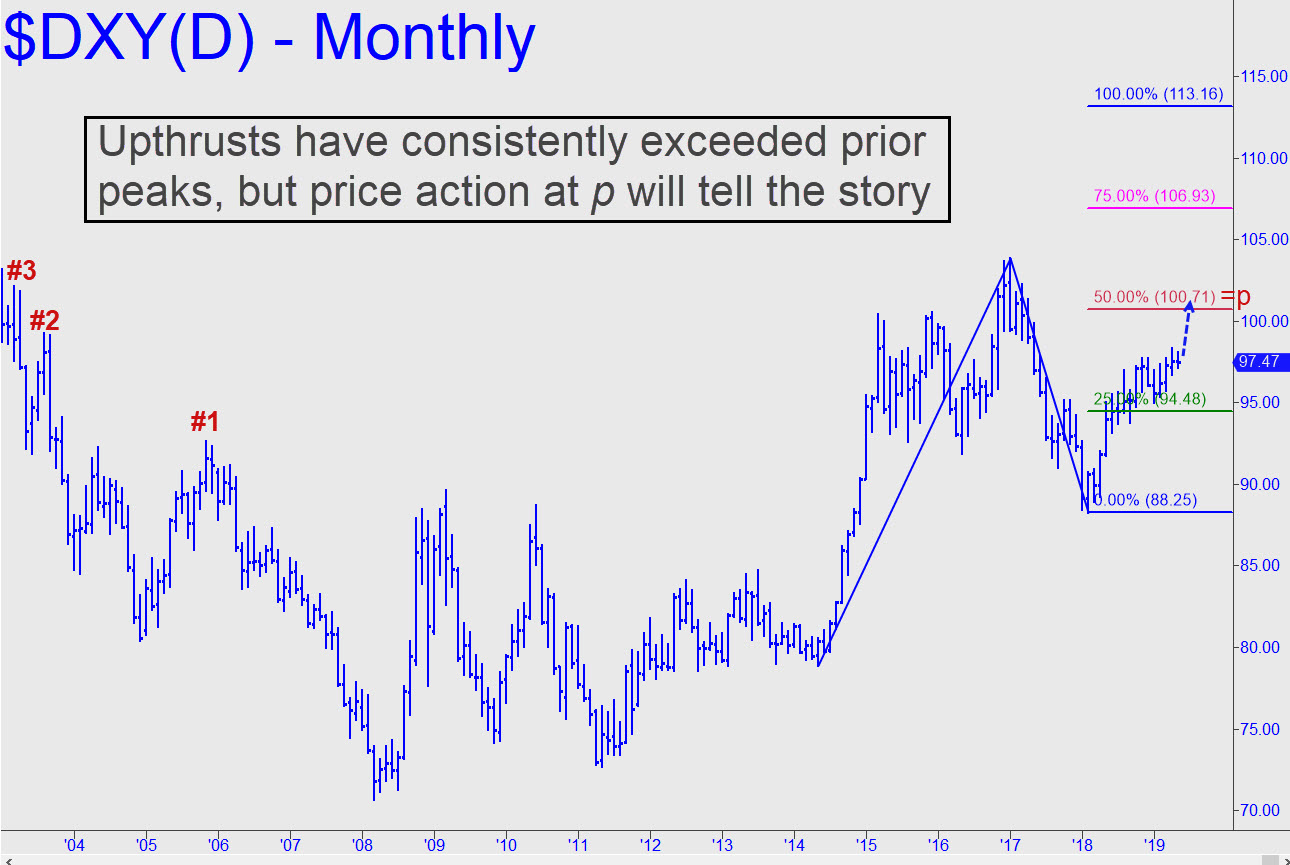

Dollar bears seem to be everywhere these days, so perhaps it’s a good time to revisit the longer-term charts, which remain bullish. Notice that each visually significant upthrust in the Dollar Index exceeded an external peak. This has serially refreshed the bullishness of the chart while implying that any bout of weakness is merely corrective. However, a key resistance lies not far above in the form of a 100.71 midpoint Hidden Pivot. Although this number can be used as a minimum upside target for now, DXY would need to push decisively above it, to perhaps 103 or higher, before we could infer that the 113.16 ‘D’ target is solidly in play. At that point, p2=106.93 could be used as a minimum upside objective.

Dollar bears seem to be everywhere these days, so perhaps it’s a good time to revisit the longer-term charts, which remain bullish. Notice that each visually significant upthrust in the Dollar Index exceeded an external peak. This has serially refreshed the bullishness of the chart while implying that any bout of weakness is merely corrective. However, a key resistance lies not far above in the form of a 100.71 midpoint Hidden Pivot. Although this number can be used as a minimum upside target for now, DXY would need to push decisively above it, to perhaps 103 or higher, before we could infer that the 113.16 ‘D’ target is solidly in play. At that point, p2=106.93 could be used as a minimum upside objective.

In an earlier DXY tout, I provided a long-term view as well as a detailed explanation of why I think the dollar is ultimately headed much higher. (Note: DXY represents a basket of currencies that is 60% weighted toward the euro.) An extremely strong dollar would be congruent with the global deflationary collapse that I believe is necessary to correct millennial excesses of debt in the financial system. I see this as unavoidable. For my essay on the coming debt deflation, click here.