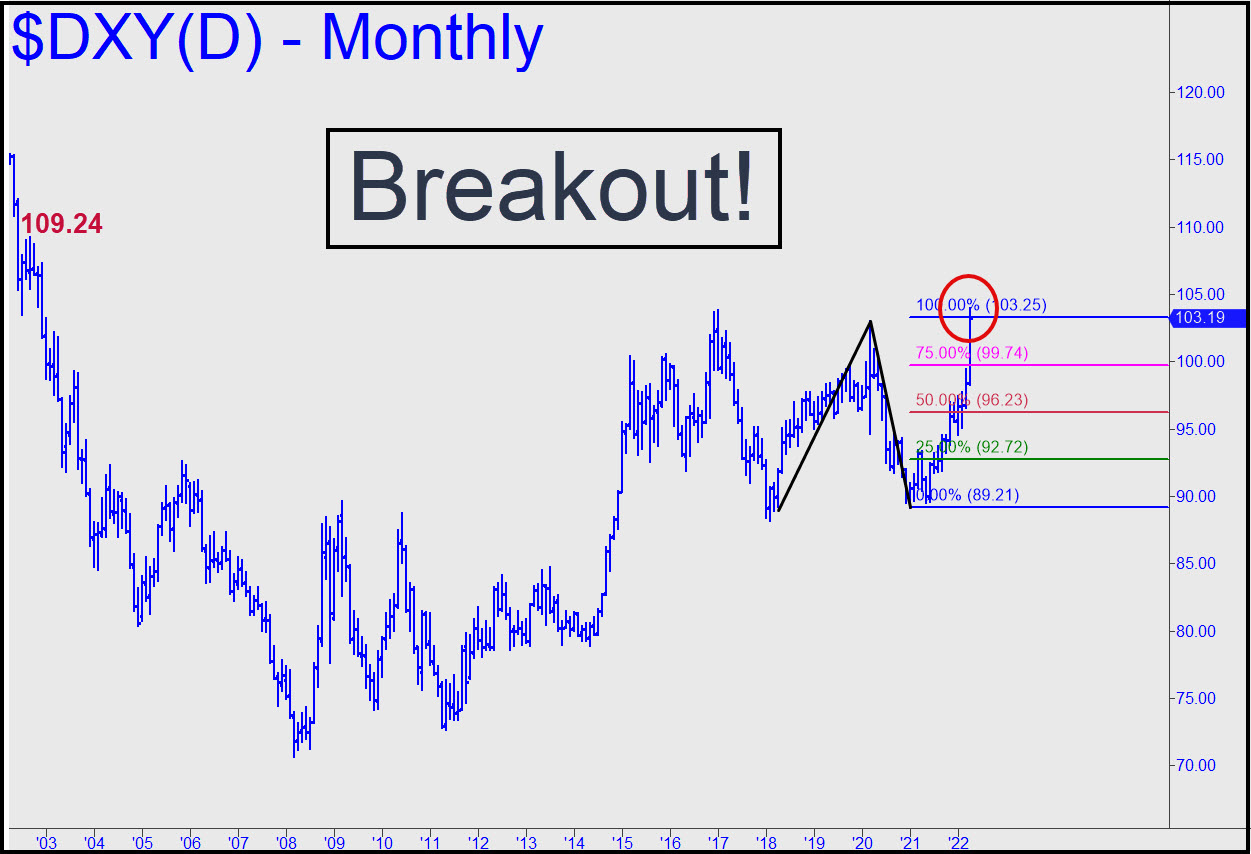

The Dollar Index last week popped through peaks going back as far as five years, flouting the Fed’s doomed efforts to ‘manage our expectations’. This is deflation knocking loudly on the door, and as the dollar continues higher it will put increasing pressure on all who owe. (See my commentary above, and click here for a lively, expansive interview at Howe Street.) In the headline essay, I’ve used a minor, look-to-the-left peak near 109 to project minimum upside for the next few weeks. However, here’s a bigger picture that yields a higher target at 112.14. I expect the dollar eventually to challenge highs near 120 recorded twenty years ago. _______ UPDATE (May 13, 9:57 p.m.): To gauge the strength of the uptrend, here’s a lesser chart that shows DXY in an apparent bullish consolidation after hitting a relatively minor rally target. The 112.14 target given above remains viable and is still likely to be reached. _______ UPDATE (May 19, 6:13 p.m.): What a difference a day makes. The sharp dive has transformed a promising technical picture into a question mark. Some will see a head-and-shoulders in the making, but we should give it another day or two before be infer that DXY is about to fall back to 100 in search of support.

The Dollar Index last week popped through peaks going back as far as five years, flouting the Fed’s doomed efforts to ‘manage our expectations’. This is deflation knocking loudly on the door, and as the dollar continues higher it will put increasing pressure on all who owe. (See my commentary above, and click here for a lively, expansive interview at Howe Street.) In the headline essay, I’ve used a minor, look-to-the-left peak near 109 to project minimum upside for the next few weeks. However, here’s a bigger picture that yields a higher target at 112.14. I expect the dollar eventually to challenge highs near 120 recorded twenty years ago. _______ UPDATE (May 13, 9:57 p.m.): To gauge the strength of the uptrend, here’s a lesser chart that shows DXY in an apparent bullish consolidation after hitting a relatively minor rally target. The 112.14 target given above remains viable and is still likely to be reached. _______ UPDATE (May 19, 6:13 p.m.): What a difference a day makes. The sharp dive has transformed a promising technical picture into a question mark. Some will see a head-and-shoulders in the making, but we should give it another day or two before be infer that DXY is about to fall back to 100 in search of support.

DXY – NYBOT Dollar Index (Last:102.88)

Posted on May 1, 2022, 5:13 pm EDT

Last Updated May 21, 2022, 5:12 pm EDT

Posted on May 1, 2022, 5:13 pm EDT

Last Updated May 21, 2022, 5:12 pm EDT

- May 4, 2022, 9:33 pm

My expansion numbers average 109.4 but there is a gap area around 97 which will fill. Is there a reasonable possibility of that happening before upside targets are reached?