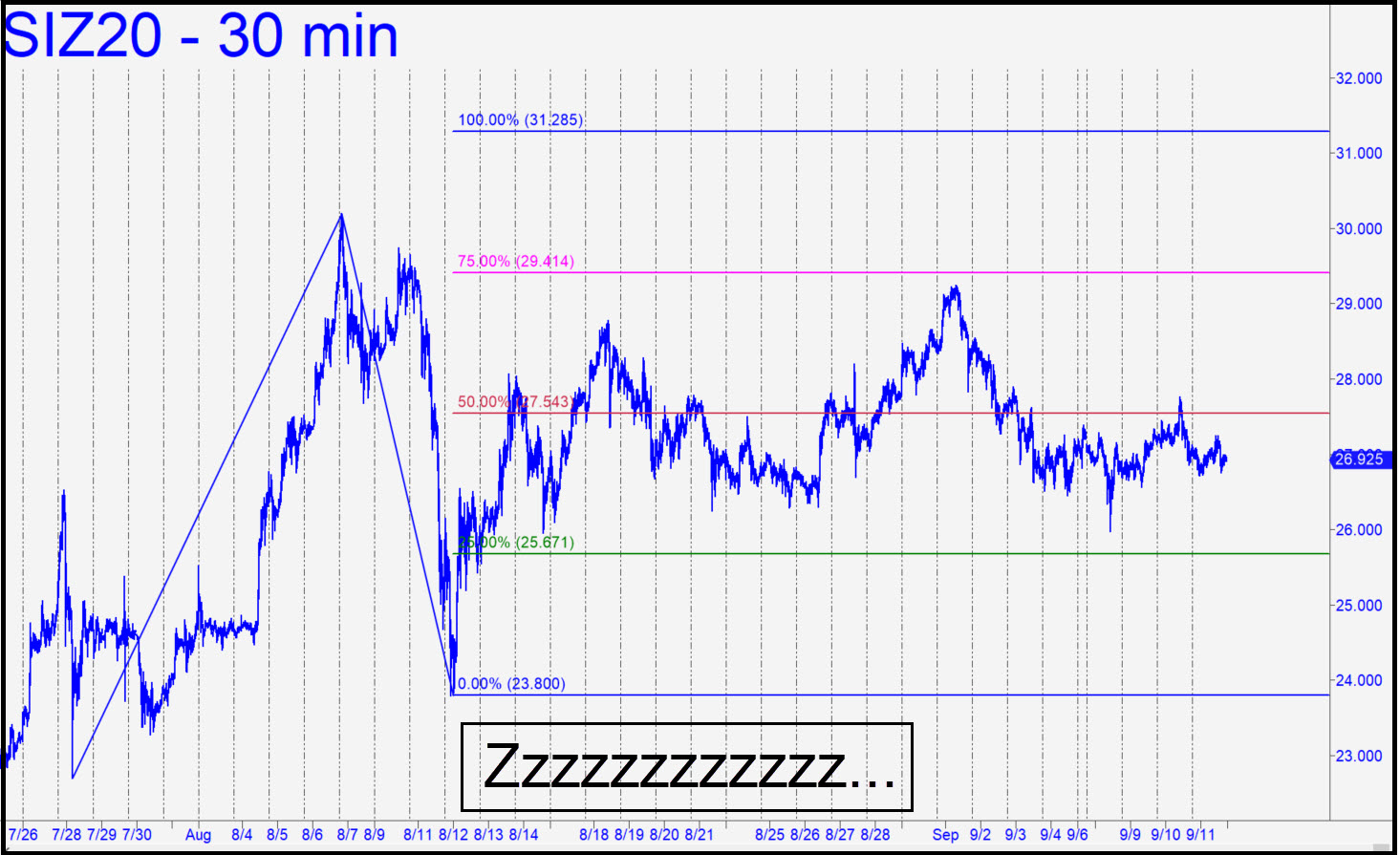

[DEC Silver] Bulls and bears have been locked in a deadly battle of tiddlywinks for a month, oscillating gratuitously in a $4 range. The tedium eventually will give way to a thrust to at least 31.285, a longstanding Hidden Pivot target shown in the chart (inset). It is always possible to take a small position using an entry pattern on a chart of lesser degree, and to take profits on most of it while leaving one or two contracts for a swing at the fences. In this case, however, the potentially interminable wait makes the strategy unpalatable, but also vulnerable to occasional swoons. We might consider a ‘mechanical’ buy on a pullback to x=25.671 nonetheless, but the $9,355/contract stop-loss demands a modified entry method to minimize risk. ______ UPDATE (Sep 20): The tiddlywinks marathon stretched on for yet another week as bulls awaited the right opportunity to demolish bears. A gratuitous swoon on Thursday was just Mr Market’s way of reminding bulls that even being right is certain to be painful at times. _______ UPDATE (Sep 21, 8:55 p.m.): The futures would need to touch 27.90 to undo the technical damage wrought by today’s plunge. That’s a tick higher than a small but significant ‘external’ peak recorded on 9/2. In the meantime, the 23.385 target shown in this chart will remain theoretically viable. _______ UPDATE (Sep 23, 10:42 a.m.): A 23.40 midpoint support is breaking down, opening a path to as low as 21.50. Here’s the chart. ______ UPDATE (Sep 23, 10:12 p.m.): The futures bounced sharply after plunging to within 36 cents of the 21.50 target. We’ll repair to the sidelines, since I’d rather not mess with mister in-between. The target remains viable nonetheless.

[DEC Silver] Bulls and bears have been locked in a deadly battle of tiddlywinks for a month, oscillating gratuitously in a $4 range. The tedium eventually will give way to a thrust to at least 31.285, a longstanding Hidden Pivot target shown in the chart (inset). It is always possible to take a small position using an entry pattern on a chart of lesser degree, and to take profits on most of it while leaving one or two contracts for a swing at the fences. In this case, however, the potentially interminable wait makes the strategy unpalatable, but also vulnerable to occasional swoons. We might consider a ‘mechanical’ buy on a pullback to x=25.671 nonetheless, but the $9,355/contract stop-loss demands a modified entry method to minimize risk. ______ UPDATE (Sep 20): The tiddlywinks marathon stretched on for yet another week as bulls awaited the right opportunity to demolish bears. A gratuitous swoon on Thursday was just Mr Market’s way of reminding bulls that even being right is certain to be painful at times. _______ UPDATE (Sep 21, 8:55 p.m.): The futures would need to touch 27.90 to undo the technical damage wrought by today’s plunge. That’s a tick higher than a small but significant ‘external’ peak recorded on 9/2. In the meantime, the 23.385 target shown in this chart will remain theoretically viable. _______ UPDATE (Sep 23, 10:42 a.m.): A 23.40 midpoint support is breaking down, opening a path to as low as 21.50. Here’s the chart. ______ UPDATE (Sep 23, 10:12 p.m.): The futures bounced sharply after plunging to within 36 cents of the 21.50 target. We’ll repair to the sidelines, since I’d rather not mess with mister in-between. The target remains viable nonetheless.

SIZ20 – December Silver (Last:22.62)

Posted on September 13, 2020, 5:08 pm EDT

Last Updated September 23, 2020, 10:10 pm EDT

Posted on September 13, 2020, 5:08 pm EDT

Last Updated September 23, 2020, 10:10 pm EDT