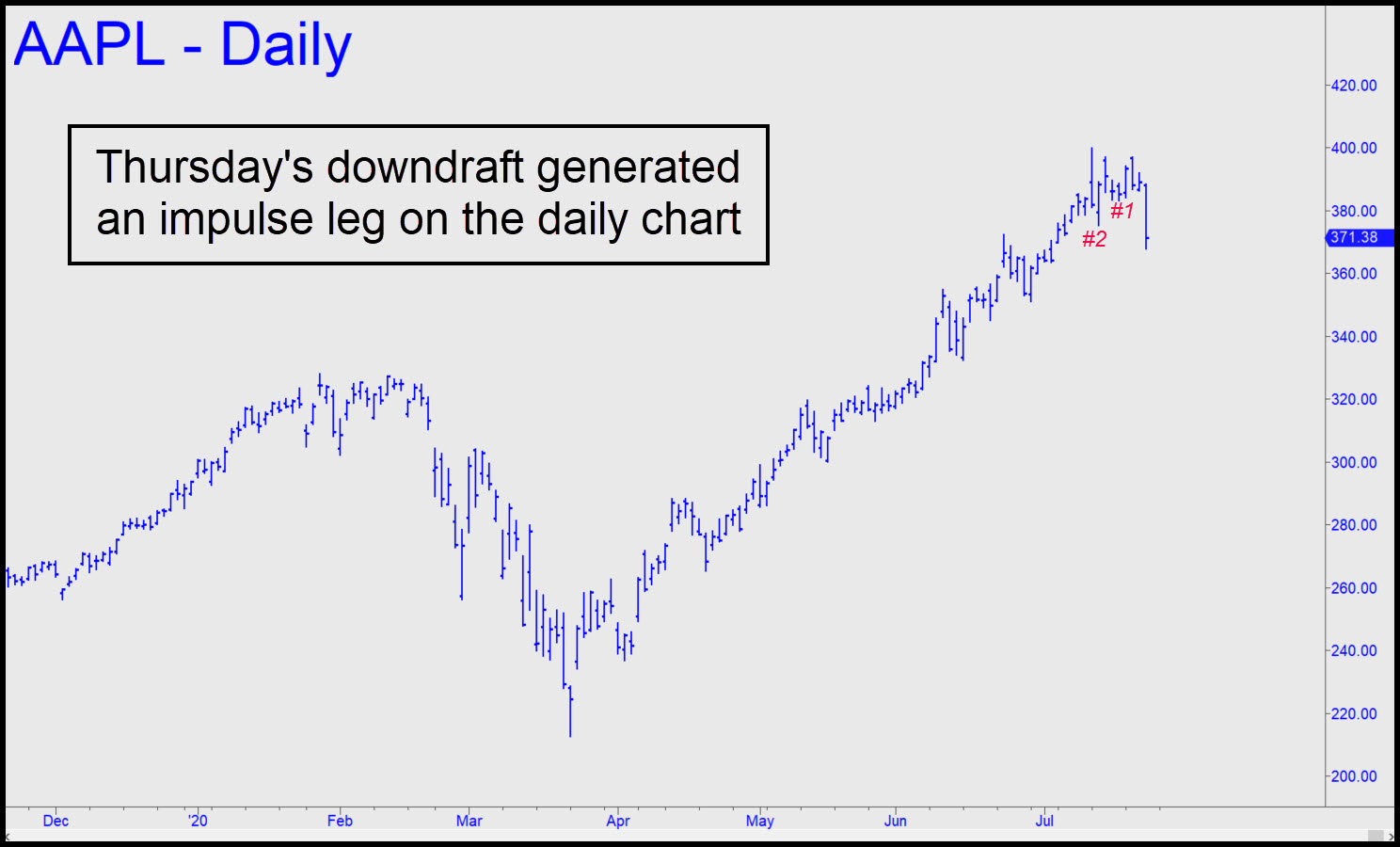

Today’s downdraft generated a robust impulse leg on the daily chart, the first time this has occurred since the start of the Covid-19 outbreak in February. Supposedly, fears are growing that Trump’s hardball tactics with China could put pressure on AAPL, which does nearly all of its assembly work in China. Why traders picked today to unload Apple shares is unclear, however, since the company’s China problem has existed for nearly three years, ever since the tariff war began.

Today’s downdraft generated a robust impulse leg on the daily chart, the first time this has occurred since the start of the Covid-19 outbreak in February. Supposedly, fears are growing that Trump’s hardball tactics with China could put pressure on AAPL, which does nearly all of its assembly work in China. Why traders picked today to unload Apple shares is unclear, however, since the company’s China problem has existed for nearly three years, ever since the tariff war began.

Trumped warned Apple years ago to get out of China, but it would seem no one in Cupertino took him very seriously. That didn’t stop investors from piling into the stock since March, driving it into a ridiculously steep rally that was manifestly inured to troubles with China’s Communist government. So how far could the stock fall? That depends on whether the downtrend stretches on for another 2-3 days, breaching a 351.28 low recorded nearly a month ago. If it happens with no significant upward corrections along the way, that would add to the imputed power of the impulse leg, conceivably signaling the beginning of a new bear market.