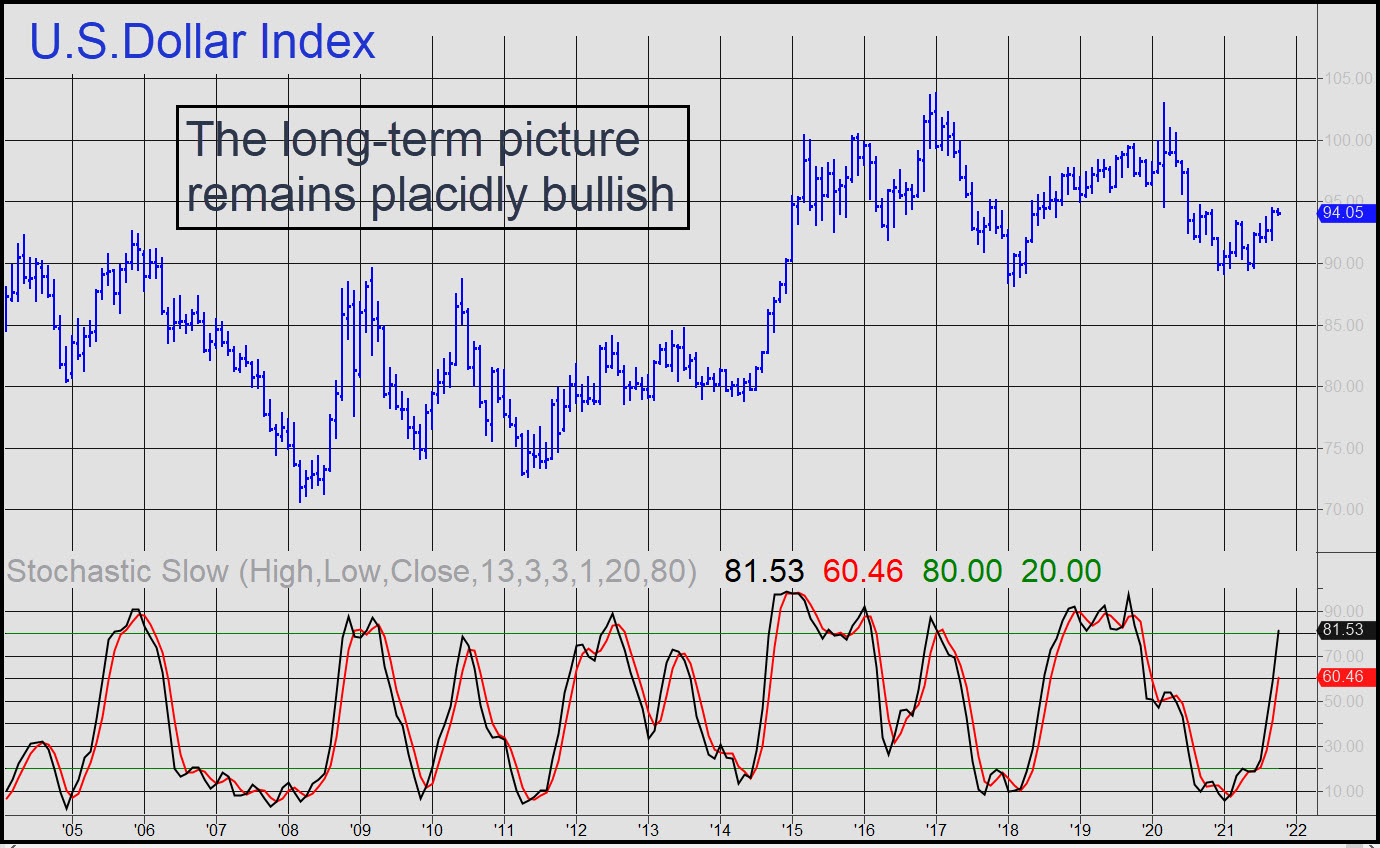

With trillions in reckless stimulus as a backdrop, it seems counterintuitive to speak of the dollar as being in a boring consolidation. But that’s what the long-term charts are saying. I’m a dollar permabull myself, since I see a deflationary endgame for the global financial bubble. But I must concede that if the Dollar Index is eventually headed to 120 or higher as I’ve been predicting, it is in no hurry to get there. The chart doesn’t give much support to dollar bears, though. The most bearish thing that could be said about it is that even though the greenback has risen only very modestly this year from the lows of a five-year range, it is already getting pretty overbought. This sluggishness is worth watching, but it is not at all menacing at present. Keep in mind as well that merely being overbought does not preclude the possibility of an enormous rally while this condition exists; it happens all the time. For the time being, however, you can tune out all the noise and ‘expert’ opinion concerning the dollar, especially the bearish kind.

With trillions in reckless stimulus as a backdrop, it seems counterintuitive to speak of the dollar as being in a boring consolidation. But that’s what the long-term charts are saying. I’m a dollar permabull myself, since I see a deflationary endgame for the global financial bubble. But I must concede that if the Dollar Index is eventually headed to 120 or higher as I’ve been predicting, it is in no hurry to get there. The chart doesn’t give much support to dollar bears, though. The most bearish thing that could be said about it is that even though the greenback has risen only very modestly this year from the lows of a five-year range, it is already getting pretty overbought. This sluggishness is worth watching, but it is not at all menacing at present. Keep in mind as well that merely being overbought does not preclude the possibility of an enormous rally while this condition exists; it happens all the time. For the time being, however, you can tune out all the noise and ‘expert’ opinion concerning the dollar, especially the bearish kind.

DXY – NYBOT Dollar Index (Last:94.05)

Posted on October 3, 2021, 5:20 pm EDT

Last Updated October 6, 2021, 7:30 am EDT

Posted on October 3, 2021, 5:20 pm EDT

Last Updated October 6, 2021, 7:30 am EDT