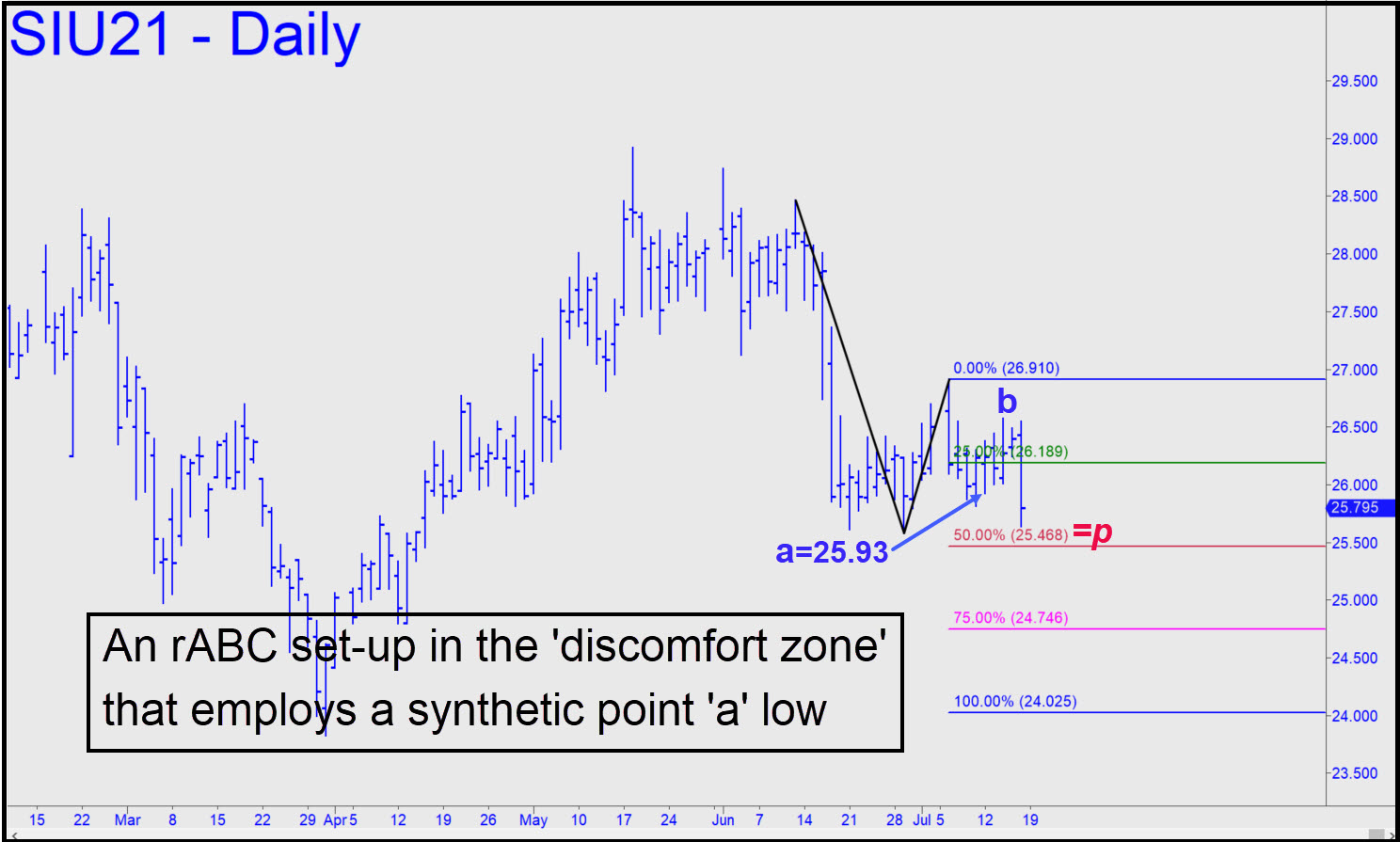

Silver has lagged gold lately and may need to grope its way lower to find good footing. The chart shown is intended to exploit that scenario with an rABC set-up and a point ‘c’ low positioned at p=25.46. This Hidden Pivot support is nicely situated in a ‘discomfort zone’, since, if you look to the left, there are no prior lows that the hoi-polloi would be referencing for structural support. Because we’re playing for a turn from p precisely, I’ve somewhat shortened the a-b interval of the reverse bullish-pattern. If you don’t trade futures and prefer to use SLV, try a tightly stopped bid at 23.46, a midpoint support equivalent to the one in the futures chart. You could also use ‘camouflage’, call options or rABC to initiate the trade, but don’t stick with it if it goes against you more than a little. _______ UPDATE (Jul 19, 6:14 p.m.): Sellers crushed the midpoint pivot at 25.46, negating our plan to position a point ‘c’ low there for an rABC buying set-up. A point ‘a’ anchored at 25.03, the intraday low, would have triggered a buy at 25.22, with p=25.41, but unless I hear from at least two subscribers who elected the trade, I won’t provide tracking guidance. _______ UPDATE (Jul 22, 4:38): Buyers took out one internal peak and two ‘externals’ on the hourly chart, imply bulls are likely to dominate at least till Sunday evening.

Silver has lagged gold lately and may need to grope its way lower to find good footing. The chart shown is intended to exploit that scenario with an rABC set-up and a point ‘c’ low positioned at p=25.46. This Hidden Pivot support is nicely situated in a ‘discomfort zone’, since, if you look to the left, there are no prior lows that the hoi-polloi would be referencing for structural support. Because we’re playing for a turn from p precisely, I’ve somewhat shortened the a-b interval of the reverse bullish-pattern. If you don’t trade futures and prefer to use SLV, try a tightly stopped bid at 23.46, a midpoint support equivalent to the one in the futures chart. You could also use ‘camouflage’, call options or rABC to initiate the trade, but don’t stick with it if it goes against you more than a little. _______ UPDATE (Jul 19, 6:14 p.m.): Sellers crushed the midpoint pivot at 25.46, negating our plan to position a point ‘c’ low there for an rABC buying set-up. A point ‘a’ anchored at 25.03, the intraday low, would have triggered a buy at 25.22, with p=25.41, but unless I hear from at least two subscribers who elected the trade, I won’t provide tracking guidance. _______ UPDATE (Jul 22, 4:38): Buyers took out one internal peak and two ‘externals’ on the hourly chart, imply bulls are likely to dominate at least till Sunday evening.

SIU21 – September Silver (Last:25.46)

Posted on July 18, 2021, 5:08 pm EDT

Last Updated July 22, 2021, 4:37 pm EDT

Posted on July 18, 2021, 5:08 pm EDT

Last Updated July 22, 2021, 4:37 pm EDT