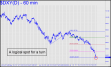

A perfect 'mechanical' buy triggered in the final hour of Wednesday's session (see inset) when the futures spasmed violently for who-knows-what stupid reason. However, even if you had been expecting this, execution would have been difficult, requiring lightning reflexes and plenty of luck. In any event, the futures should now be presumed bound for the 26.975 target, at least, even if they have yet to reach the 24.718 midpoint pivot where taking a partial profit on half the position would be in order. _______ UPDATE (Jul 30, 2:32 p.m. ET): The futures spent the day treading water, suspended midway between the 23.589 'mechanical' entry point and the theoretical stop-loss at 22.45. I am unable to predict with any confidence how this tedious dirge will settle, but I'd become a buyer again below the stop.

Rick Ackerman

GCQ20 – August Gold (Last:1943.10)

– Posted in: Current Touts Free

August Gold's leap Monday night missed a longstanding target at 1992.40 by $18, which ordinarily would warrant a cautious stance for at least a few days. In this case, however, the recovery following an overnight sell-off has been so quick and effortless that a lasting push above $2000 seems all but assured. The modest, 2006.20 target shown in the chart is one of several I could have displayed, but it will suffice for now as a minimum upside objective. I'll haul out some bigger charts with more ambitious targets once gold looks like it has found solid footing above $2000. ______ UPDATE (Jul 30, 2:35 p.m. ET): Today's snoozefest did not alter the bullish picture for the near-to-intermediate term.

SIU20 – Sep Silver (Last:24.525)

– Posted in: Current Touts Free

Although Silver's explosive rally over the last few days has nearly maxed out the hourly chart, bulls have reason to celebrate. As you can see, the rally exceeded a key external peak at 25.120 recorded seven years ago during the summer of 2013. The move has generated the most powerful impulse leg this vehicle has seen in nearly a decade, and it implies that any significant pullback in the weeks and months ahead be regarded as a buying opportunity. Stay tuned to the chat room, since we finally have a trend we can trade aggressively. ______ UPDATE (Jul 28, 5:06 p.m. ET): The violent price swings we saw today ended with the futures idling placidly in the exact middle of the range. This is peculiar though hardly bearish, since it suggests that even after getting viciously trapped at Monday night's highs, bulls were back at it hours later, chastened but not the least bit fearful. Let's step aside for a day and see how it goes. When the old high gives way, look for further upside to a marginal new high, at least, at 26.56 (60-min, A=22.175 on 7/22). Evening note: night owls can try bottom-fishing at 22.888 off this pattern on the 60-min: a=26.275; b= 22.46; c= 24.795 ( 7/28 at 11:00 a.m. ET)

DXY – NYBOT Dollar Index (Last:93.50)

– Posted in: Current Touts Free

The dollar's steep fall since March mirrors the egregiously overdone rally that has occurred in nearly everything else. There is no good reason for the dollar to be plummeting, but on Wall Street a bad reason will always suffice, especially in times when outright insanity rules the markets as it is doing now. That said, there are reasons to expect a turn from the current low, which touched a 93.57 downside target on the hourly chart Monday. I'd be surprised if there's no significant bounce, given the clarity of the pattern, However, I am prepared for more slippage nonetheless, possibly to the trendline shown. It comes in around 91.61, almost exactly two points lower. Here's a chart that shows this. Regardless, the pullback to the green line (94.48) must be regarded as a promising 'mechanical' buying opportunity, stop 88.24. We'll paper trade this one, but I should note that all such trades presented here over the last several months have been winners. ______ UPDATE (Jul 29, 7:37 p.m.): Any further slippage beneath the 93.57 'hidden' support will send the dollar down to 91.61 in search of good traction. ______ UPDATE (Jul 30, 2:39 p.m.): So much for the 93.54 support. You should use 91.61 as a downside objective for the near term. _______ UPDATE (Aug 3, 5:48 p.m.): Despite the rally since Friday, the damage has already been done, and I still expect lower lows. Regardless, I'm going to back away for a week or two, since price action in the currencies in general has gotten extremely tiresome. They used to be good 'non-correlating' vehicles to trade, but these days even the 100% manipulated Swiss franc acts like an eighth grader's science project.

