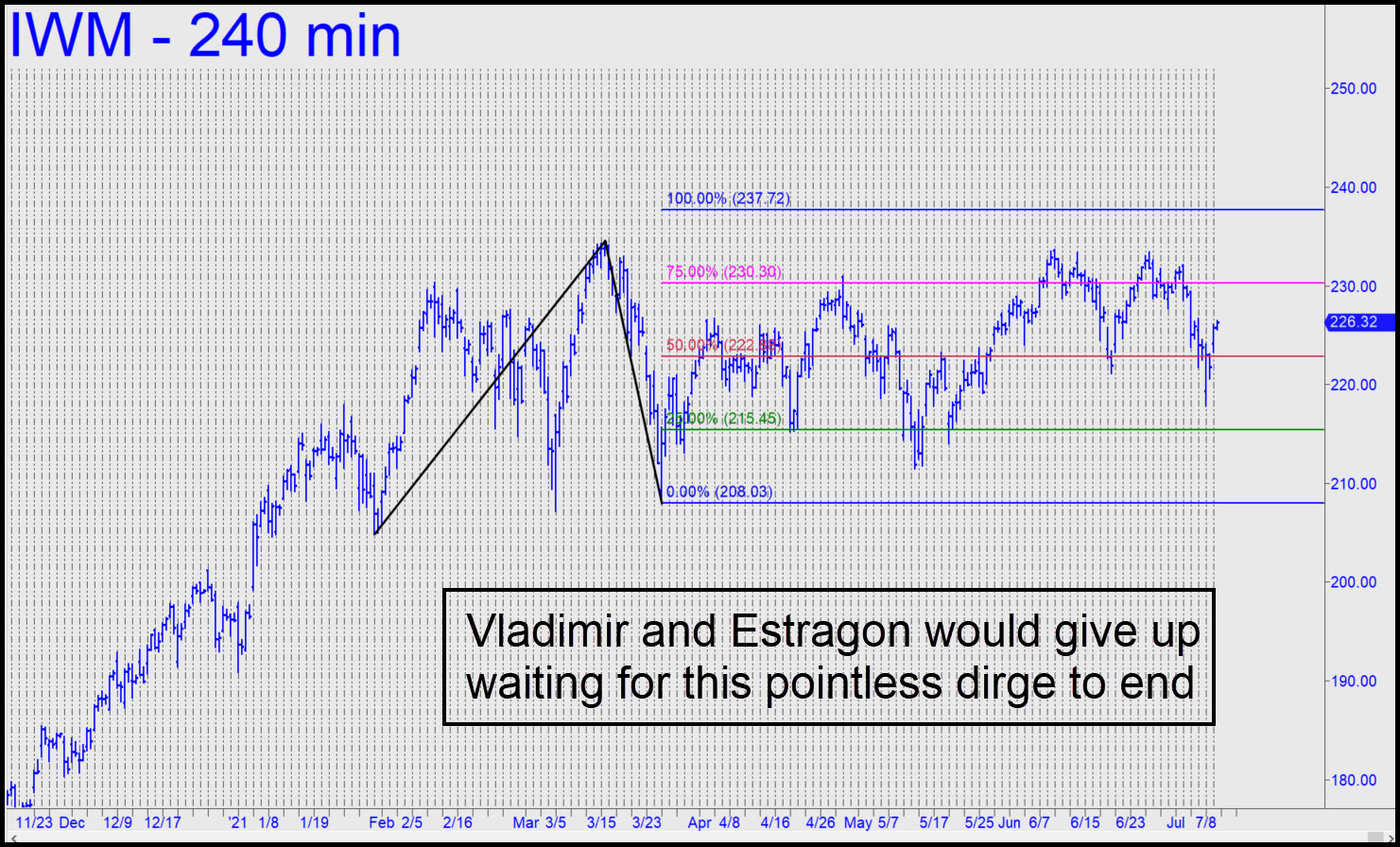

I’ve been tracking this heap because it once had a following, but the portfolio monkeys long ago moved on to more lucrative, invented themes, jettisoning humble ‘value’ for lunatic growthies that are easier to expand to a horizon set at infinity. Not that there was ever much real value in the small-caps, only that they were less absurdly priced than the FAANGs. I’ll keep IWM on the home page nonetheless but leave it to some sharp-eyed subscriber to wake me when opportunity knocks. The 237.72 target is still valid, by the way, and I wouldn’t mind shorting there if the opportunity should arise, but we should have no illusions that this will happen soon. ______ UPDATE (Jul 13, 10:36 p.m. ET): The 215/220/225 butterfly spread I recommended on June 9 has nearly quadrupled in price, so it’s time to exit if you haven’t already. A subscriber reported he was in $ 0.35 and out today for 1.26. Any others? ______ UPDATE (Jul 31, 4:35 p.m.): I am leaving this glue horse on the list as a placeholder, pending the day when the portfolio chimps who made it their absolutely favoritest flavor between March 2020 and February of this year return it to fashion. _______ UPDATE (Aug 5, 11:19 p.m.): A rising tide lifts all boats, as the saying goes, so don’t be surprised if an explosive rally in QQQ that looks imminent hoists this garbage barge’s gunnel above the water line. ______ UPDATE (Aug 14): The garbage barge has gone nowhere, other than gratuitously up and down to annoy everyone. IWM’s behavior shows how DaBoyz are in complete control, owing in no small part to an almost complete absence of sellers. Although institutional demand for Russell 2000 stocks is effectively at zero and has been since March, it still doesn’t go down; it is on autopilot, a self-maintaining artifact of the bull market.

I’ve been tracking this heap because it once had a following, but the portfolio monkeys long ago moved on to more lucrative, invented themes, jettisoning humble ‘value’ for lunatic growthies that are easier to expand to a horizon set at infinity. Not that there was ever much real value in the small-caps, only that they were less absurdly priced than the FAANGs. I’ll keep IWM on the home page nonetheless but leave it to some sharp-eyed subscriber to wake me when opportunity knocks. The 237.72 target is still valid, by the way, and I wouldn’t mind shorting there if the opportunity should arise, but we should have no illusions that this will happen soon. ______ UPDATE (Jul 13, 10:36 p.m. ET): The 215/220/225 butterfly spread I recommended on June 9 has nearly quadrupled in price, so it’s time to exit if you haven’t already. A subscriber reported he was in $ 0.35 and out today for 1.26. Any others? ______ UPDATE (Jul 31, 4:35 p.m.): I am leaving this glue horse on the list as a placeholder, pending the day when the portfolio chimps who made it their absolutely favoritest flavor between March 2020 and February of this year return it to fashion. _______ UPDATE (Aug 5, 11:19 p.m.): A rising tide lifts all boats, as the saying goes, so don’t be surprised if an explosive rally in QQQ that looks imminent hoists this garbage barge’s gunnel above the water line. ______ UPDATE (Aug 14): The garbage barge has gone nowhere, other than gratuitously up and down to annoy everyone. IWM’s behavior shows how DaBoyz are in complete control, owing in no small part to an almost complete absence of sellers. Although institutional demand for Russell 2000 stocks is effectively at zero and has been since March, it still doesn’t go down; it is on autopilot, a self-maintaining artifact of the bull market.

IWM – Russell 2000 ETF (Last:221.13)

Posted on July 11, 2021, 5:03 pm EDT

Last Updated August 14, 2021, 3:09 pm EDT

Posted on July 11, 2021, 5:03 pm EDT

Last Updated August 14, 2021, 3:09 pm EDT