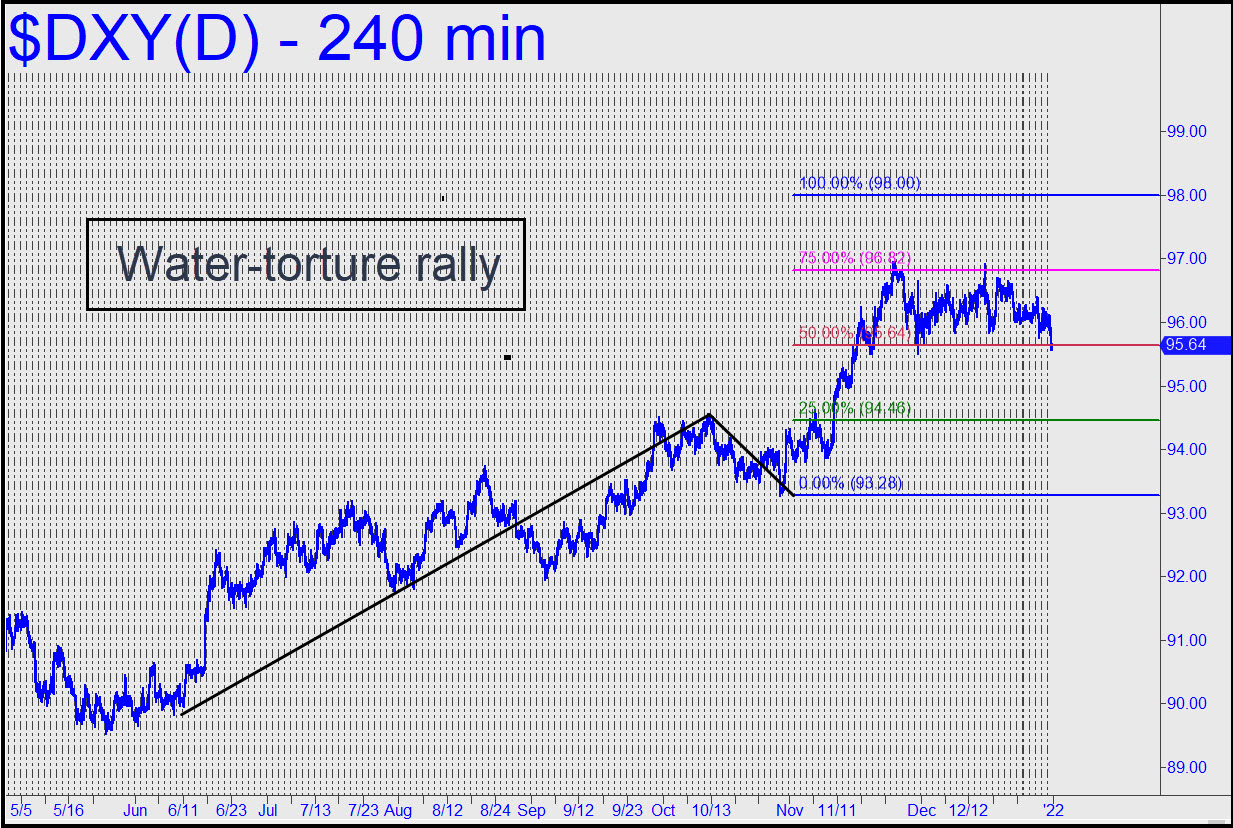

I am updating DXY not because it has done anything interesting since November, but just to have the U.S. dollar on my ‘new’ front page. It has been locked in a consolidation pattern since then, although the year ended with an imminent but not necessarily serious breakdown. If the correction continues, it will allow me to switch to a more regular pattern instead of the fiercely gnarly one that has informed us the last month or so. Regardless, we can continue to use D=98.00 as a minimum upside objective for the bull cycle begun in May. It is part of a much larger, bull market that started in 2014. _______ UPDATE (Jan 27, 9:04 p.m. ET): The 98.00 target is in-the-bag, so let’s shift our sights upward to the 102.83 D target of this reverse pattern. You can use p2=99.43 as a minimum upside objective for the near term. ______ UPDATE (Feb 3, 9:47 p.m.): The dollar has gone into a fake death dive after rallying to within easy distance of the 98.00 target drum-rolled above. We’ll move to the sidelines for now, the better to sleep through the buck’s indeterminate funk.

I am updating DXY not because it has done anything interesting since November, but just to have the U.S. dollar on my ‘new’ front page. It has been locked in a consolidation pattern since then, although the year ended with an imminent but not necessarily serious breakdown. If the correction continues, it will allow me to switch to a more regular pattern instead of the fiercely gnarly one that has informed us the last month or so. Regardless, we can continue to use D=98.00 as a minimum upside objective for the bull cycle begun in May. It is part of a much larger, bull market that started in 2014. _______ UPDATE (Jan 27, 9:04 p.m. ET): The 98.00 target is in-the-bag, so let’s shift our sights upward to the 102.83 D target of this reverse pattern. You can use p2=99.43 as a minimum upside objective for the near term. ______ UPDATE (Feb 3, 9:47 p.m.): The dollar has gone into a fake death dive after rallying to within easy distance of the 98.00 target drum-rolled above. We’ll move to the sidelines for now, the better to sleep through the buck’s indeterminate funk.

DXY – NYBOT Dollar Index (Last:95.23)

Posted on January 2, 2022, 5:06 pm EST

Last Updated February 8, 2022, 4:30 pm EST

Posted on January 2, 2022, 5:06 pm EST

Last Updated February 8, 2022, 4:30 pm EST