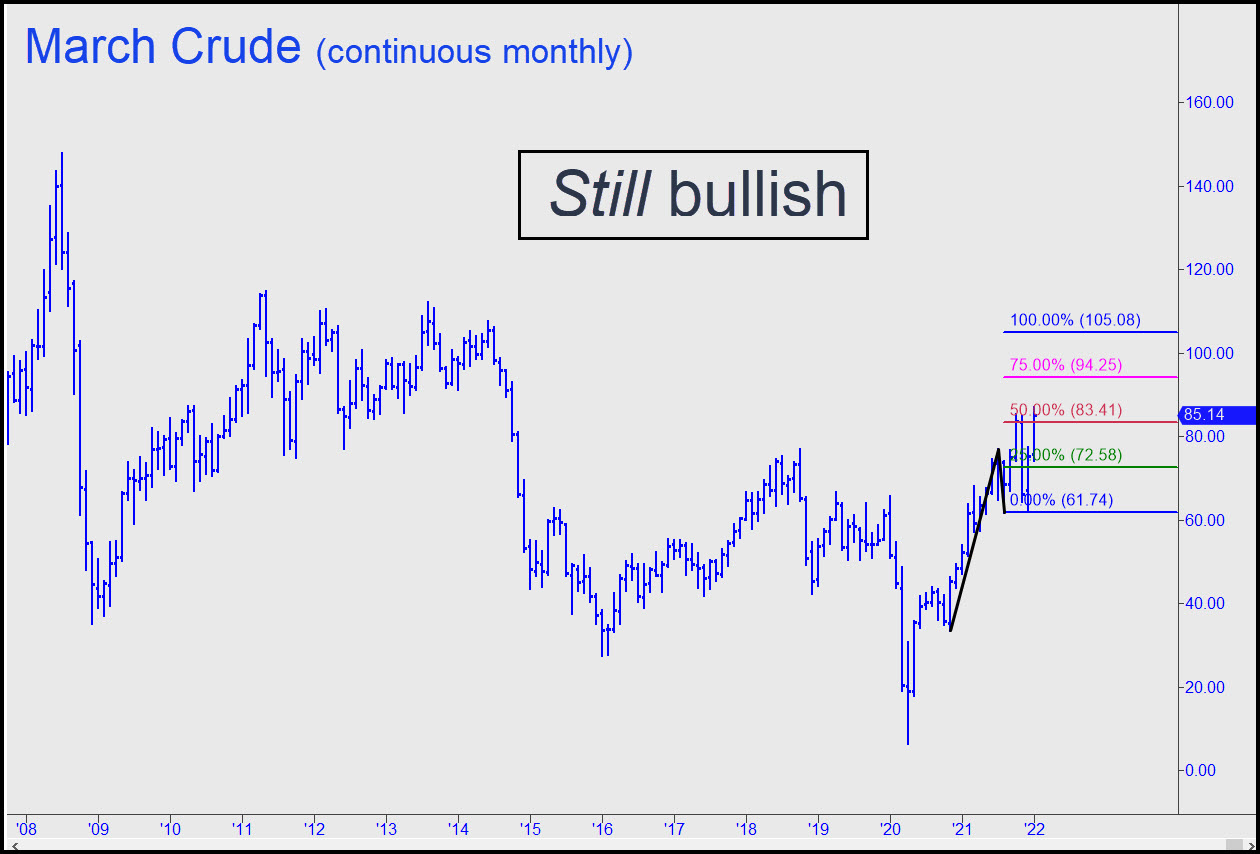

Whatever is pushing up quotes for crude, it’s scary to imagine. Stocks have been acting as if they understand that the party is over. But energy prices? You’d think the global economy was about to embark on a boom so robust that it will somehow overcome the world’s hopelessly knotted supply chain. In actuality, the economy of the most important buyer of oil at the margin, China, is close to imploding, starting with a real estate bubble that could be the biggest ever. Is crude perhaps discounting a collapse in supply when Putin attacks Ukraine? Whatever the answer, and even if a bear market in stocks has begun, the March oil’s monthly chart implies that prices are on their way up to at least 105.08 this winter. Gas by then will be $6 a gallon, which, far from exacerbating inflation, is more likely to knock the economy on its ass. ______ UPDATE (Feb 2, 9:24 p.m.): This chart shows why it is impossible to be long in crude while keeping risk:reward in propitious balance. Notice how each new marginal high is followed by a swooning dive that is about three times what you would have made holding the position from one peak to the next.

Whatever is pushing up quotes for crude, it’s scary to imagine. Stocks have been acting as if they understand that the party is over. But energy prices? You’d think the global economy was about to embark on a boom so robust that it will somehow overcome the world’s hopelessly knotted supply chain. In actuality, the economy of the most important buyer of oil at the margin, China, is close to imploding, starting with a real estate bubble that could be the biggest ever. Is crude perhaps discounting a collapse in supply when Putin attacks Ukraine? Whatever the answer, and even if a bear market in stocks has begun, the March oil’s monthly chart implies that prices are on their way up to at least 105.08 this winter. Gas by then will be $6 a gallon, which, far from exacerbating inflation, is more likely to knock the economy on its ass. ______ UPDATE (Feb 2, 9:24 p.m.): This chart shows why it is impossible to be long in crude while keeping risk:reward in propitious balance. Notice how each new marginal high is followed by a swooning dive that is about three times what you would have made holding the position from one peak to the next.

CLH22 – March Crude (Last:87.66)

Posted on January 23, 2022, 5:21 pm EST

Last Updated February 14, 2022, 5:35 pm EST

Posted on January 23, 2022, 5:21 pm EST

Last Updated February 14, 2022, 5:35 pm EST