NQU20 – Sep E-Mini Nasdaq (Last:10,682)

– Posted in: Current Touts FreeThe futures have bounced robustly after coming nowhere near our opportunistic bid at 9579. Now they appear bound for the 10746 Hidden Pivot target of the pattern shown. A run-up to that number, at least, is very likely because of the ease with which buyers turned the 10628 midpoint resistance into support in less than a day. If the rally pokes through 10746 decisively, that would telegraph a likely test of all-time highs just above 11,000 recorded last week. It is not yet a given, however, since the broad averages have seemed heavy for more than a week, notwithstanding that most days have produced at least modest gains. ______ UPDATE (July 28, 7:01 a.m. ET): The futures topped overnight at 10758, a tenth of one percent above where predicted, before selling off sharply. The 12-point overshoot is most surely not sufficient for us to assume that a test of the old record high is inevitable. _______ UPDATE (Jul 29, 7:44 p.m.): Buying interest has been close to zero, but DaBoyz evidently are determined to keep this hoax aloft for distribution until the last sucker has been coaxed aboard. This is apparent in the failure of perfectly fine, minor ABC downtrends to even reach their Hidden Pivot midpoints. Here's what I'm talking about.

AAPL – Apple Computer (Last:409.55)

– Posted in: Current Touts Rick's Picks

Bears have lacked the will and the guts to follow through on last week's hard sell-off. Instead, AAPL has launched into a wafting rebound, punctuated Monday by an opportunistic leap on the opening bar. Shorts had better be prepared to get squeezed all the way up to D=387.84, a minor rally target shown in the chart. It will be scant consolation to AAPL skeptics at this point, but the failure of the opening-bar goosing to exceed an external peak at 379.87 recorded last Thursday on the way down is a subtle sign that bulls' confidence is ebbing, even if only slightly. As a practical matter, this will enhance our odds for getting short at midpoint and secondary Hidden Pivots, as well as D targets similar in degree to the ones shown. ______ UPDATE (Jul 28, 5:24 p.m. ET): So much for shorting into strength. There was none, only a feeble opening that suggested DaBoyz were setting up a distribution day from the get-go rather than attempting to goose shorts off an oversold opening bar. Now watch AAPL fall to at least 359.52, the midpoint Hidden Pivot support of this pattern. You can scalp-trade some calls down there provided the stock gets within 3-4 cents of the target. _____ UPDATE (Jul 29, 8:04 p.m.): What on earth could I have been thinking when I predicted the stock would fall to at least 359.52? This is the most popular stock on earth, and none of its torqued institutional sponsors are even thinking about parting with a single share. It looks bound now for at least 386.96, the target of the ersatz ABC pattern shown here. This impulse leg isn't good enough, even, for government work, although I'm sure it will work perfectly well for AAPL. Jump on a pullback to 376.52 using

The Coming Civil War

– Posted in: Free

If Trump wins in November, it is foreseeable that his many enemies will ratchet up their hatred for him to even more destructive extremes. A bloody civil war would become likely, escalating an already violent cultural battle to a new threshold. How this might impact our schools, workplaces and neighborhoods is unpredictable even if the tactical outcome is not. The red states, wide-open spaces where politically conservative Americans tend to live and work, have superior firepower, to put it mildly, and their geographical vastness has rendered them invulnerable to attack. They also provide most of the food consumed by blue-zone denizens, implying red partisans could lay siege to blue, bringing the color war to a relatively quick end. Natural allies in flyover states include farmers, truckers and meatpackers, along with private-sector workers everywhere whose bosses do not report to diversity officers. Political liberals have taken to boycotting the wares of nearly everyone perceived as unfriendly to their cause. It remains to be seen whether conservatives can get sufficiently aroused to return fire, not only by boycotting every product or service tied to virtue-signaling, BLM-pandering corporate suck-ups, but by disrupting the flow of essentials into the big cities where political radicals live. Starvation Videos at Six! It is not hard to imagine the Democrats' urban strongholds running up the white flag in a month or two, when they've come to resemble hell-holes like the ill-fated Chaz in Seattle. Cities that have been run into the ground over the last 50 years by Democrats would become far worse, virtually unlivable even for the dregs. Who would want to remain in such a place? Even Antifa, when they are done looting and setting businesses ablaze, return to their parents' basements to quaff beer and watch themselves on television. Watching themselves starve would surely

