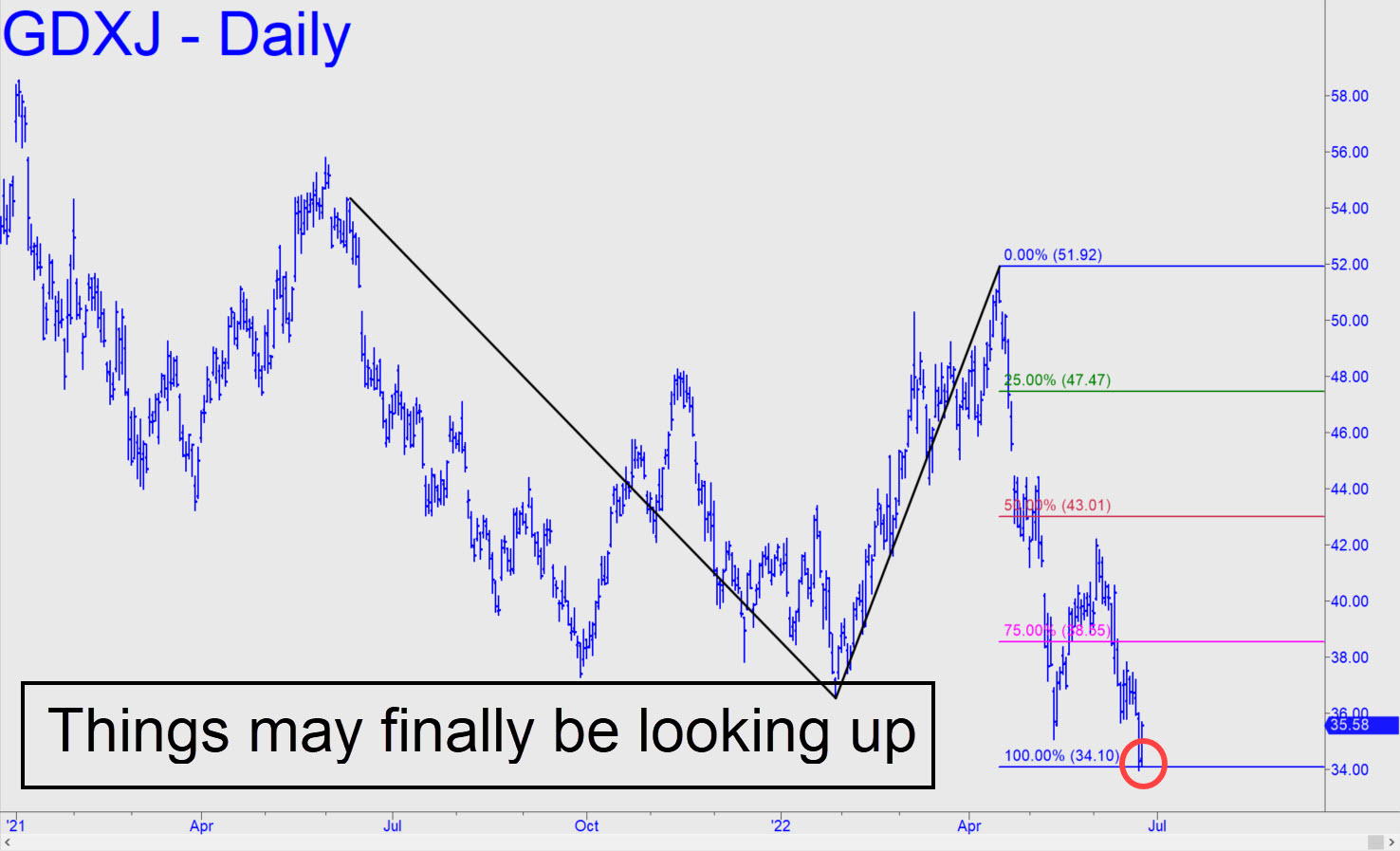

GDXJ bounce sharply Friday off a major downside target that has been a year in coming. I was reminded by a Pivoteer in the Trading Room that I had characterized the 34.10 ‘D’ target shown in the chart as a potential back-up-the-truck opportunity for bulls who have been patiently waiting for this cinder block to hit bottom. And perhaps it has, since the pattern is far too gnarly to have been queered by village idiots and algos who seem, finally, to have gotten the hang of reading conventional ABCD patterns. This one would not likely have been on their radar, even if it represents radical perfection in our playbook. It helps, too, that I myself had forgotten about the target and haven’t mentioned it in a long while. If you bought the low on Friday, please let me know in the chat room so that I can establish a tracking position. ______ UPDATE (Jun 28, 7:14 p.m.): Much as this little p.o.s. would love to keep falling just to make sure every bull has been squashed like a bug, it’s going to have one very tough time taking out the 32.68 Hidden Pivot support shown in this chart. Speculative buying, tightly stopped, is strongly encouraged, especially if you made money on the way down. Rookies looking for action can bid 32.71 for 200 shares, stop 32.49. _______ UPDATE (Jun 30, 3:54 p.m.): This turd is really starting to stink up the place. I’ve given up caring or even believing there has to be a bottom. But for anyone who is somehow still interested, the next logical downside target is 29.92. Bottom-fishing there is recommended if your hobby is losing money. Here’s the chart. ______ UPDATE (Jul 6, 1:59 p.m.):This bathyscaphe has bobbed up from a low today at 29.82. How shocking! See the chat room discussion, which includes a ‘forced’ bottom-fishing trade in August Gold that is currently taking on water. ______ UPDATE (Jul 7, 6:12 p.m.): GDXJ has lifted tentatively off a 29.82 low, but it’s too early to hazard a guess about how far the rally will go. In any event, it was a promising place for an important turn to have occurred. If you hold a long position tied to my guidance, please let me know in the chat room so that I can determine whether to provide tracking guidance. ________ UPDATE (Jull 8, 9:00 a.m.): Numerous subscribers reported getting long, so I am establishing a tracking position of 400 shares (or multiple thereof) from 29.92. For now, take profit on half at a current price of around 31.35. Use a 30.52 stop-loss for what remains. To simplify accounting, it can be carried for an adjusted cost-basis of 28.49.

