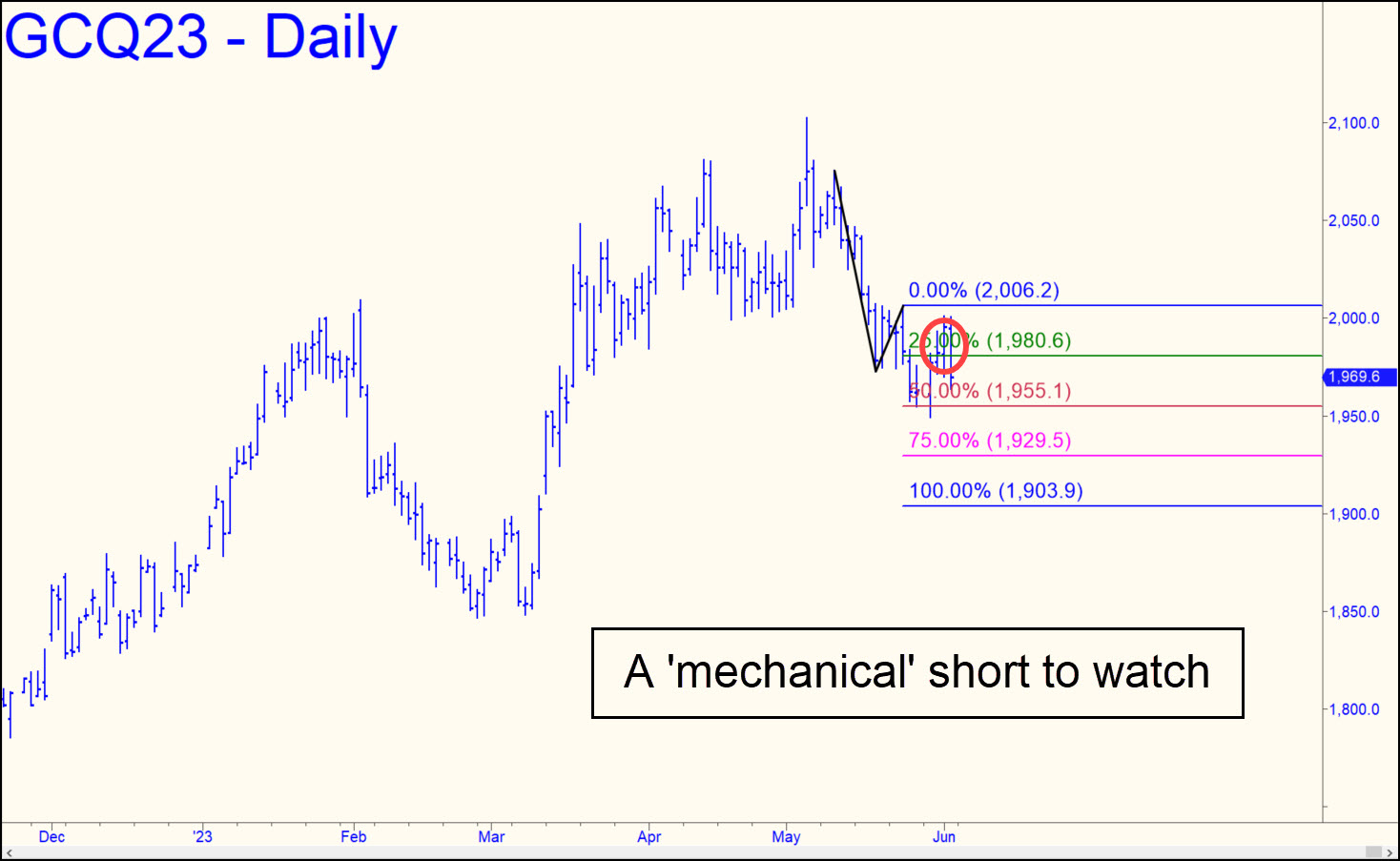

Last week’s bullish feint triggered a less-than-appealing ‘mechanical’ short at the green line (x=1980.60). The selloff into the close was bound for a retest of p=1955.10, but if this ‘hidden’ support fails, look for more downside to 1929.50, the secondary (p2) pivot. Bears have had trouble doing serious damage, so there’s no reason to think the downtrend, a correction from May 4’s 2102 high, is likely to reach the D target at 1903.90. That implies p2 should be bottom-fished, presumably with a reverse pattern of small degree (aka ‘camouflage’). ______ UPDATE (Jun 5, 6:59 p.m.): We’ll let gold bulls, bears and the Wharton-educated criminals who manipulate them bayonet each other bloody for a while, but by all means please nudge me in the chat room if you see easy money sitting on the table.

Last week’s bullish feint triggered a less-than-appealing ‘mechanical’ short at the green line (x=1980.60). The selloff into the close was bound for a retest of p=1955.10, but if this ‘hidden’ support fails, look for more downside to 1929.50, the secondary (p2) pivot. Bears have had trouble doing serious damage, so there’s no reason to think the downtrend, a correction from May 4’s 2102 high, is likely to reach the D target at 1903.90. That implies p2 should be bottom-fished, presumably with a reverse pattern of small degree (aka ‘camouflage’). ______ UPDATE (Jun 5, 6:59 p.m.): We’ll let gold bulls, bears and the Wharton-educated criminals who manipulate them bayonet each other bloody for a while, but by all means please nudge me in the chat room if you see easy money sitting on the table.

GCQ23 – August Gold (Last:1978.60)

Posted on June 4, 2023, 5:19 pm EDT

Last Updated June 5, 2023, 6:59 pm EDT

Posted on June 4, 2023, 5:19 pm EDT

Last Updated June 5, 2023, 6:59 pm EDT