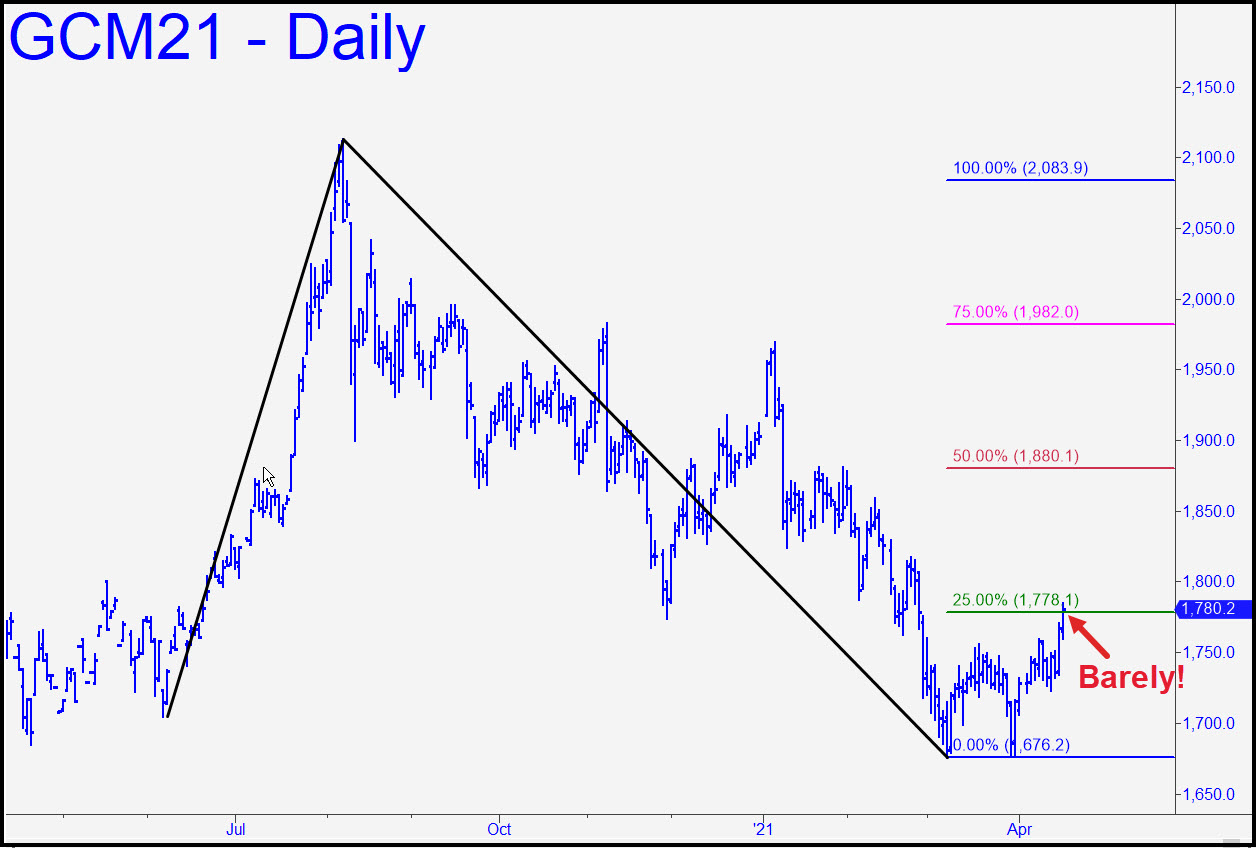

June Gold cleared a key hurdle on Friday by an inch, triggering a theoretical buy signal tied to a 2083.90 target. First things first, however, meaning we should set our sights no higher than p=1880.10 for the time being. This midpoint Hidden Pivot can serve as a minimum upside objective for a climb that would take about 2-3 weeks, assuming the bullishness evident in Silver is present. Even though the rally has yet to generate an impulse leg on the daily chart, this is the most bullish price action we’ve seen in gold since last summer. A longer-term chart allows for a projection of 2286, (A=681 in October, 2008), but it would take two weekly closes above 1976 to warrant getting excited about it. _______ UPDATE (Apr 19, 9:45 p.m. ET): Bulls got sandbagged in the early going, generating an impulsive decline that projects to as low as 1752.90 over the near-term. You can bottom-fish there with a ‘reverse ABC’ pattern using this chart’s ‘b’as your point ‘A’ for the reversal. _______ UPDATE (Apr 20, 6:41 p.m.): The correction never even got close to the secondary pivot at 1758.90, let alone the ‘d’ target $6 below it. This is bullish price action, and it projects most immediately to 1792.00. _______ UPDATE (Apr 21, 5:20 p.m.): June Gold closed above the green line (1778.10), putting a midpoint resistance at 1880.10 in play (see inset) as minimum upside objective for the near-to-intermediate -erm.

June Gold cleared a key hurdle on Friday by an inch, triggering a theoretical buy signal tied to a 2083.90 target. First things first, however, meaning we should set our sights no higher than p=1880.10 for the time being. This midpoint Hidden Pivot can serve as a minimum upside objective for a climb that would take about 2-3 weeks, assuming the bullishness evident in Silver is present. Even though the rally has yet to generate an impulse leg on the daily chart, this is the most bullish price action we’ve seen in gold since last summer. A longer-term chart allows for a projection of 2286, (A=681 in October, 2008), but it would take two weekly closes above 1976 to warrant getting excited about it. _______ UPDATE (Apr 19, 9:45 p.m. ET): Bulls got sandbagged in the early going, generating an impulsive decline that projects to as low as 1752.90 over the near-term. You can bottom-fish there with a ‘reverse ABC’ pattern using this chart’s ‘b’as your point ‘A’ for the reversal. _______ UPDATE (Apr 20, 6:41 p.m.): The correction never even got close to the secondary pivot at 1758.90, let alone the ‘d’ target $6 below it. This is bullish price action, and it projects most immediately to 1792.00. _______ UPDATE (Apr 21, 5:20 p.m.): June Gold closed above the green line (1778.10), putting a midpoint resistance at 1880.10 in play (see inset) as minimum upside objective for the near-to-intermediate -erm.

GCM21 – June Gold (Last:1794.30)

Posted on April 18, 2021, 5:12 pm EDT

Last Updated April 22, 2021, 10:15 pm EDT

Posted on April 18, 2021, 5:12 pm EDT

Last Updated April 22, 2021, 10:15 pm EDT