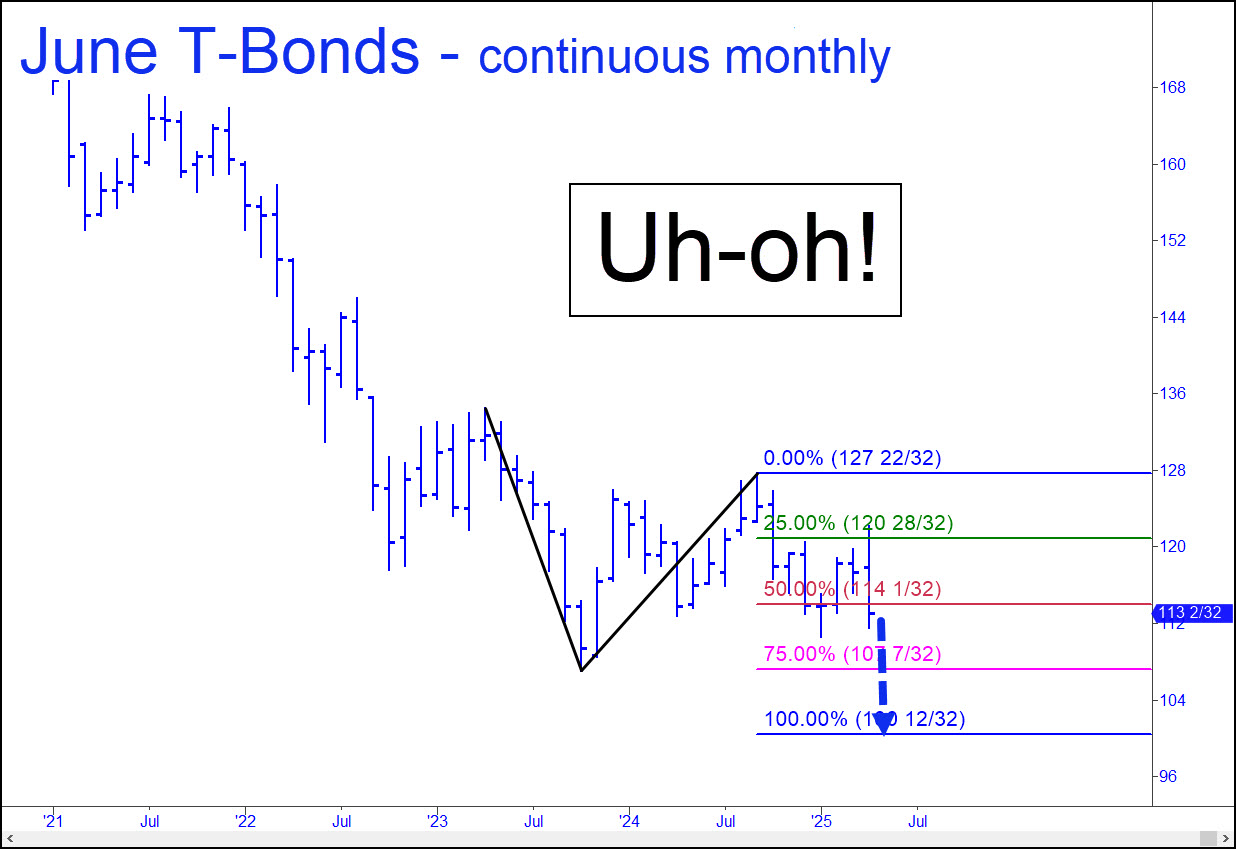

T-Bonds and stocks came down so hard today that I now give my ‘outrageously bullish scenario’ (see above) no better than a 50% chance of surviving. Putting aside gold’s globally unnerving price surge, June T-Bond futures bulldozed a path down to as low as 100^12. If that were to happen, the implied rise in interest rates would be sufficient to tip the U.S. and global economies into deepest recession.

T-Bonds and stocks came down so hard today that I now give my ‘outrageously bullish scenario’ (see above) no better than a 50% chance of surviving. Putting aside gold’s globally unnerving price surge, June T-Bond futures bulldozed a path down to as low as 100^12. If that were to happen, the implied rise in interest rates would be sufficient to tip the U.S. and global economies into deepest recession.

A reported $7.5 trillion in Treasury debt needs to be refinanced over the next three years, with much of it due in 2025. It is therefore a particularly bad time for the Masters of the Universe to lose control of long-term rates. Beleaguered consumers will struggle even harder, and an already tottering commercial real estate market will finally give up the ghost. Residential real estate is about to deflate as well, putting a potentially economically rejuvenating refinancing cycle so far out of reach that Baby Boomers might not see another in their lifetime. Trump will get the blame, and deservedly so. Usually, economic cycles of boom and bust are much bigger than the presidency, but in this case, if stocks continue to fall, Trump will surely have been the catalyst. _______ UPDATE (April 25): Last week’s rally left the futures a hair shy of an important Hidden Pivot midpoint resistance at 116^14. A decisive move through it would not announce that the bear market is over, but it would quietly suggest an important turn may be nigh. It would also imply the futures are on their way to 121^11, a Hidden Pivot that would leave the June contract just short of a breakout. The pattern will not be comfy-cozy for seasoned Pivoters, but I am using it nonetheless, in part because of its obscurity. (Always keep in mind our rule concerning Hidden Pivot midpoints in odd or unseemly patterns: they work anyway.) _______ UPDATE (Apr 29, 3:38 p.m. EDT): The futures have finally punched through the 116^14 resistance, but because it took so long (three weeks), there can be no assurance that 121^11 will be reached. Although this seems likely, I’ll suggest using p2=118^29 as a minimum upside objective for the time being. Here’s a timely chart.

$USM25 – June T-Bonds (Last:117^02)

Posted on April 21, 2025, 6:33 pm EDT

Last Updated April 29, 2025, 3:37 pm EDT

Posted on April 21, 2025, 6:33 pm EDT

Last Updated April 29, 2025, 3:37 pm EDT

-

April 21, 2025, 11:36 pm

Are tariffs the cause of the stock market contraction? The stock market has been overdue for a major correction for at least 10 years. The housing market since 1974 has gone up for 4-5 years, followed by a 3-4 fall. However, since 2009 the housing market has only gone up. There has not been such a rise in house prices (15 year) since WWII, and the rate of increase has never been this high.

The tariff gamble might or might not pay off. If there really are 6 trillion dollars invested in manufacturing plants, it will be a long-term bonanza. The problem is that there is little incentive to invest if the interest rates skyrocket and the equity market plunges.

Our country is insolvent and on the verge of bankruptcy. This will only be Trump’s fault if he fails to revert to a 2019 budget, balance it, and make at least a miniscule repayment on the national debt. The country is like a homeowner who does not have sufficient income to make the house payments and continues to borrow to make the mortgage payments. Sooner or later the homeowner will not be able to borrow more because the value of the house falls below the mortgage level and lenders see that there is no ability to repay. Lan Zhongguo.