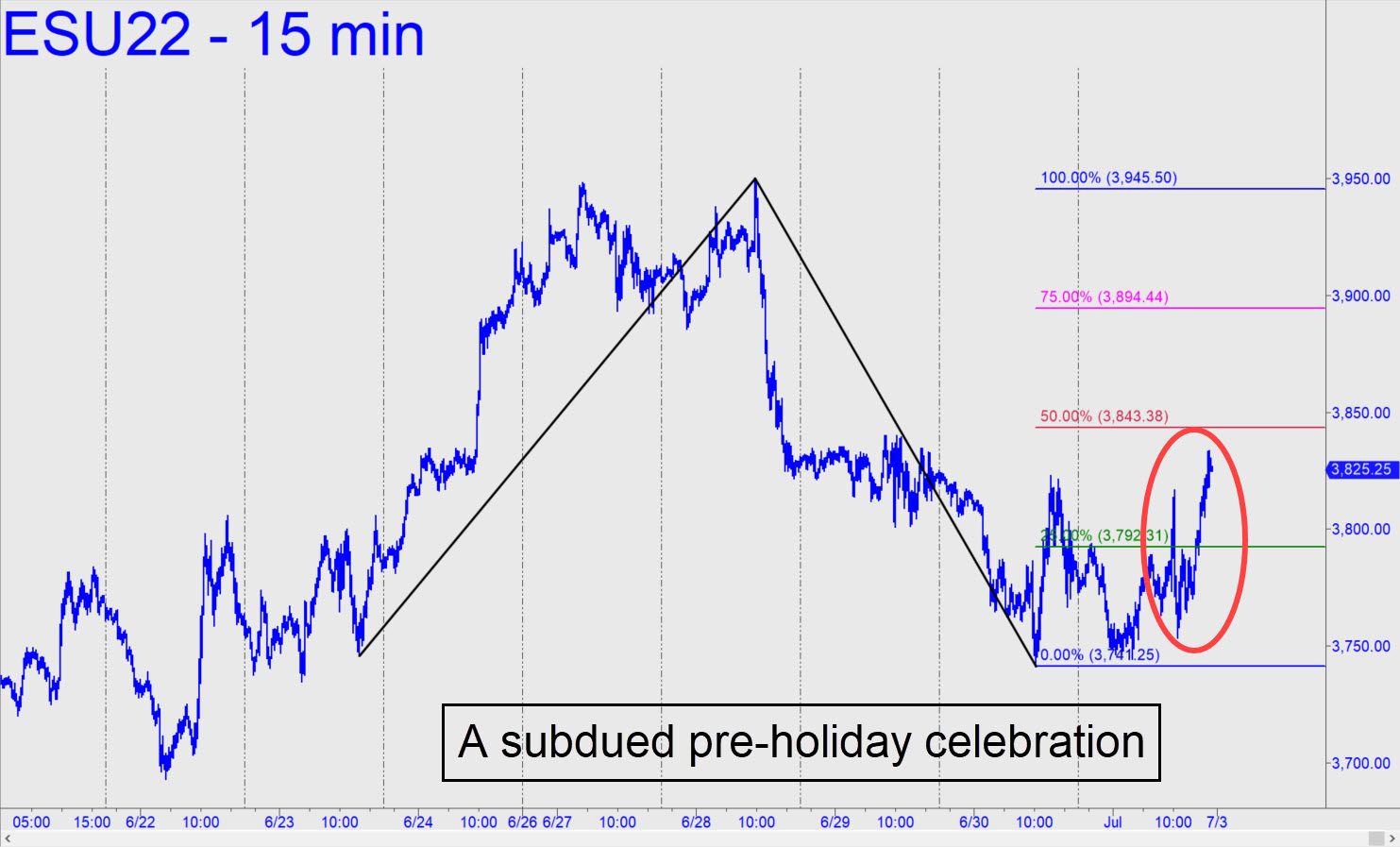

Even springboarding off an engineered low in the first hour on Friday, DaBoyz were unable to achieve the modest red-line target shown in the chart. The thugs who work the night shift will get another crack at it Monday evening, or whenever it is that stocks re-open for a short while to avoid a legally forbidden four-day hiatus. I won’t suggest placing any bets until we’ve seen how this bear rally does when pitted against the 3843.38 Hidden Pivot resistance. As always, a decisive move past a midpoint would imply more upside to p2 (3894 in this case) at least, or possibly to D (3945). However far it gets, I seriously doubt this rally is destined for greatness. Bears will need to be on their guard nonetheless, since feel-good delusions from a celebratory Fourth weekend could persist into the new week. ______ UPDATE (Jul 5, 8;33 p.m.): Today’s excruciating ‘Braveheart’ short-squeeze did not amount to much, even on the hourly chart. But it did breathe new life into this conventional, bullish pattern with a 3998.00 target. As always, it’s all about how buyers handle p=3869.63, which has yet to be touched. _______ UPDATE (Jul 6, 7:35 p.m.): It was only a matter of time before monkeys and algos discovered how our midpoint Hidden Pivot works, but their inept use of it today suggests that we’ll have to refine our own methods to stay a few years ahead of them. Traders who shorted an inch shy of p=3869.63 got stopped out quickly with a feint just above it, turning late-session action into amateur hour. Anyway, you know the drill: It’ll take a decisive push past p=3869.63 to clinch a leg up to D=3998.00. A pullback in the meantime to x=3805.44 would trigger a ‘mechanical’ buy, but I’m recommending the trade only to those who have done this little trick camo-style at least five times.

Even springboarding off an engineered low in the first hour on Friday, DaBoyz were unable to achieve the modest red-line target shown in the chart. The thugs who work the night shift will get another crack at it Monday evening, or whenever it is that stocks re-open for a short while to avoid a legally forbidden four-day hiatus. I won’t suggest placing any bets until we’ve seen how this bear rally does when pitted against the 3843.38 Hidden Pivot resistance. As always, a decisive move past a midpoint would imply more upside to p2 (3894 in this case) at least, or possibly to D (3945). However far it gets, I seriously doubt this rally is destined for greatness. Bears will need to be on their guard nonetheless, since feel-good delusions from a celebratory Fourth weekend could persist into the new week. ______ UPDATE (Jul 5, 8;33 p.m.): Today’s excruciating ‘Braveheart’ short-squeeze did not amount to much, even on the hourly chart. But it did breathe new life into this conventional, bullish pattern with a 3998.00 target. As always, it’s all about how buyers handle p=3869.63, which has yet to be touched. _______ UPDATE (Jul 6, 7:35 p.m.): It was only a matter of time before monkeys and algos discovered how our midpoint Hidden Pivot works, but their inept use of it today suggests that we’ll have to refine our own methods to stay a few years ahead of them. Traders who shorted an inch shy of p=3869.63 got stopped out quickly with a feint just above it, turning late-session action into amateur hour. Anyway, you know the drill: It’ll take a decisive push past p=3869.63 to clinch a leg up to D=3998.00. A pullback in the meantime to x=3805.44 would trigger a ‘mechanical’ buy, but I’m recommending the trade only to those who have done this little trick camo-style at least five times.

ESU22 – Sep E-Mini S&P (Last:3850.75)

Posted on July 3, 2022, 5:00 pm EDT

Last Updated July 6, 2022, 7:44 pm EDT

Posted on July 3, 2022, 5:00 pm EDT

Last Updated July 6, 2022, 7:44 pm EDT