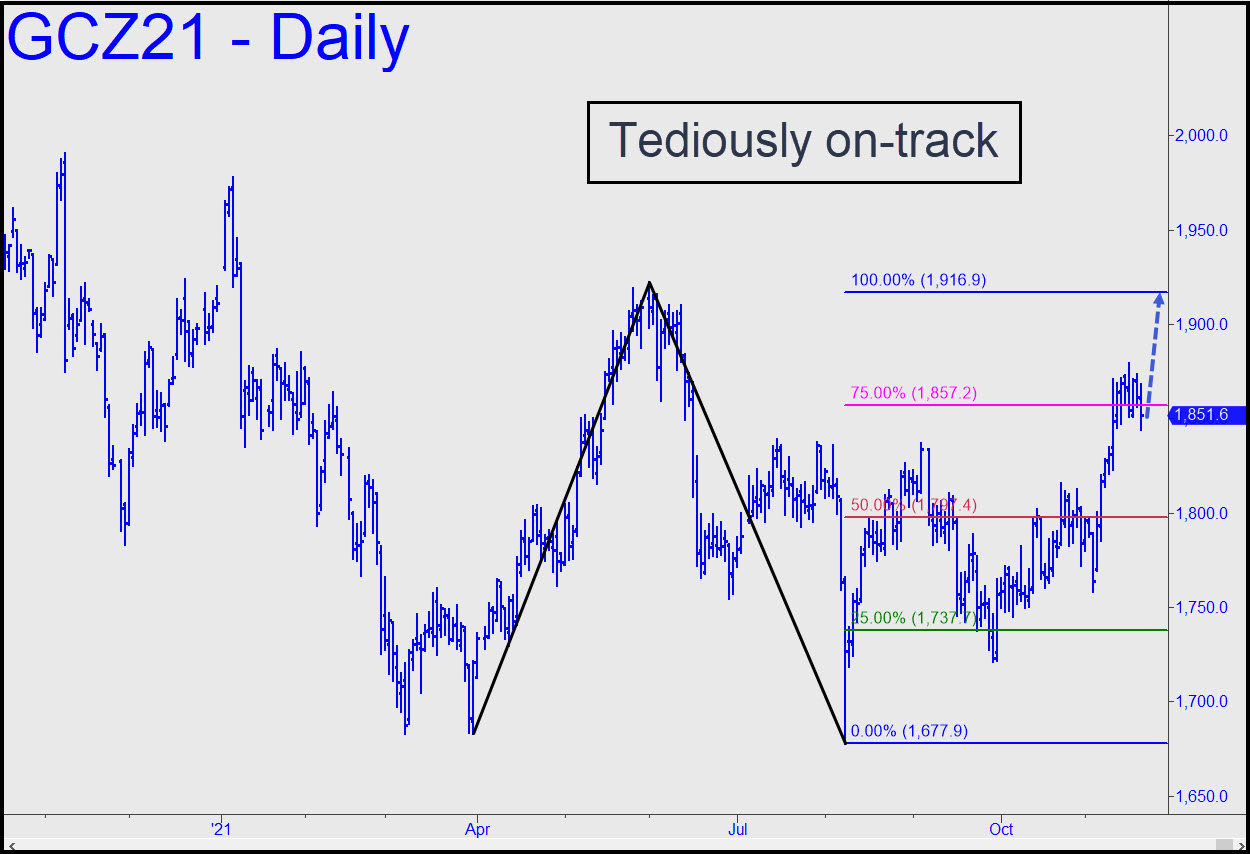

December Gold remains on track for a move to at least 1916.90, the ‘reverse’ D rally target shown in the inset. Two weeks of tedium have at lest partially consolidated the very robust impulse leg begun on November 3 from 1758. However, we shouldn’t rule out the possibility of a $30-$50 swoon to alleviate gold’s constipation before it heads up to 1916.90. The implied $2000 entry risk of bullishly trading the resulting pattern means we’ll need to set it up on charts of lesser degree. You should stay tuned to the chat room, but also keep your email ‘Notifications’ switched on if you want to keep closely apprised. ______ UPDATE (Nov 22, 9:52 p.m.): The December contract fell almost $50, validating my warning, but technically it won’t become a swoon until we’ve see a strong bounce that recoups the loss. In the meantime, a further fall to p=1797.40 would trip a ‘mechanical’ buy, and so would a hit at x=1737.70. Nudge me in the chat room if you would like me to vet your ‘camouflage’ entry set-up. _______ UPDATE (Nov 23, 5:48 p.m.): We’re in no hurry to get long nor to play hero as gold’s predatory masters simulate scary weakness. I still think we’ll have our chance down around 1737.70.

December Gold remains on track for a move to at least 1916.90, the ‘reverse’ D rally target shown in the inset. Two weeks of tedium have at lest partially consolidated the very robust impulse leg begun on November 3 from 1758. However, we shouldn’t rule out the possibility of a $30-$50 swoon to alleviate gold’s constipation before it heads up to 1916.90. The implied $2000 entry risk of bullishly trading the resulting pattern means we’ll need to set it up on charts of lesser degree. You should stay tuned to the chat room, but also keep your email ‘Notifications’ switched on if you want to keep closely apprised. ______ UPDATE (Nov 22, 9:52 p.m.): The December contract fell almost $50, validating my warning, but technically it won’t become a swoon until we’ve see a strong bounce that recoups the loss. In the meantime, a further fall to p=1797.40 would trip a ‘mechanical’ buy, and so would a hit at x=1737.70. Nudge me in the chat room if you would like me to vet your ‘camouflage’ entry set-up. _______ UPDATE (Nov 23, 5:48 p.m.): We’re in no hurry to get long nor to play hero as gold’s predatory masters simulate scary weakness. I still think we’ll have our chance down around 1737.70.

GCZ21 – December Gold (Last:1789.50)

Posted on November 21, 2021, 5:14 pm EST

Last Updated November 28, 2021, 10:04 pm EST

Posted on November 21, 2021, 5:14 pm EST

Last Updated November 28, 2021, 10:04 pm EST