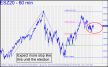

I suggested early last week to tune out this vehicle — advice that turns out to have saved us some stress. The futures oscillated nervously within a relatively tight range, paralyzed, if not by fear, then by uncertainty. Not much will be required to turn the futures into a runaway helium balloon, however, and this could happen as early as mid-week on growing perceptions that Trump will win. This notion could conceivably have gained critical mass by the time you read this on Sunday night, since Biden’s campaign was taking on serious water when last week ended. Even if his now well-documented decades of graft fail to gain traction with the news media, he has enough other problems, including, most recently, voters in Pennsylvania, Texas and Oklahoma who heard what he said about killing the oil industry during Thursday’s debate. The news media’s disgraceful state of dereliction is not going unnoticed either, and it could gain millions of votes for Trump from Americans who are nauseated by the extremely biased coverage the campaign has received. My commentary (see above) provides yet another big reason why pollsters who have picked Sleazy Joe are growing more wrong with each passing day. Concerning the E-Mini S&Ps, if they vault the 3571.50 target shown in the chart, we can confidently infer that investors have caught a whiff of the coming Trump victory. ______ UPDATE (Oct 26, 9:34 p.m. ET): A 100-point decline might have been a worrisome sign for Trump, but bears — and therefore Biden partisans — had to settle for much less by the time short-covering kicked in after-hours trading. Let’s see now whether sellers can get second wind. ______ UPDATE (Oct 27, 9;27 p.m.): A pullback to the green line would trigger a weak ‘mechanical’ buy, stop 3198.00. The trade rates around a 6.8 out of 10.0), since the failure of the futures two weeks ago to reach the 3589 target could be read as a last-gasp rally. For now, though, we should view the weakness since then as related to anxious uncertainty about the outcome of the election. ______ UPDATE (Oct 28, 10:42 p.m.): The buy signal noted above triggered, but I am not enthusiastic enough about it to suggest that you take the plunge unless you can ‘rABC’ yourself aboard on the 15-minute chart. _______ UPDATE (Oct 29, 9:56 pm.): The wacky swings we saw today are likely to turn docile as the week ends, since no one can predict the outcome of the election with confidence. We’ll steer clear of this dervish for now.

I suggested early last week to tune out this vehicle — advice that turns out to have saved us some stress. The futures oscillated nervously within a relatively tight range, paralyzed, if not by fear, then by uncertainty. Not much will be required to turn the futures into a runaway helium balloon, however, and this could happen as early as mid-week on growing perceptions that Trump will win. This notion could conceivably have gained critical mass by the time you read this on Sunday night, since Biden’s campaign was taking on serious water when last week ended. Even if his now well-documented decades of graft fail to gain traction with the news media, he has enough other problems, including, most recently, voters in Pennsylvania, Texas and Oklahoma who heard what he said about killing the oil industry during Thursday’s debate. The news media’s disgraceful state of dereliction is not going unnoticed either, and it could gain millions of votes for Trump from Americans who are nauseated by the extremely biased coverage the campaign has received. My commentary (see above) provides yet another big reason why pollsters who have picked Sleazy Joe are growing more wrong with each passing day. Concerning the E-Mini S&Ps, if they vault the 3571.50 target shown in the chart, we can confidently infer that investors have caught a whiff of the coming Trump victory. ______ UPDATE (Oct 26, 9:34 p.m. ET): A 100-point decline might have been a worrisome sign for Trump, but bears — and therefore Biden partisans — had to settle for much less by the time short-covering kicked in after-hours trading. Let’s see now whether sellers can get second wind. ______ UPDATE (Oct 27, 9;27 p.m.): A pullback to the green line would trigger a weak ‘mechanical’ buy, stop 3198.00. The trade rates around a 6.8 out of 10.0), since the failure of the futures two weeks ago to reach the 3589 target could be read as a last-gasp rally. For now, though, we should view the weakness since then as related to anxious uncertainty about the outcome of the election. ______ UPDATE (Oct 28, 10:42 p.m.): The buy signal noted above triggered, but I am not enthusiastic enough about it to suggest that you take the plunge unless you can ‘rABC’ yourself aboard on the 15-minute chart. _______ UPDATE (Oct 29, 9:56 pm.): The wacky swings we saw today are likely to turn docile as the week ends, since no one can predict the outcome of the election with confidence. We’ll steer clear of this dervish for now.

ESZ20 – December E-Mini S&P (Last:3273.75)

Posted on October 25, 2020, 5:20 pm EDT

Last Updated October 29, 2020, 9:57 pm EDT

Posted on October 25, 2020, 5:20 pm EDT

Last Updated October 29, 2020, 9:57 pm EDT

- October 28, 2020, 12:27 am

-

October 27, 2020, 10:37 am

Just in case anyone is interested, this baby is going back down to 3050-2900 area, if more then to 2700. At that point if we hear free money sounds from the Fed (purchasing ETF’S ?) then it’s a Buy Buy Buy.

Regardless of who wins, it appears from this guy’s vantage point that we are in a greater depression. Trump has pushed us into socialism, there is no exit strategy, only more debt and job losses ahead. How will we get back to capitalism–who knows? I’ll go with Biden/Harris. Harris appears to be the only viable candidate of the entire field. But at the moment, the inmates are running the asylum.

Best,

Bruce