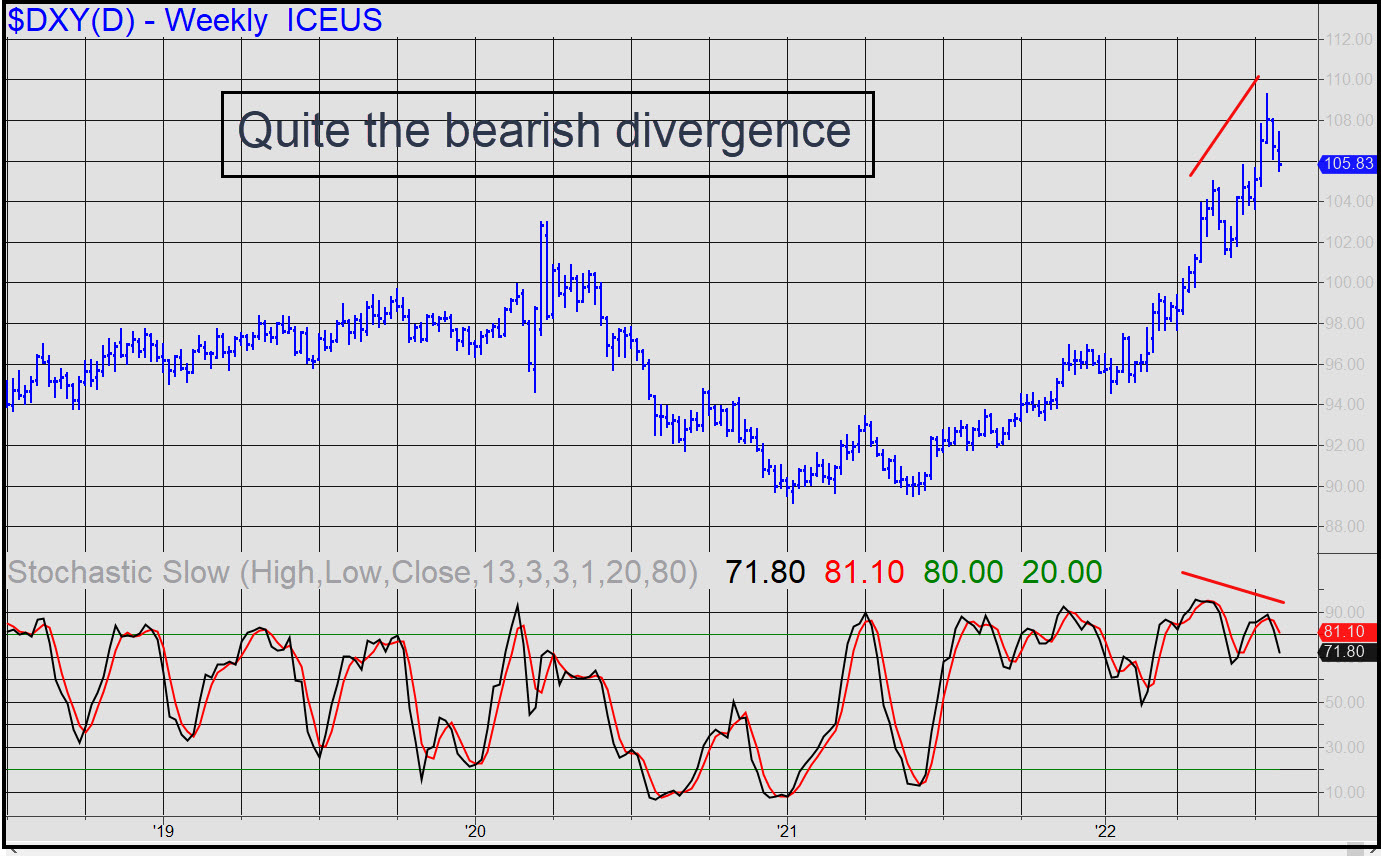

This correction could turn out to be be the most significant since the Covid outbreak in 2020. Higher peaks this spring diverged from lower stochastic peaks, as you can see. This is quite bearish and portends more weakness until the stochastic lines reach the oversold zone between zero and 20. There are no obvious Hidden Pivots target below, but an imaginative reading of the weekly chart suggests the dollar could grope its way down to as low as 97.63 in search of bottom. That would represent an ostensibly healthy, 10% correction from the 109.29 high recorded a few weeks ago. It would probably be misread as the dollar’s death knell, but from a technical standpoint the retracement could prepare the buck for a rally strong enough to usher in an era of deflation that seems inevitable.

This correction could turn out to be be the most significant since the Covid outbreak in 2020. Higher peaks this spring diverged from lower stochastic peaks, as you can see. This is quite bearish and portends more weakness until the stochastic lines reach the oversold zone between zero and 20. There are no obvious Hidden Pivots target below, but an imaginative reading of the weekly chart suggests the dollar could grope its way down to as low as 97.63 in search of bottom. That would represent an ostensibly healthy, 10% correction from the 109.29 high recorded a few weeks ago. It would probably be misread as the dollar’s death knell, but from a technical standpoint the retracement could prepare the buck for a rally strong enough to usher in an era of deflation that seems inevitable.

DXY – NYBOT Dollar Index (Last:105.83)

Posted on July 31, 2022, 5:24 pm EDT

Last Updated July 30, 2022, 12:36 am EDT

Posted on July 31, 2022, 5:24 pm EDT

Last Updated July 30, 2022, 12:36 am EDT