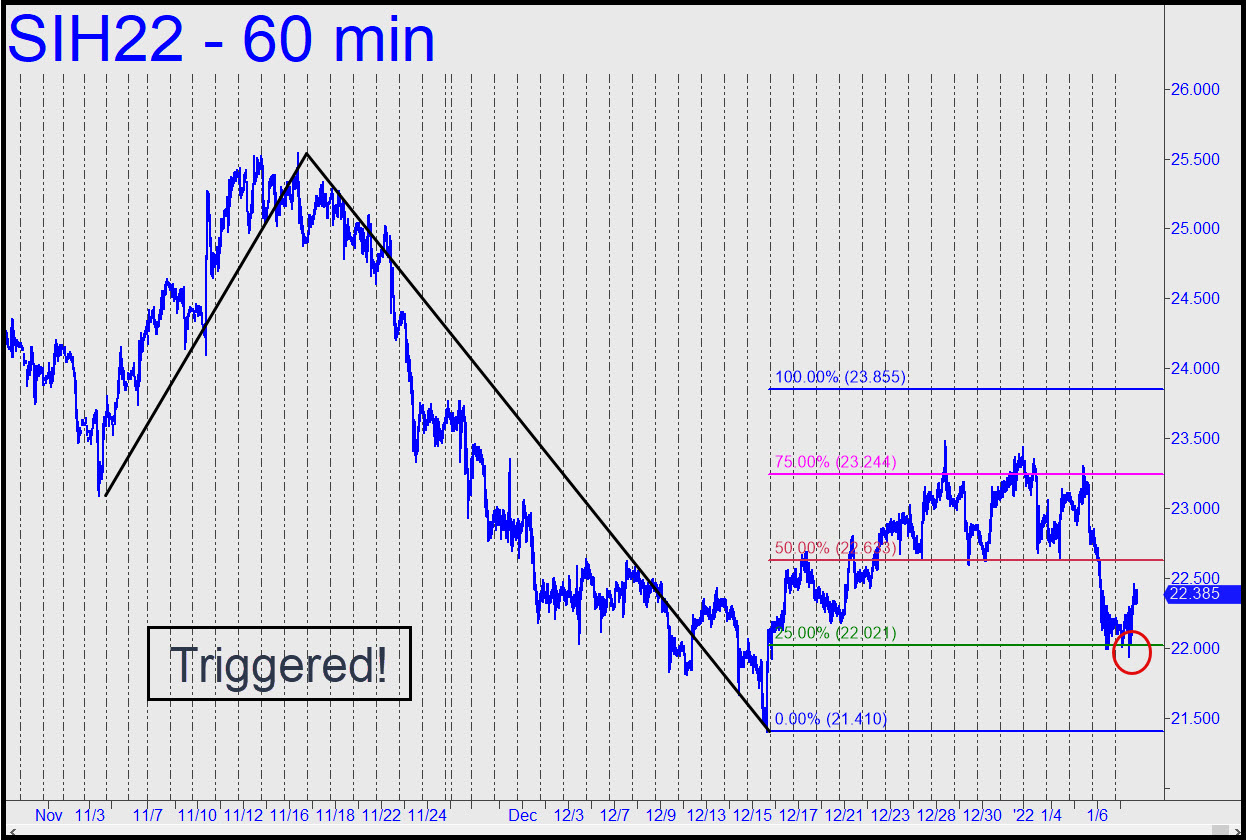

A ‘mechanical’ buy that had been two weeks in coming triggered on Friday after bouncing off the green line at 22.02 no fewer than three times. Numerous subscribers swore on a stack of Holy Bibles that they have been paying attention to my Silver touts, so I will establish a tracking position and see how it goes. I’ll use a 22.10 cost basis, since Thursday’s initial bounce from the green line would have been stopped out following a partial, profitable exit. The not-so-sloppy-seconds pattern we are left to trade is shown here, and it implies two contracts would have been exited at p=22.27. Cash out a third at d=22.59 and use a 22.03 stop-loss for the 25% that remains unless instructed otherwise. _______ UPDATE (Jan 10, 7:03 p.m.): The futures are closing on 22.59 this evening. Exit another 25% as suggested, but switch to an impulsive stop-loss on the 30-minute chart for the 25% that remains. This implies stopping out the trade if a presumably corrective down-leg exceeds two prior lows without correcting, At present, the stop would be at 22.36. ______ UPDATE (Jan 11, 8:41 p.m.): If you Bible-thumping supposed silver lovers followed my instructions, you are still long a single contract (or 25% of the original position), with a realized gain of $4150 and another $3400 of unrealized. Use a 22.48 stop-loss for what remains, o-c-o with a closing offer at 23.20. An exit there would yield a total profit of around $9100. _______ UPDATE (Jan 12, 1:24 p.m.): Today’s strong upthrust has hit 23.22, so we are officially out of the position with a theoretical profit of $9100. The rally impaled the midpoint pivot of a larger pattern with such force that we can now use D=24.01 shown in this chart as a minimum upside objective.

A ‘mechanical’ buy that had been two weeks in coming triggered on Friday after bouncing off the green line at 22.02 no fewer than three times. Numerous subscribers swore on a stack of Holy Bibles that they have been paying attention to my Silver touts, so I will establish a tracking position and see how it goes. I’ll use a 22.10 cost basis, since Thursday’s initial bounce from the green line would have been stopped out following a partial, profitable exit. The not-so-sloppy-seconds pattern we are left to trade is shown here, and it implies two contracts would have been exited at p=22.27. Cash out a third at d=22.59 and use a 22.03 stop-loss for the 25% that remains unless instructed otherwise. _______ UPDATE (Jan 10, 7:03 p.m.): The futures are closing on 22.59 this evening. Exit another 25% as suggested, but switch to an impulsive stop-loss on the 30-minute chart for the 25% that remains. This implies stopping out the trade if a presumably corrective down-leg exceeds two prior lows without correcting, At present, the stop would be at 22.36. ______ UPDATE (Jan 11, 8:41 p.m.): If you Bible-thumping supposed silver lovers followed my instructions, you are still long a single contract (or 25% of the original position), with a realized gain of $4150 and another $3400 of unrealized. Use a 22.48 stop-loss for what remains, o-c-o with a closing offer at 23.20. An exit there would yield a total profit of around $9100. _______ UPDATE (Jan 12, 1:24 p.m.): Today’s strong upthrust has hit 23.22, so we are officially out of the position with a theoretical profit of $9100. The rally impaled the midpoint pivot of a larger pattern with such force that we can now use D=24.01 shown in this chart as a minimum upside objective.

SIH22 – March Silver (Last:23.20)

Posted on January 9, 2022, 5:11 pm EST

Last Updated January 12, 2022, 1:23 pm EST

Posted on January 9, 2022, 5:11 pm EST

Last Updated January 12, 2022, 1:23 pm EST

- January 9, 2022, 8:01 pm

For those who regard the COT data as significant it is presently bullish for gold and silver as the structure of the market is pointed upward. The silver commercial short position is low and the gold COT short position is 237,500 short contracts which is the lowest since June 2019. This is a very bullish market structure. It argues that prices will rise (before getting slapped down again) but is the set-up for a long trade.