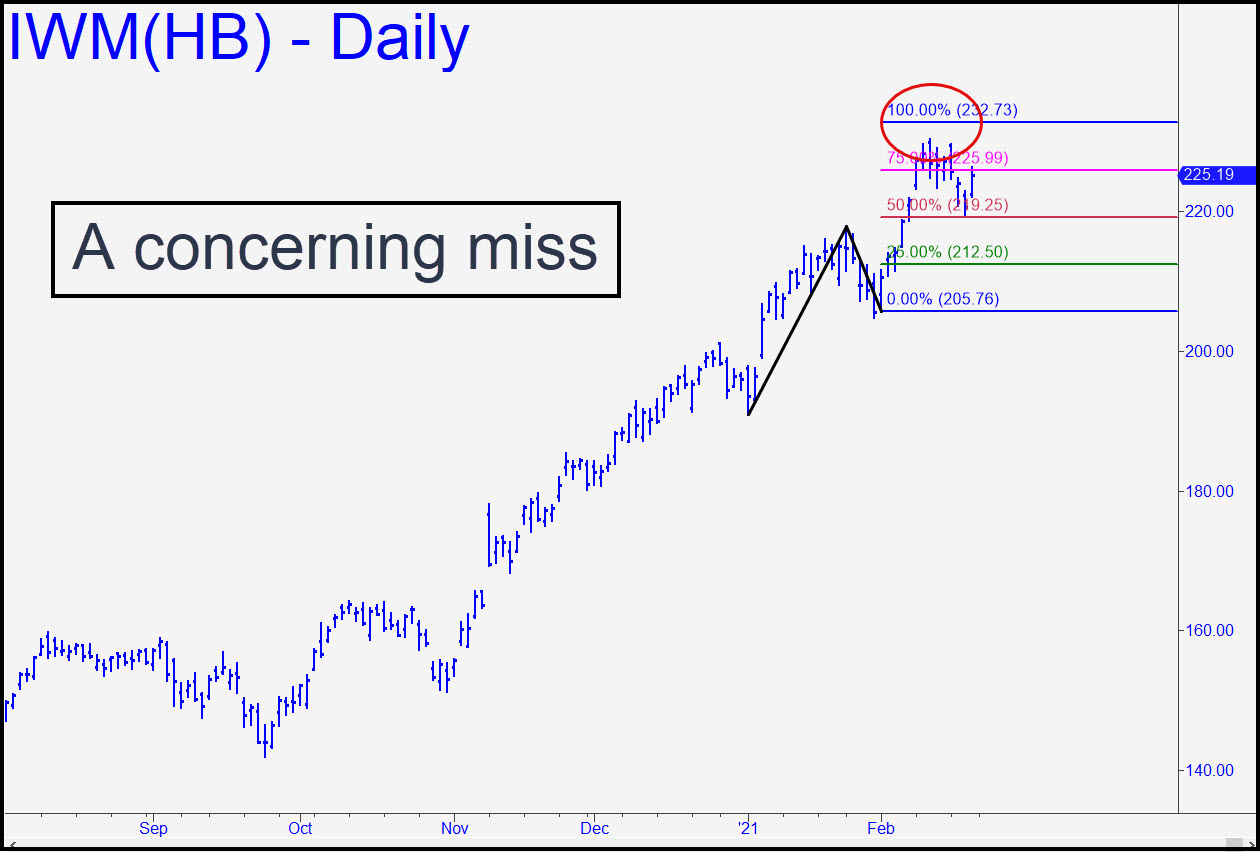

IWM’s recent failure to achieve either of two rally targets I’d drum-rolled is curious, given that it has been the vehicle of choice for portfolio chimps paid to throw other people’s money at superficially appealing ‘themes’. The more important of the targets is 234.82, derived from a pattern that stretches back to the beginning of the bull market in 2009. The other is the 232.72 target shown in the inset. It’s possible the chimps, abetted by their unwitting slaves, short-covering bears, will lay waste to the two Hidden Pivot obstacles in the week(s) ahead. For now, though, we can infer only that Big Money has stalled, presumably waiting for bears to provide the kind of boost that mere bullish buying cannot. Given the targeted tops that have occurred recently in the Dow, QQQ and S&Ps, the burden of proof will be on the optimists as the week begins. ______ UPDATE (Feb 24, 7:25 p.m.): The lunatic brigades were back, bolstered by short covering that drove this gas bag to within easy distance of 234.82. Right now, that’s the only place I’m recommending getting short. _______ UPDATE (Feb 25, 6:12 p.m. EST): Our chances of getting short at 234.82 further dimmed today, although IWM’s dive has yet to do any serious damage to the intraday charts. Let’s see what Friday brings.

IWM’s recent failure to achieve either of two rally targets I’d drum-rolled is curious, given that it has been the vehicle of choice for portfolio chimps paid to throw other people’s money at superficially appealing ‘themes’. The more important of the targets is 234.82, derived from a pattern that stretches back to the beginning of the bull market in 2009. The other is the 232.72 target shown in the inset. It’s possible the chimps, abetted by their unwitting slaves, short-covering bears, will lay waste to the two Hidden Pivot obstacles in the week(s) ahead. For now, though, we can infer only that Big Money has stalled, presumably waiting for bears to provide the kind of boost that mere bullish buying cannot. Given the targeted tops that have occurred recently in the Dow, QQQ and S&Ps, the burden of proof will be on the optimists as the week begins. ______ UPDATE (Feb 24, 7:25 p.m.): The lunatic brigades were back, bolstered by short covering that drove this gas bag to within easy distance of 234.82. Right now, that’s the only place I’m recommending getting short. _______ UPDATE (Feb 25, 6:12 p.m. EST): Our chances of getting short at 234.82 further dimmed today, although IWM’s dive has yet to do any serious damage to the intraday charts. Let’s see what Friday brings.

IWM – Russell 2000 ETF (Last:218.52 )

Posted on February 21, 2021, 5:15 pm EST

Last Updated February 25, 2021, 6:12 pm EST

Posted on February 21, 2021, 5:15 pm EST

Last Updated February 25, 2021, 6:12 pm EST