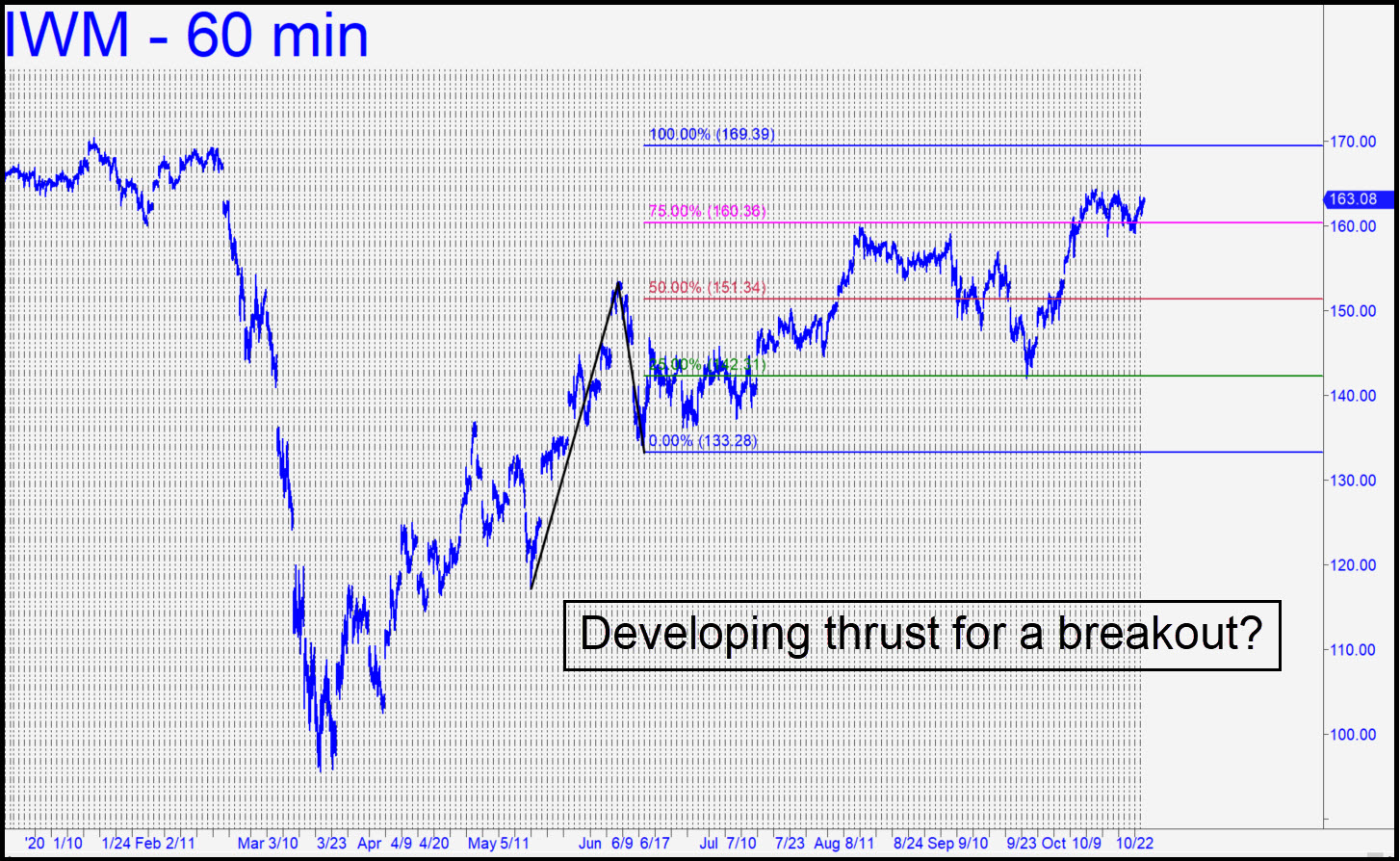

We hold ten Nov 6 130 puts for 0.16 as a hedge against a Biden victory, but they will offer scant consolation if the tragedy of a Biden/Harris administration comes to pass. I consider this improbable, however, and the likelihood of Trump’s re-election would be confirmed if IWM exceeds the 169.39 target shown with a manic leap. It looked as though buyers were developing thrust for this last week, when would-be resistance at p2=160.36 was gradually turned into support. The Russell 2000 and the Industrial Average have lagged the Nasdaq 100 since March, but they appear eager to make up for lost time. A strong across-the-board rally this week would imply that investors have finally realized the pollsters are the same nitwits they were in 2016. _______ UPDATE (Oct 26, 9:56 p.m. ET): Sell half your puts if they double in price. They traded back up to 0.16 today, and although that is our official entry price, some subscribers reported getting in for as little as 0.08. _____ UPDATE (Oct 28, 11:11 p.m) With stocks plunging today, the puts traded as high as 0.35, allowing some subscribers to as much as quadruple their initial stake. At the very least, using an ‘official’ price of 0.16 representing the worst actual fill reported on entry, subscribers would have been able to double out of half of their positions at 0.32 as advised. Now offer three more puts to close for 1.10 and keeping the remaining two until next week. ______ UPDATE (Oct 29, 10:38): The talking heads said investors were ‘hopeful’ for a few hours today that Biden stimulus will be good for small-caps. Not much we can do about it but sit tight. The puts have some critical time left on them.

We hold ten Nov 6 130 puts for 0.16 as a hedge against a Biden victory, but they will offer scant consolation if the tragedy of a Biden/Harris administration comes to pass. I consider this improbable, however, and the likelihood of Trump’s re-election would be confirmed if IWM exceeds the 169.39 target shown with a manic leap. It looked as though buyers were developing thrust for this last week, when would-be resistance at p2=160.36 was gradually turned into support. The Russell 2000 and the Industrial Average have lagged the Nasdaq 100 since March, but they appear eager to make up for lost time. A strong across-the-board rally this week would imply that investors have finally realized the pollsters are the same nitwits they were in 2016. _______ UPDATE (Oct 26, 9:56 p.m. ET): Sell half your puts if they double in price. They traded back up to 0.16 today, and although that is our official entry price, some subscribers reported getting in for as little as 0.08. _____ UPDATE (Oct 28, 11:11 p.m) With stocks plunging today, the puts traded as high as 0.35, allowing some subscribers to as much as quadruple their initial stake. At the very least, using an ‘official’ price of 0.16 representing the worst actual fill reported on entry, subscribers would have been able to double out of half of their positions at 0.32 as advised. Now offer three more puts to close for 1.10 and keeping the remaining two until next week. ______ UPDATE (Oct 29, 10:38): The talking heads said investors were ‘hopeful’ for a few hours today that Biden stimulus will be good for small-caps. Not much we can do about it but sit tight. The puts have some critical time left on them.

IWM – Russell 2000 ETF (Last:155.14)

Posted on October 25, 2020, 5:06 pm EDT

Last Updated October 29, 2020, 10:42 pm EDT

Posted on October 25, 2020, 5:06 pm EDT

Last Updated October 29, 2020, 10:42 pm EDT