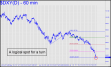

The dollar’s steep fall since March mirrors the egregiously overdone rally that has occurred in nearly everything else. There is no good reason for the dollar to be plummeting, but on Wall Street a bad reason will always suffice, especially in times when outright insanity rules the markets as it is doing now. That said, there are reasons to expect a turn from the current low, which touched a 93.57 downside target on the hourly chart Monday. I’d be surprised if there’s no significant bounce, given the clarity of the pattern, However, I am prepared for more slippage nonetheless, possibly to the trendline shown. It comes in around 91.61, almost exactly two points lower. Here’s a chart that shows this. Regardless, the pullback to the green line (94.48) must be regarded as a promising ‘mechanical’ buying opportunity, stop 88.24. We’ll paper trade this one, but I should note that all such trades presented here over the last several months have been winners. ______ UPDATE (Jul 29, 7:37 p.m.): Any further slippage beneath the 93.57 ‘hidden’ support will send the dollar down to 91.61 in search of good traction. ______ UPDATE (Jul 30, 2:39 p.m.): So much for the 93.54 support. You should use 91.61 as a downside objective for the near term. _______ UPDATE (Aug 3, 5:48 p.m.): Despite the rally since Friday, the damage has already been done, and I still expect lower lows. Regardless, I’m going to back away for a week or two, since price action in the currencies in general has gotten extremely tiresome. They used to be good ‘non-correlating’ vehicles to trade, but these days even the 100% manipulated Swiss franc acts like an eighth grader’s science project.

The dollar’s steep fall since March mirrors the egregiously overdone rally that has occurred in nearly everything else. There is no good reason for the dollar to be plummeting, but on Wall Street a bad reason will always suffice, especially in times when outright insanity rules the markets as it is doing now. That said, there are reasons to expect a turn from the current low, which touched a 93.57 downside target on the hourly chart Monday. I’d be surprised if there’s no significant bounce, given the clarity of the pattern, However, I am prepared for more slippage nonetheless, possibly to the trendline shown. It comes in around 91.61, almost exactly two points lower. Here’s a chart that shows this. Regardless, the pullback to the green line (94.48) must be regarded as a promising ‘mechanical’ buying opportunity, stop 88.24. We’ll paper trade this one, but I should note that all such trades presented here over the last several months have been winners. ______ UPDATE (Jul 29, 7:37 p.m.): Any further slippage beneath the 93.57 ‘hidden’ support will send the dollar down to 91.61 in search of good traction. ______ UPDATE (Jul 30, 2:39 p.m.): So much for the 93.54 support. You should use 91.61 as a downside objective for the near term. _______ UPDATE (Aug 3, 5:48 p.m.): Despite the rally since Friday, the damage has already been done, and I still expect lower lows. Regardless, I’m going to back away for a week or two, since price action in the currencies in general has gotten extremely tiresome. They used to be good ‘non-correlating’ vehicles to trade, but these days even the 100% manipulated Swiss franc acts like an eighth grader’s science project.

DXY – NYBOT Dollar Index (Last:93.50)

Posted on July 27, 2020, 7:39 pm EDT

Last Updated August 3, 2020, 5:49 pm EDT

Posted on July 27, 2020, 7:39 pm EDT

Last Updated August 3, 2020, 5:49 pm EDT