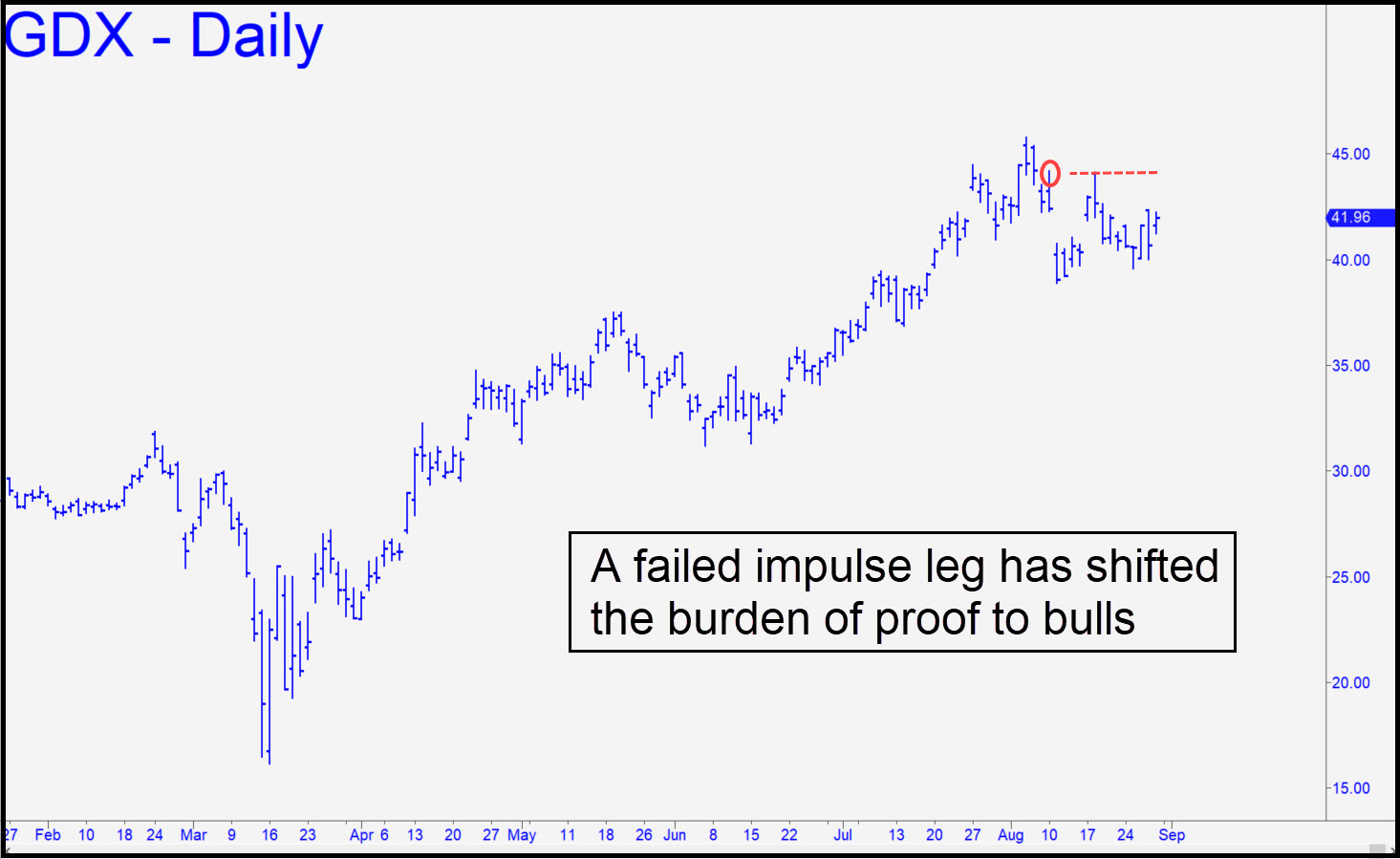

The burden of proof rests with bulls for the time being, since the rally from Aug 11-18 failed to surpass a distinctive ‘external’ peak at 44.18 (see inset). If the corresponding ABC downtrend were to play out, a touch at 42.48 would trigger a ‘mechanical’ short with a 37.64 price objective. This is blandly objective analysis, but I must tell you that I’m not thrilled with the prospect of shorting GDX, given the difficulties sellers have had pushing gold lower over the last two weeks. I’ll recommend watching from the sidelines for a couple of days, although there are always ways to trade the lesser charts with risk well controlled. I have crowdsourced this task but will join in the discussion if the interest is there. ______ UPDATE (Sep 3, 10:27 p.m.) The paper-trade short has gone as much as $205 in-the-black and is still profitable, predicated on a 37.64 target. Two successively higher Friday closes would turn stochastic indicators on the weekly chart bullish. ______ UPDATE (Sep 5): The short position is showing a theoretical gain of around $650 on four round lots. I’ll suggest a 41.81 stop-loss for now, o-c-o with an order to cover the position four cents above the 37.64 target. ______ UPDATE (Sep 9, 11:48 p.m.): My bad, since half of the short position should have been covered last week at p=40.87. The trade produced a $244 theoretical profit nonetheless. I am taking a vacation from GDX for a while, since it is too much trouble to track — the most annoying vehicle on the list. I will wade into the discussion nonetheless if subscribers show active interest in this vehicle in the Trading Room.

The burden of proof rests with bulls for the time being, since the rally from Aug 11-18 failed to surpass a distinctive ‘external’ peak at 44.18 (see inset). If the corresponding ABC downtrend were to play out, a touch at 42.48 would trigger a ‘mechanical’ short with a 37.64 price objective. This is blandly objective analysis, but I must tell you that I’m not thrilled with the prospect of shorting GDX, given the difficulties sellers have had pushing gold lower over the last two weeks. I’ll recommend watching from the sidelines for a couple of days, although there are always ways to trade the lesser charts with risk well controlled. I have crowdsourced this task but will join in the discussion if the interest is there. ______ UPDATE (Sep 3, 10:27 p.m.) The paper-trade short has gone as much as $205 in-the-black and is still profitable, predicated on a 37.64 target. Two successively higher Friday closes would turn stochastic indicators on the weekly chart bullish. ______ UPDATE (Sep 5): The short position is showing a theoretical gain of around $650 on four round lots. I’ll suggest a 41.81 stop-loss for now, o-c-o with an order to cover the position four cents above the 37.64 target. ______ UPDATE (Sep 9, 11:48 p.m.): My bad, since half of the short position should have been covered last week at p=40.87. The trade produced a $244 theoretical profit nonetheless. I am taking a vacation from GDX for a while, since it is too much trouble to track — the most annoying vehicle on the list. I will wade into the discussion nonetheless if subscribers show active interest in this vehicle in the Trading Room.

GDX – Gold Miners ETF (Last:42.35)

Posted on August 30, 2020, 5:06 pm EDT

Last Updated September 9, 2020, 11:48 pm EDT

Posted on August 30, 2020, 5:06 pm EDT

Last Updated September 9, 2020, 11:48 pm EDT