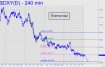

With Sam Bankman Fried's sordid tale no longer getting airplay, the hucksters in charge of bitcoin have seized the moment to goose cryptos higher with almost no bullish buying. It remains to be seen where heavy supply will spoil the fun, but you can count on delusion-resistant pockets of it at round numbers: 25,000, 30,000, 35,000 and so on. The first is likely to give way shortly, if for no other reason than that a series of highs made there in July and August looms, a tempting bullseye on the backs of doubters. Moreover, no one would be stupid enough to get short here and now, rendering that additional source of supply moot. Nearly all of our 'mechanical' trades in bitcoin over the years have been profitable because this tactic is particularly well suited to exploiting vehicles that move violently. In this case, however, we'll pass up the recent signal to get short at x=21,774 and wait for a less risky chance at 'voodoo' numbers that lie, respectively, near 30,000 and 40,000. Whether bitcoin gets there or not depends entirely on whether the bear rally in stocks keeps on going. When the cryptos eventually resume their fall to oblivion, however, you can bet that the first few days of the collapse will astound with their magnitude. _______ UPDATE (Feb 10): Turns out there was supply lurking at 25,000 after all -- so much of it, in fact, that this flying pig barely poked its snout above 24,000 before sellers smacked it down. The high was strongly impulsive on the daily chart nonetheless, so buyers will assuredly be back when 'news' that could be construed as even remotely bullish for cryptos surfaces. Here's the picture. _______ UPDATE (Feb 15, 8:43 p.m.): Once above mid-August's peak at 25,203, BRTI's no-supply crime spree

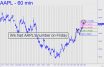

Treat the stock market as you would a sleazy carnival game and you hold the key to accurately predicting its behavior. Take AAPL, for instance. We should have known that permabears were being set up for a fleecing when an always-complicit news media worked slavishly to stoke anticipation of horrendous Q4 earnings. Apple certainly didn't disappoint in that regard when the company on Thursday reported its first year-over-year sales decline since 2019. Such announcements are usually made after the close, enabling the thieves who manipulate stock prices for a living to work their magic. As they have done countless times in the past, they pulled their bids in after-hours trading following Apple's grim announcement. This induced widows and pensioners to vomit Apple shares at distress prices five percent below where they'd traded on the close. QE Mythology With sellers utterly spent, DaBoyz were easily able to short-squeeze the stock back up to the intraday high within hours. The rigged ups and downs that made this ruse work are shown in this chart. From that point forward, their clown-dunking antics were on autopilot. As the stock relapsed in the wee hours, they covered shorts laid out at Thursday evening's secondary peak. Sellers didn't realize how badly they'd been had until around 5 a.m., when AAPL finished basing on near-zero volume and launched into an 8% rally, from 145 to 157, before the regular session began. QE mythology aside, this is how the Fed effectively injects large sums of instantly spendable money into the economy. With credit stimulus there will always be a lag between falling interest rates and their intended effect on consumer spending. But gift investors/consumers with an 8% rally in the world's biggest-cap stock on a Friday afternoon and you have spiked the wealth effect with methamphetamine. By the

The steep, slick wall created by last summer's plunge left us with no 'external' peaks to judge the staying power of the bounce since October's 91.85 low. I've used an unconventional 'reverse' pattern to provide some clues, and it would seem to imply that TLT will rally to at least D=113.78. This is affirmed by its unwillingness to provide bulls with any good 'mechanical' buying opportunities on the daily or weekly charts. We'll want to pay close attention if the rally exceeds 113.78 and pushes toward a test of the 120.69 peak recorded in August. Its decisive breach would be a big deal, since that would suggest interest rates are likely to keep falling.

I've altered the view somewhat, lowering point A' and its target to make the chart seem less discouraging. Previously, there was an unachieved rally target at 24.95 that stayed perpetually out of reach despite gold's having achieved a corresponding target. The justification is that Silver is in a bull market, which implies that the two-month struggle to achieve D has been accumulation rather than distribution. Even so, March Silver may have to fall out of its tedious range to get a running start on a new recovery high. In the meantime, it remains untradeable, other than by those who enjoy hunkering down on the 15-minute chart for days on end.

