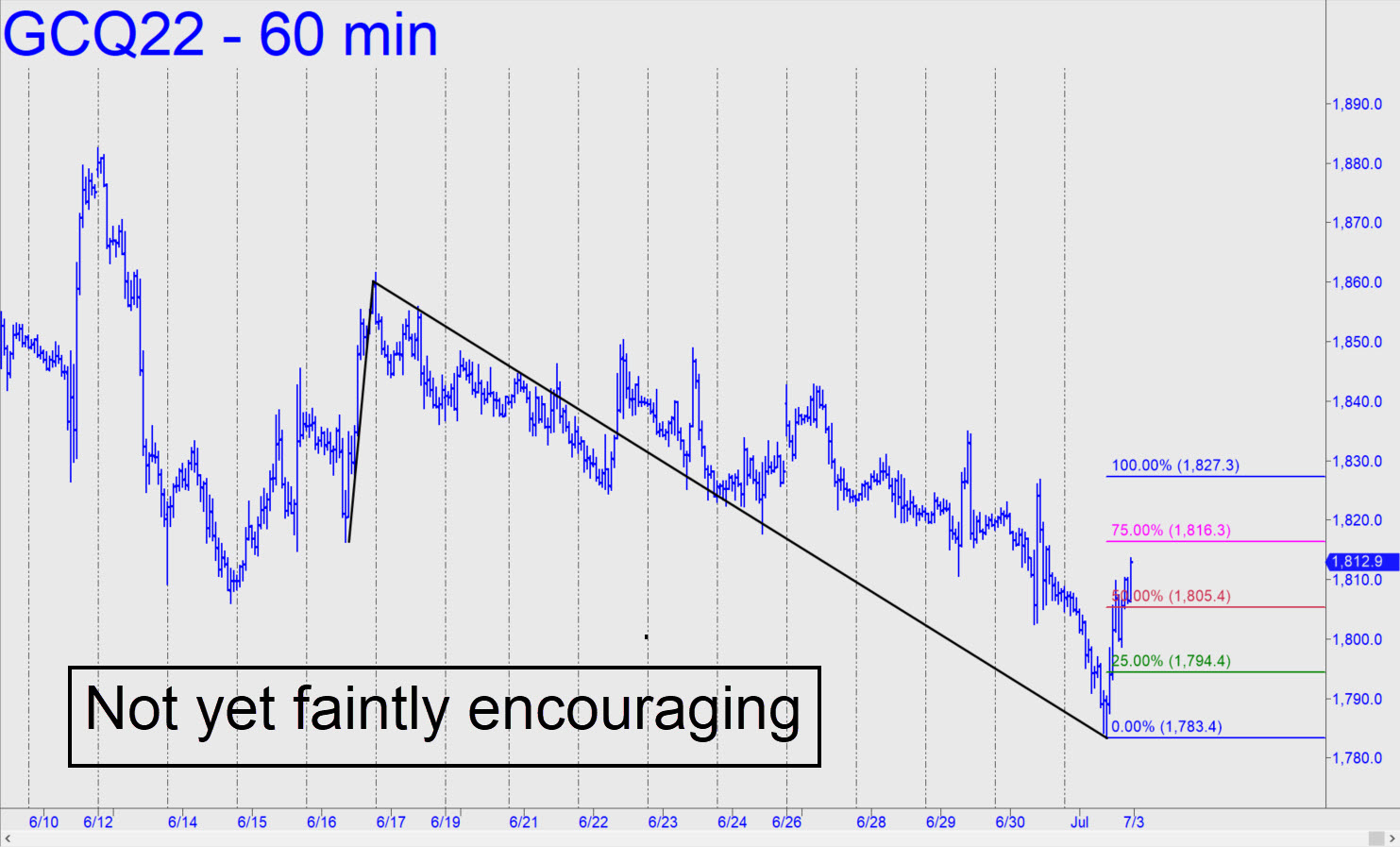

I’ve been so down on gold lately that I should probably recuse myself, but here we go anyway: The trampoline rally off Friday’s heavily manipulated low is likely bound for at least 1828.80, the D target of the reverse pattern shown. It is not quite a done deal because of the hesitation at p. That’s why bulls should be careful if and when the move hits p2=1817.30, where a tradeable reversal could occur. Meanwhile it would take a print exceeding 1882.50 to negate the 1756.90 downside target that has been in play for nearly a month. ______ UPDATE (Jul 5, 11:20 a.m. EDT): So much for giving gold the benefit of the doubt. Today’s freefall looks bound for D=1746.30, a back-up-the-truck spot for bottom fishing as far as I’m concerned. Here’s the chart, with a pattern that caught a beautiful mechanical short just head of what eventually will have been a $136 selloff. _______ UPDATE (Jul 6, 8:06 p.m.): We’re now working on a 1710.00 target, although the bearish forecast did not prevent our exploiting a mid-day rally worth as much as $2300 to anyone who followed my 11:43 a.m. Trading Room ‘rABC’ guidance. (It also went out in timely fashion to all subscribers in the form of a ‘Notification’.)))))))))))))

I’ve been so down on gold lately that I should probably recuse myself, but here we go anyway: The trampoline rally off Friday’s heavily manipulated low is likely bound for at least 1828.80, the D target of the reverse pattern shown. It is not quite a done deal because of the hesitation at p. That’s why bulls should be careful if and when the move hits p2=1817.30, where a tradeable reversal could occur. Meanwhile it would take a print exceeding 1882.50 to negate the 1756.90 downside target that has been in play for nearly a month. ______ UPDATE (Jul 5, 11:20 a.m. EDT): So much for giving gold the benefit of the doubt. Today’s freefall looks bound for D=1746.30, a back-up-the-truck spot for bottom fishing as far as I’m concerned. Here’s the chart, with a pattern that caught a beautiful mechanical short just head of what eventually will have been a $136 selloff. _______ UPDATE (Jul 6, 8:06 p.m.): We’re now working on a 1710.00 target, although the bearish forecast did not prevent our exploiting a mid-day rally worth as much as $2300 to anyone who followed my 11:43 a.m. Trading Room ‘rABC’ guidance. (It also went out in timely fashion to all subscribers in the form of a ‘Notification’.)))))))))))))

GCQ22 – August Gold (Last:1736.80)

Posted on July 3, 2022, 5:12 pm EDT

Last Updated July 7, 2022, 6:03 pm EDT

Posted on July 3, 2022, 5:12 pm EDT

Last Updated July 7, 2022, 6:03 pm EDT