GDXJ bounce sharply Friday off a major downside target that has been a year in coming. I was reminded by a Pivoteer in the Trading Room that I had characterized the 34.10 ‘D’ target shown in the chart as a potential back-up-the-truck opportunity for bulls who have been patiently waiting for this cinder block to hit bottom. And perhaps it has, since the pattern is far too gnarly to have been queered by village idiots and algos who seem, finally, to have gotten the hang of reading conventional ABCD patterns. This one would not likely have been on their radar, even if it represents radical perfection in our playbook. It helps, too, that I myself had forgotten about the target and haven’t mentioned it in a long while. If you bought the low on Friday, please let me know in the chat room so that I can establish a tracking position. ______ UPDATE (Jun 28, 7:14 p.m.): Much as this little p.o.s. would love to keep falling just to make sure every bull has been squashed like a bug, it’s going to have one very tough time taking out the 32.68 Hidden Pivot support shown in this chart. Speculative buying, tightly stopped, is strongly encouraged, especially if you made money on the way down. Rookies looking for action can bid 32.71 for 200 shares, stop 32.49. _______ UPDATE (Jun 30, 3:54 p.m.): This turd is really starting to stink up the place. I’ve given up caring or even believing there has to be a bottom. But for anyone who is somehow still interested, the next logical downside target is 29.92. Bottom-fishing there is recommended if your hobby is losing money. Here’s the chart. ______ UPDATE (Jul 6, 1:59 p.m.):This bathyscaphe has bobbed up from a low today at 29.82. How shocking! See the chat room discussion, which includes a ‘forced’ bottom-fishing trade in August Gold that is currently taking on water. ______ UPDATE (Jul 7, 6:12 p.m.): GDXJ has lifted tentatively off a 29.82 low, but it’s too early to hazard a guess about how far the rally will go. In any event, it was a promising place for an important turn to have occurred. If you hold a long position tied to my guidance, please let me know in the chat room so that I can determine whether to provide tracking guidance. ________ UPDATE (Jull 8, 9:00 a.m.): Numerous subscribers reported getting long, so I am establishing a tracking position of 400 shares (or multiple thereof) from 29.92. For now, take profit on half at a current price of around 31.35. Use a 30.52 stop-loss for what remains. To simplify accounting, it can be carried for an adjusted cost-basis of 28.49.

GDXJ – Junior Gold Miner ETF (Last:31.35)

Posted on June 26, 2022, 5:23 pm EDT

Last Updated July 8, 2022, 9:00 am EDT

Posted on June 26, 2022, 5:23 pm EDT

Last Updated July 8, 2022, 9:00 am EDT