We had AAPL's number on Friday, allowing all you option junkies to get short with puts just a hair off the top. Don't count your chickens, though, even if a nimble subscriber reported a quick, $600 profit in the final minutes. The finale featured a panic-induced short-squeeze to slightly above the day's previous peak, then a collapse cleverly timed so that it wouldn't have enough time to snowball and cause real damage. Here's what the end-of-day plunge looked like on the lesser charts: a mash-up of AAPL's weaselly sponsors and little guys who never give up on the challenge of beating them at their stupid, nasty little game.

I've simplified the outlook with a single target at 100.18, stripping out another at 101.03 that is likely to be just a weigh station. A fall to 'par', if not lower, seems fated. Even if the downtrend has seemed relentless and interminable, it would amount to a relatively moderate 12.7% correction off the September high at 114.78. There is of course another possibility: If DXY heads decisively lower after testing 100, that would suggest the deflationary endgame for the global economy is farther off than I'd imagined. It is inevitable, but the most promiscuous credit stimulus in history has simply delayed it.

[This week's commentary was written by David Isham, a real estate investor from Northern California who has subscribed to Rick's Picks since its inception more than 20 years ago. RA ] With the ongoing financial turmoil and the potential start of another world war, gold is behaving as we would expect, showing exceptional strength. Although we are nowhere near the top as open interest is still low, we still must be on the lookout for a short-term top. The gold bull has traditionally carried as few riders higher as possible, and I suspect this time will not be any different. Rick has identified targets above $2,000, and there are two peaks at $2078 where there will be plenty of buy stops for the algos to run and establish short positions. If they do run the buy-stops, they would then look to attack sell-stops under $1,600 so that they could cover profitably and get long again. A long-term Fibonacci fan (aka 'speed resistance lines') with a red 2/3 line has acted as both resistance and support since this bull market started in 2001 and would be a likely target on the downside. Such a dramatic move would also set up a slingshot move to the upside. If we do get one more, dramatic move down I would also expect gold stocks to hold up well relative to physical. My strategy is to accumulate gold and silver mining stocks and not try to time buying and selling my core positions, since I could get left behind if I am wrong about a big drop. However, any large move down would be an opportunity to add to my positions. A Golden Slingshot Martin Armstrong does not think the US dollar will last beyond 2028. It has the distinction of being the only currency

I jumped the gun last week with expectations of a small rally to complete the aging pattern to D=41.17. The way bulls frolicked when they first moved above p=33.49 seemed to all but ensure GDXJ would get there. It will, but we'll need to keep in step with the evidence before we assume that a strong bullish thrust past D is about to lock up more upside toward 51.51. That's an important rest station on the way to $100, or perhaps even to 179.44, where the all-time high occurred in the final days of 2010. _______ UPDATE (Jan 26, 10:28 a.m. EST): GDXJ has fallen sharply this morning after coming within a penny of my longstanding target at 41.17. Since this marks the finale of a pattern going back to early November, it 'should' take at least 2-3 weeks to set up for the next bull cycle. Any sooner would be commensurately more bullish. The next push will be to the 43.49 target shown here.

Bertie's deep-pocket sponsors lost no time putting the squeeze on shorts with market-moving news. For one, there was the rumor that the U.S., Canada and the Philippines used bitcoin to pay ransom to the hackers who briefly shut down air travel in those countries. The felons were likely trained and sponsored by China or North Korea, making bitcoin seem not merely useful, but even a little respectable as the currency of choice for highly sophisticated criminals. Also providing artificial lift for the cryptos was a perfectly timed announcement that FTX, the exchange bankrupted by Sam Bankman Fried, might be resurrected. If the cabal driving bitcoin higher can vault the 25,203 point 'C' high of the pattern shown (inset) -- an even bet right now, in my estimation -- they'll have an unimpeded shot at 30,000-plus.

The dollar picked up no support on the way down through p=103.33, but that does not necessarily portend another failure when it reaches the 'D' Hidden Pivot support at 101.03. However, the seven days of distribution that have occurred since the drop from p to p2 have likely tilted the odds toward a breach of D. If a decisive one occurs, use 100.18 as a new minimum downside projection. That is the D target, on the daily chart, of A=113.15 on November 3.