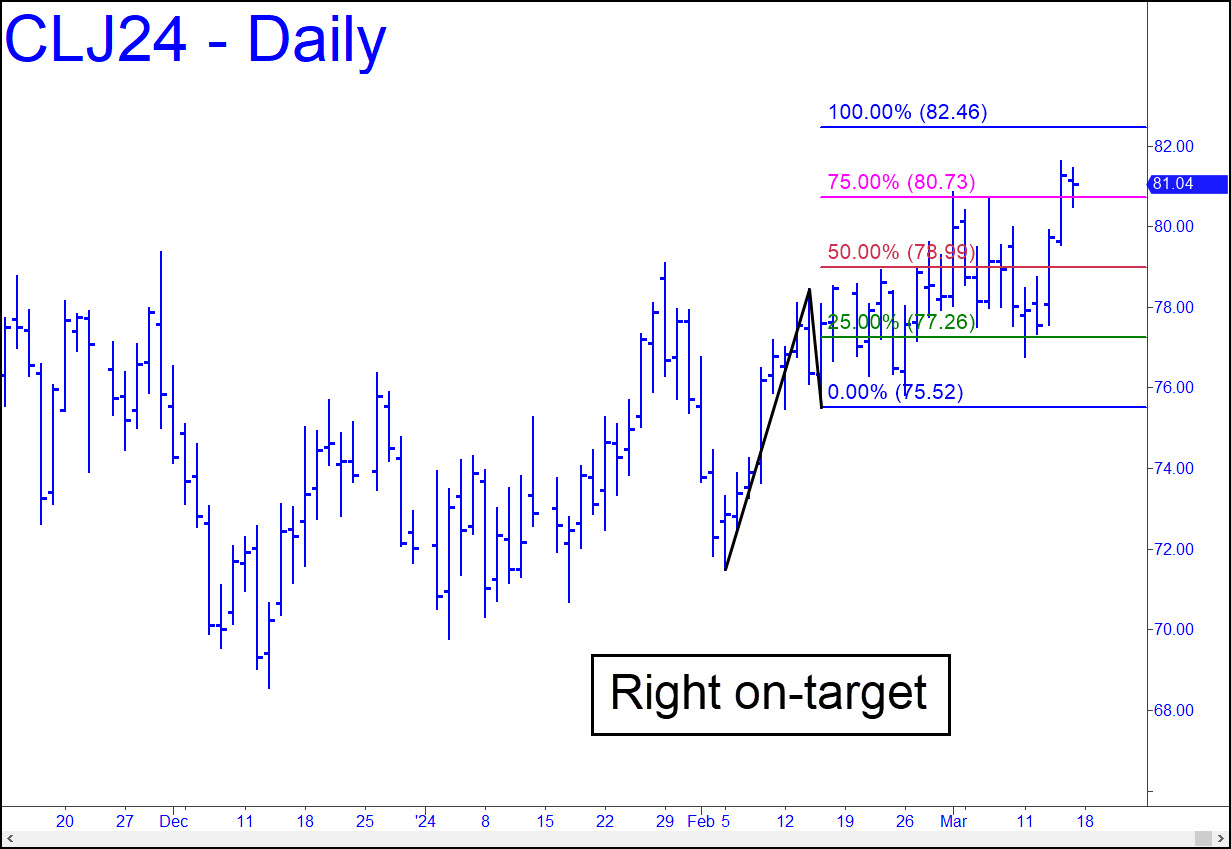

For all its wacky histrionics, crude remains one of the most tradeable vehicles tracked on this list. The pattern shown, with an 82.48 rally target we’ve been using as a lodestar, produced a second ‘mechanical’ buy at x=77.26 last week that went on to rack up significant gains without much fuss or stress. Paradoxically, most of the trades come from thrusts into ‘discomfort’ zones that are so predictable that they should be called ‘relaxation’ zones. I will continue to provide real-time guidance for this vehicle that is commensurate with the interest subscribers show in the chat room. ______ UPDATE (Mar 18, 10:24 a.m.): I am raising my target to 83.26, since buyers are not having much difficulty surpassing rally targets of lesser degree. The pattern’s point ‘B’ high is more sausage-y than I would prefer, but I’ll use it anyway because the pattern itself looks gnarly enough to evade widespread detection and use. The target will be shortable when reached, but your trading bias should be bullish until then. If you were looking for yet one more negative factor to slow down the psychotic bull market rampage, crude’s effortless waft above $80 barrel could be it, since it threatens to raise the price of everything tied to energy prices — i.e., virtually all goods and services sold on this troubled planet. _______ UPDATE (4:03 p.m.): The rally from the Feb 5 low has gone out of control, killing my enthusiasm for getting short. It looks to be headed for 86.15; however, even on the five-minute chart, there was just one dicey chance to get long today using an rABC trigger. ______ UPDATE (Mar 20, 5:33 p.m.): See my 12:45 post in the chat room for an equivalent target for the May contract, plus actionable guidance.

For all its wacky histrionics, crude remains one of the most tradeable vehicles tracked on this list. The pattern shown, with an 82.48 rally target we’ve been using as a lodestar, produced a second ‘mechanical’ buy at x=77.26 last week that went on to rack up significant gains without much fuss or stress. Paradoxically, most of the trades come from thrusts into ‘discomfort’ zones that are so predictable that they should be called ‘relaxation’ zones. I will continue to provide real-time guidance for this vehicle that is commensurate with the interest subscribers show in the chat room. ______ UPDATE (Mar 18, 10:24 a.m.): I am raising my target to 83.26, since buyers are not having much difficulty surpassing rally targets of lesser degree. The pattern’s point ‘B’ high is more sausage-y than I would prefer, but I’ll use it anyway because the pattern itself looks gnarly enough to evade widespread detection and use. The target will be shortable when reached, but your trading bias should be bullish until then. If you were looking for yet one more negative factor to slow down the psychotic bull market rampage, crude’s effortless waft above $80 barrel could be it, since it threatens to raise the price of everything tied to energy prices — i.e., virtually all goods and services sold on this troubled planet. _______ UPDATE (4:03 p.m.): The rally from the Feb 5 low has gone out of control, killing my enthusiasm for getting short. It looks to be headed for 86.15; however, even on the five-minute chart, there was just one dicey chance to get long today using an rABC trigger. ______ UPDATE (Mar 20, 5:33 p.m.): See my 12:45 post in the chat room for an equivalent target for the May contract, plus actionable guidance.

CLJ24 – April Crude (Last:82.93)

Posted on March 17, 2024, 5:13 pm EDT

Last Updated March 20, 2024, 5:33 pm EDT

Posted on March 17, 2024, 5:13 pm EDT

Last Updated March 20, 2024, 5:33 pm EDT