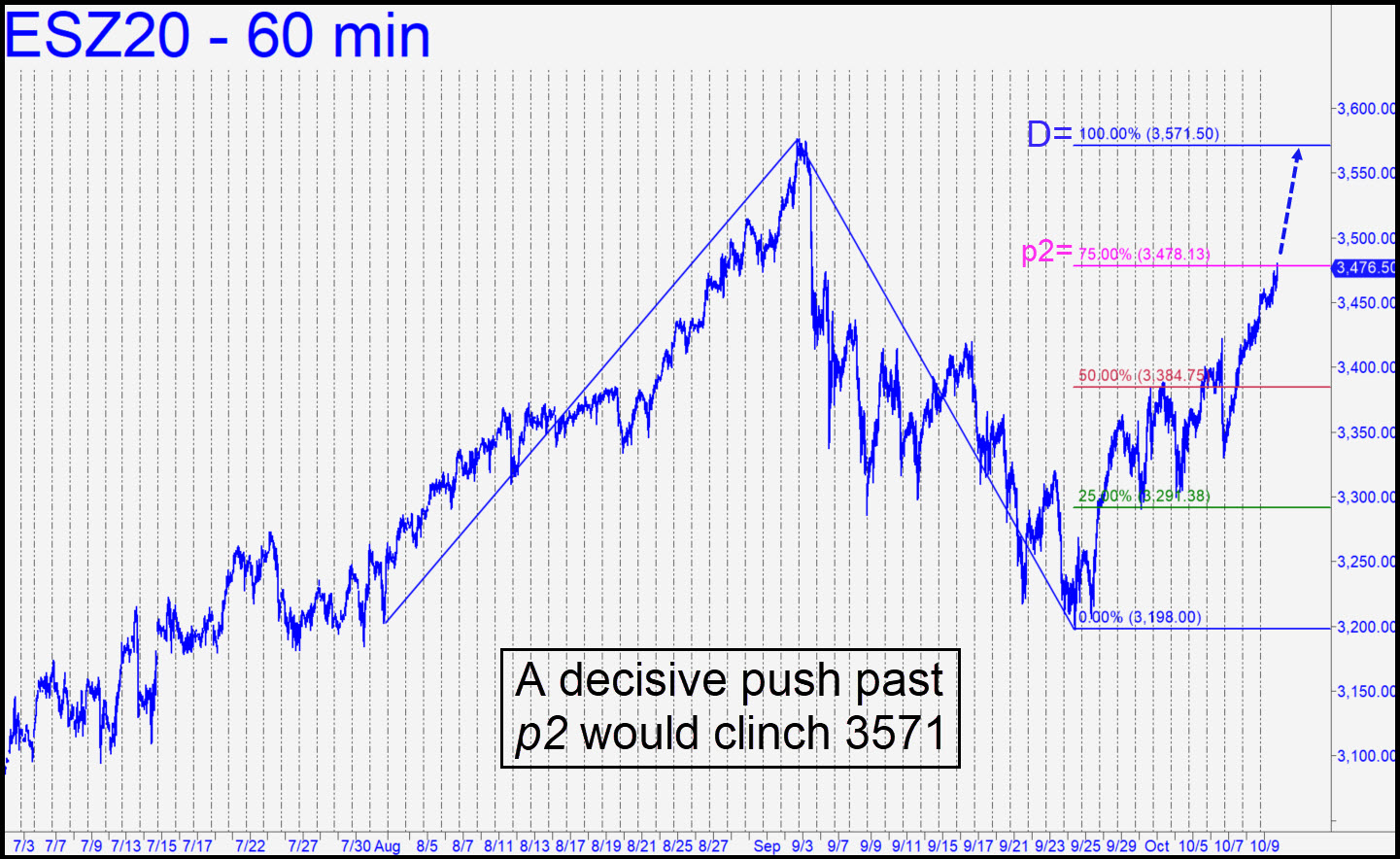

The top of Friday’s 39-point rally came within less than two points of the 3481.75 target I’d sent out the night before. If you got short up there as advised, set a break-even stop-loss for now and cover half if the futures pull back to 3473.00. I’ll update my instruction if Sunday’s opening is worse than merely weak. Alternatively, targets of a bigger, bullish pattern remain in play. They lie, respectively at p2=3478.13 and D=3571.50. Both are shown in the chart (inset) and, because of an adjustment to point ‘A’, are somewhat lower than the targets given here previously. ______ UPDATE (Oct 12, 6:26 p.m. ET): A strong, unpaused rally has made a potential short-term finishing stroke to D=3571.50 all but unavoidable. Short there aggressively with a tight stop-loss if you’ve caught a profitable ride up. _______ UPDATE (Oct 14, 6:55 p.m.): The at times maniacal upsurge of the last few weeks has in fact, and so far, curiously avoided a finishing stroke D=3571.50. This is mildly bearish on its face, but we should give bulls the benefit of the doubt, since the selling over the last couple of days has been quite subdued. This is no reason to give up hope that bears will roar before the week ends, but for now there is no reason to assume the weakness is anything more than a garden-variety retracement. Here’s the picture. ______ UPDATE (Oct 15, 5:4 p.m.): Well, dear permabears, there is a growing list of reasons why you should give up hope, since you’ve accomplished precious little in three days. I’ve mentioned numerous times over the years that a trader could have reaped a fortune buying any downtrend on its third day. Further proof of this may come soon.

The top of Friday’s 39-point rally came within less than two points of the 3481.75 target I’d sent out the night before. If you got short up there as advised, set a break-even stop-loss for now and cover half if the futures pull back to 3473.00. I’ll update my instruction if Sunday’s opening is worse than merely weak. Alternatively, targets of a bigger, bullish pattern remain in play. They lie, respectively at p2=3478.13 and D=3571.50. Both are shown in the chart (inset) and, because of an adjustment to point ‘A’, are somewhat lower than the targets given here previously. ______ UPDATE (Oct 12, 6:26 p.m. ET): A strong, unpaused rally has made a potential short-term finishing stroke to D=3571.50 all but unavoidable. Short there aggressively with a tight stop-loss if you’ve caught a profitable ride up. _______ UPDATE (Oct 14, 6:55 p.m.): The at times maniacal upsurge of the last few weeks has in fact, and so far, curiously avoided a finishing stroke D=3571.50. This is mildly bearish on its face, but we should give bulls the benefit of the doubt, since the selling over the last couple of days has been quite subdued. This is no reason to give up hope that bears will roar before the week ends, but for now there is no reason to assume the weakness is anything more than a garden-variety retracement. Here’s the picture. ______ UPDATE (Oct 15, 5:4 p.m.): Well, dear permabears, there is a growing list of reasons why you should give up hope, since you’ve accomplished precious little in three days. I’ve mentioned numerous times over the years that a trader could have reaped a fortune buying any downtrend on its third day. Further proof of this may come soon.

ESZ20 – December E-Mini S&P (Last:3476.00)

Posted on October 11, 2020, 5:18 pm EDT

Last Updated October 15, 2020, 5:35 pm EDT

Posted on October 11, 2020, 5:18 pm EDT

Last Updated October 15, 2020, 5:35 pm EDT