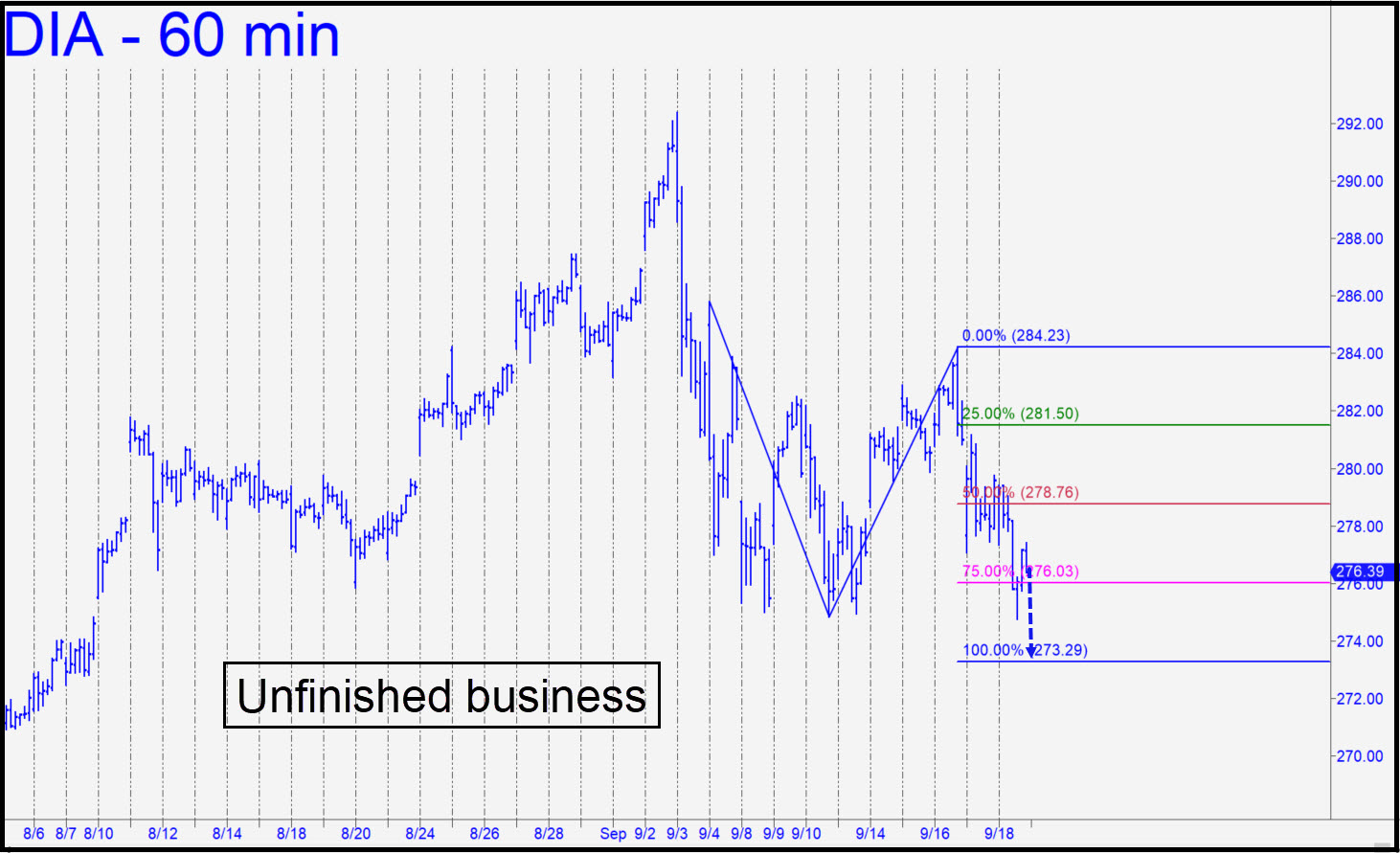

[DIA] Bears turned chicken Friday afternoon, scrambling needlessly to cover shorts ahead of a weekend that was unlikely to produce ‘good’ news. Now, a rally to p=278.76 would trip a weak ‘mechanical’ short, stop 280.59. I’d suggest paper-trading this one unless you’ve caught a profitable ride up to 278,76. The trade should be executed with a rABC set-up on the 15-minute chart (or less). As always, if the eventual, expected fall to D=273.29 exceeds the target, especially on a closing basis, that would warn of more weakness to come. _______ UPDATE (Sep 21, 8:49 p.m. ET): Sellers are probably done for now, having achieved the ‘D’ target of a three-week-old pattern almost exactly. It is calculated using the highest possible ‘A’ on the chart; my original target used a secondary high recorded on Sep 3 and was relatively conservative. Here’s the chart. _____ UPDATE (Sep 22, 5:16 p.m.): This pattern, with a 274.68 rally target, can serve for trading purposes, implying a ‘mechanical’ long from x=271.01, or a short from D=274.68 for those who have enjoyed the ride up. Please note that a gap opening in the morning — something that occurs regularly in this vehicle — could negate the pattern or at least diminish its usefulness.

[DIA] Bears turned chicken Friday afternoon, scrambling needlessly to cover shorts ahead of a weekend that was unlikely to produce ‘good’ news. Now, a rally to p=278.76 would trip a weak ‘mechanical’ short, stop 280.59. I’d suggest paper-trading this one unless you’ve caught a profitable ride up to 278,76. The trade should be executed with a rABC set-up on the 15-minute chart (or less). As always, if the eventual, expected fall to D=273.29 exceeds the target, especially on a closing basis, that would warn of more weakness to come. _______ UPDATE (Sep 21, 8:49 p.m. ET): Sellers are probably done for now, having achieved the ‘D’ target of a three-week-old pattern almost exactly. It is calculated using the highest possible ‘A’ on the chart; my original target used a secondary high recorded on Sep 3 and was relatively conservative. Here’s the chart. _____ UPDATE (Sep 22, 5:16 p.m.): This pattern, with a 274.68 rally target, can serve for trading purposes, implying a ‘mechanical’ long from x=271.01, or a short from D=274.68 for those who have enjoyed the ride up. Please note that a gap opening in the morning — something that occurs regularly in this vehicle — could negate the pattern or at least diminish its usefulness.

DIA – Dow Industrials ETF (Last:272.78)

Posted on September 20, 2020, 5:07 pm EDT

Last Updated September 23, 2020, 10:20 am EDT

Posted on September 20, 2020, 5:07 pm EDT

Last Updated September 23, 2020, 10:20 am EDT