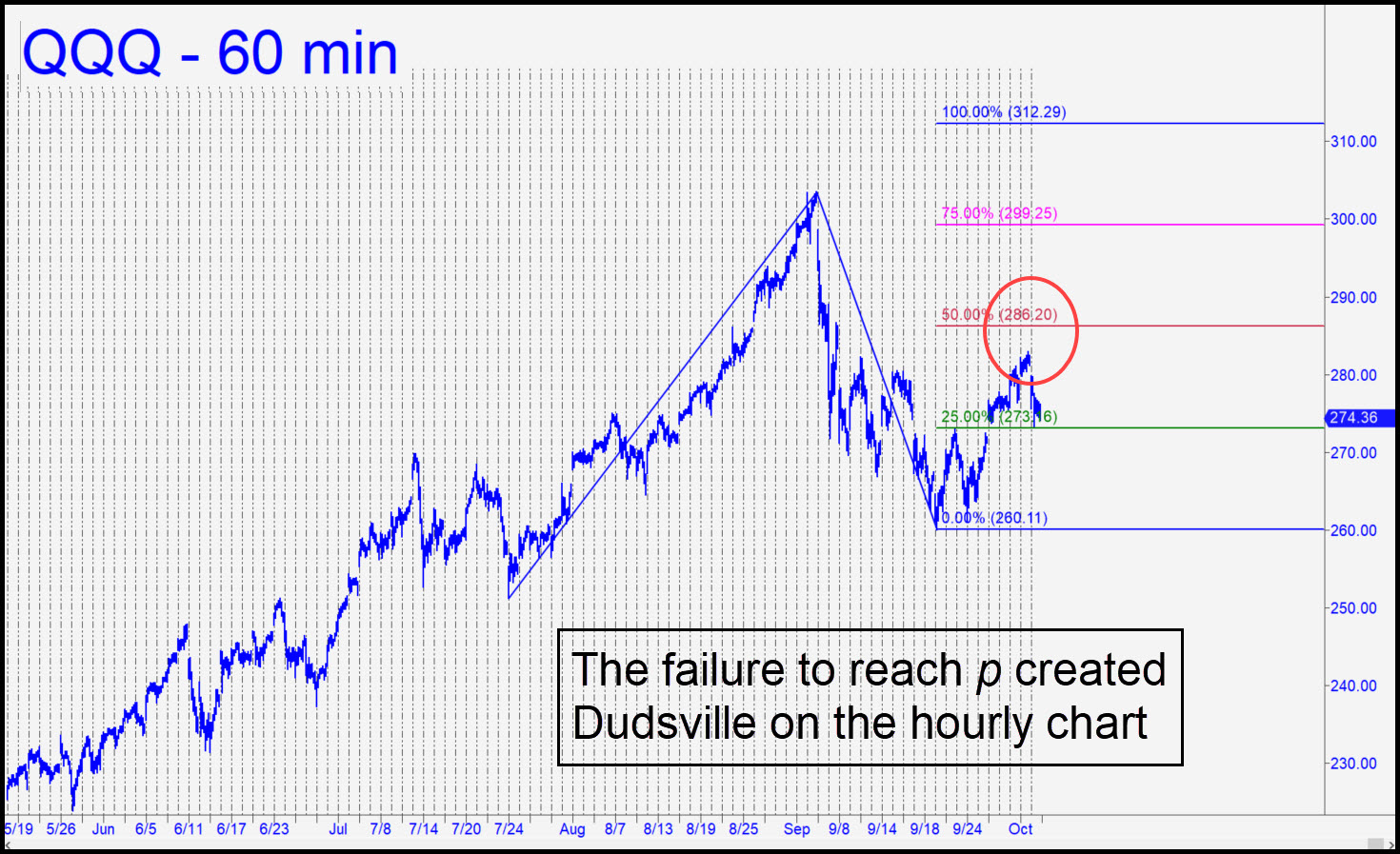

The Cubes laid an egg on Friday to end a week that had begun with a scorching rally. The news concerning Trump caused bulls to turn tail and left bears less than eager to cover short positions ahead of the weekend. From a technical standpoint this vehicle failed to trigger a ‘mechanical’ buy on the drop to the green line because it had failed to reach the red line first (see inset). There is nothing bearish about this per se, but it is most unusual for QQQ to miss an opportunity to signal a ‘mechanical’ long following a decent rally leg on the hourly chart. Since the failed upthrust was impulsive nonetheless, having exceeded some distinctive ‘external’ peaks, we should give bulls the benefit of the doubt as the week begins. All bets are off, however, if the news from Walter Reed Hospital is concerning. _______ UPDATE (Oct 5, 5:23 p.m.): If bulls are going to put Friday’s punk performance behind them, they’ll need to push this hoax up to at least p=286.20 — or better yet past it, to demonstrate some of the mettle it will take to achieve D=312.29. _______ UPDATE (Oct 9): Even with a short-squeeze gap on the opening, the Cubes still fell a millimeter shy of p=286.20 when they ought to have exceeded it. We’ll give bulls the benefit of the doubt for the moment anyway, but the yellow flag will be out until such time as they impale the red line. _______ UPDATE (Oct 12, 7:12 p.m.): My gut is saying D=312.29 will be reached eventually, but you can try shorting p2=299.25 anyway. Use puts priced under 0.65 that expire this Friday, but do the trade only if QQQ is within 0.07 points of the target. Stop yourself out if 301.40 is touched. Here’s the chart. ______ UPDATE (Oct 13, 8:33 p.m.): Cancel the trade, since two days of sloppy action just below p2=299.25 is not conducive to our squeezing off a clean shot if the pivot is touched. _______ UPDATE (Oct 14, 8:16 p.m.): The pattern shown, with a 287.38 downside target, stinks because it has neither a one-off ‘A’ nor a legitimate ‘B’, but it’s good enough to use for setting up ‘mechanical’ shorts on the way down, or even bottom-fishing at D if you’ve made a few bucks being short. _______ UPDATE (Oct 15, 6:21 p.m.): My short-term bias has shifted to bullish in the E-Mini Nasdaq, but there are no easy handholds for day-trading this vehicle on Friday. It does not trade round-the-clock, and Thursday morning’s opening-bar selloff created a gap with no ‘external’ peaks that can be used to create entry set-ups.