ESU20 – Sep E-Mini S&P (Last:3242.00)

– Posted in: Current Touts Rick's PicksBears struggled unsuccessfully to push stocks lower Friday following a weak opening, implying DaBoyz will have things well under control when trading resumes Sunday evening. Accordingly, I'll recommend using a 'mechanical' bid to bottom-fish at p=3158.25, stop 3080.00. This implies entry risk of $3900 per contract, so the trade is recommended only to those who can cut the risk by at least 85% using a 'camouflage' set-up. If you're new to mechanical trades, try paper-trading this one to help build your confidence. Our winning streak for these set-ups is probably at around ten now. The ultimate destination is an absurdly bullish Hidden Pivot at 3392.75 that has been in play since mid-June, but which became even more likely two weeks ago when buyers crushed p=3158.25. _______ UPDATE (Jul 27, 5:03 p.m. ET): Even with headline help from a Fed worried about a deep economic relapse, bears were unable to push the futures down an inch, let alone to the 3158.25 midpoint support where we'd hoped to do some bottom-fishing. The 3392.75 rally target remains viable, although bulls have shown little energy or eagerness themselves to get there. _______ UPDATE (Jul 29, 6:26 p.m.): Steady distribution has been quiet but palpable, which is to say: sneaky. Even so, bears have been too intimidated to act, making it painful to hold short positions ahead of the inevitable plunge. Sunday night is the most logical time for one to begin, and so we'll look to take home a few puts on Friday. It will require news to trigger the selloff, but one shudders to think about what the news might be in these already way-too-interesting times. _______ UPDATE (Jul 30, 2:50 p.m.): With news out that GDP fell an annualized 34.5% in Q2 and no relief in sight for the pandemic-stricken economy, it's no

Apple’s Problems

– Posted in: FreeAAPL fell hard Thursday, although it's too early to tell whether this was just a garden-variety shakedown or perhaps the start of a new bear market. There was news out that some state attorneys general were investigating the company for deceiving customers. But if such investigations ever had consequences or produced results, public floggings for FAANG executives would be grist for infotainment, and Mark Zuckerberg, along with his "don't-be-evil" peers at Google, would be doing hard time. Could Trump's hardening stance against China be responsible for the pummeling AAPL took? Nearly all of the firm's assembly work is done there, and the company has not exactly embraced the task of moving it elsewhere -- presumably to places where business did not depend on kowtowing to double-dealing, lying, cheating, patent-filching commie scum.

AAPL – Apple Computer (Last:371.38)

– Posted in: Current Touts Free

Today's downdraft generated a robust impulse leg on the daily chart, the first time this has occurred since the start of the Covid-19 outbreak in February. Supposedly, fears are growing that Trump's hardball tactics with China could put pressure on AAPL, which does nearly all of its assembly work in China. Why traders picked today to unload Apple shares is unclear, however, since the company's China problem has existed for nearly three years, ever since the tariff war began. Trumped warned Apple years ago to get out of China, but it would seem no one in Cupertino took him very seriously. That didn't stop investors from piling into the stock since March, driving it into a ridiculously steep rally that was manifestly inured to troubles with China's Communist government. So how far could the stock fall? That depends on whether the downtrend stretches on for another 2-3 days, breaching a 351.28 low recorded nearly a month ago. If it happens with no significant upward corrections along the way, that would add to the imputed power of the impulse leg, conceivably signaling the beginning of a new bear market.