The Cubes laid an egg on Friday to end a week that had begun with a scorching rally. The news concerning Trump caused bulls to turn tail and left bears less than eager to cover short positions ahead of the weekend. From a technical standpoint this vehicle failed to trigger a ‘mechanical’ buy on the drop to the green line because it had failed to reach the red line first (see inset). There is nothing bearish about this per se, but it is most unusual for QQQ to miss an opportunity to signal a ‘mechanical’ long following a decent rally leg on the hourly chart. Since the failed upthrust was impulsive nonetheless, having exceeded some distinctive ‘external’ peaks, we should give bulls the benefit of the doubt as the week begins. All bets are off, however, if the news from Walter Reed Hospital is concerning. _______ UPDATE (Oct 5, 5:23 p.m.): If bulls are going to put Friday’s punk performance behind them, they’ll need to push this hoax up to at least p=286.20 — or better yet past it, to demonstrate some of the mettle it will take to achieve D=312.29. _______ UPDATE (Oct 9): Even with a short-squeeze gap on the opening, the Cubes still fell a millimeter shy of p=286.20 when they ought to have exceeded it. We’ll give bulls the benefit of the doubt for the moment anyway, but the yellow flag will be out until such time as they impale the red line. _______ UPDATE (Oct 12, 7:12 p.m.): My gut is saying D=312.29 will be reached eventually, but you can try shorting p2=299.25 anyway. Use puts priced under 0.65 that expire this Friday, but do the trade only if QQQ is within 0.07 points of the target. Stop yourself out if 301.40 is touched. Here’s the chart. ______ UPDATE (Oct 13, 8:33 p.m.): Cancel the trade, since two days of sloppy action just below p2=299.25 is not conducive to our squeezing off a clean shot if the pivot is touched. _______ UPDATE (Oct 14, 8:16 p.m.): The pattern shown, with a 287.38 downside target, stinks because it has neither a one-off ‘A’ nor a legitimate ‘B’, but it’s good enough to use for setting up ‘mechanical’ shorts on the way down, or even bottom-fishing at D if you’ve made a few bucks being short. _______ UPDATE (Oct 15, 6:21 p.m.): My short-term bias has shifted to bullish in the E-Mini Nasdaq, but there are no easy handholds for day-trading this vehicle on Friday. It does not trade round-the-clock, and Thursday morning’s opening-bar selloff created a gap with no ‘external’ peaks that can be used to create entry set-ups.

QQQ – Nasdaq ETF (Last:290.02)

Posted on October 4, 2020, 5:06 pm EDT

Last Updated October 18, 2020, 5:54 pm EDT

Posted on October 4, 2020, 5:06 pm EDT

Last Updated October 18, 2020, 5:54 pm EDT