Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's Free Picks

$MSFT – Microsoft (Last:498.00)

The grandaddy of all short squeezes (in dollar terms) stopped an inch shy of the 503.69 target we’ve been using. It looks like ‘our’ target got front-run on the intraday charts, but the view shown, of the daily chart, ‘feels’ like the target will be achieved. In any case, we

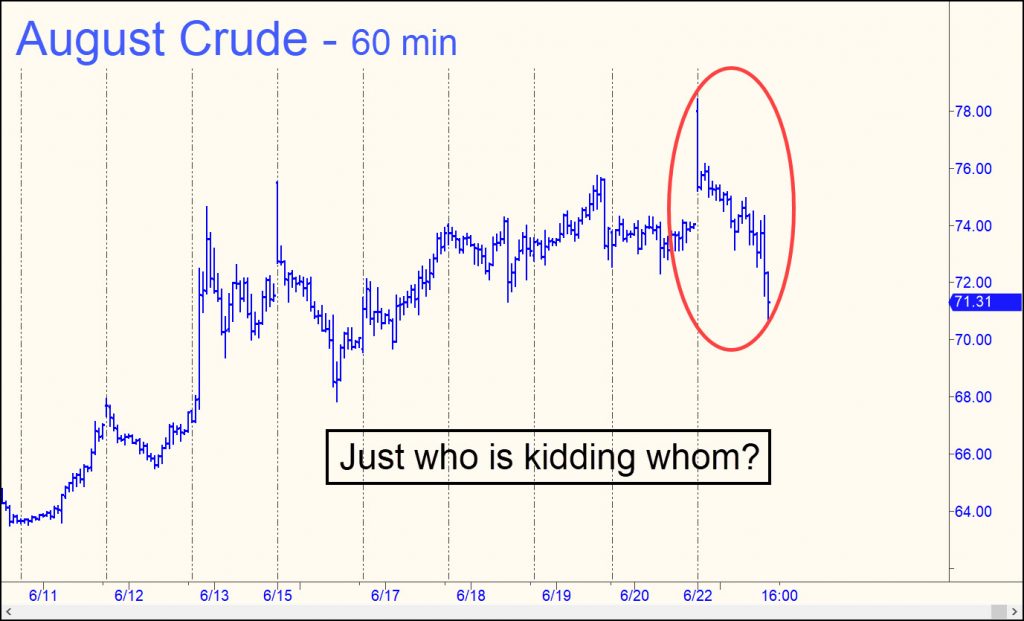

CLQ25 – August Crude (Last:66.71)

Right on cue, Bloomberg.com splashed an article on its front page over the weekend explaining why the price of crude has been so subdued in the face of potentially severe supply disruptions in the Middle East. Turns out the world is awash in oil, the article explained — not just

TLT – Lehman Bond ETF (Last:84.55)

We should know soon whether Silver’s mini-explosion upward, the second in three months, is just another false start. From a Hidden Pivot perspective, the selloff of the last two weeks is not as bearish as it seems. It triggered an attractive ‘mechanical’ buy on Monday when it touched the green

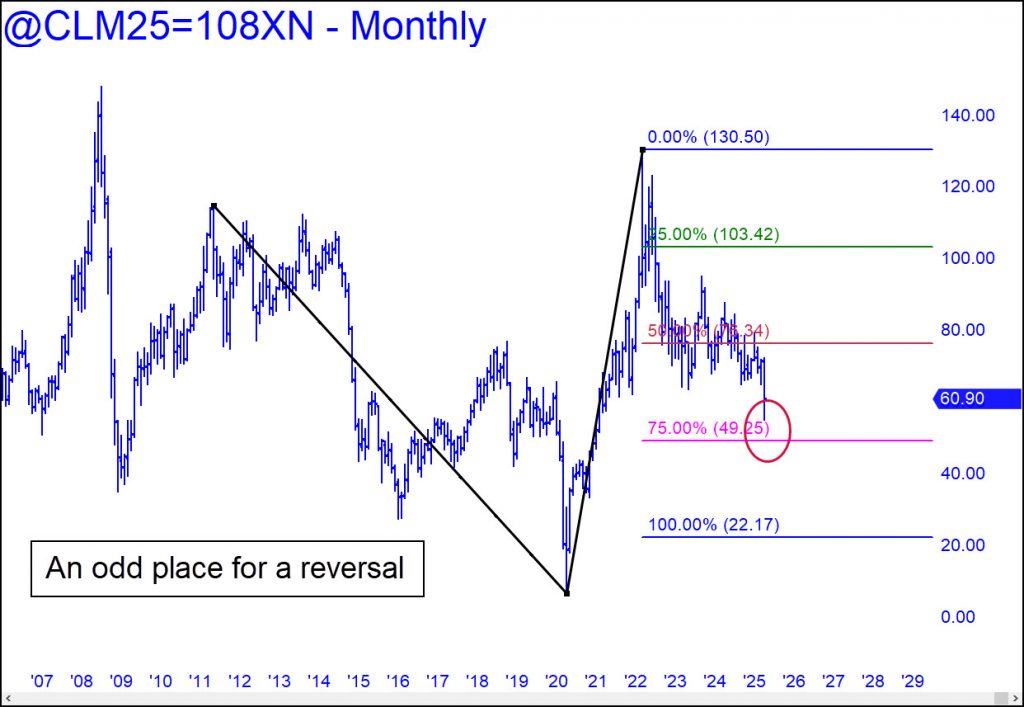

CLM25 – June Crude (Last:60.90)

Quotes for crude have turned up from an odd place, well shy of a ‘secondary’ Hidden Pivot support at 49.25. Odds of a relapse will depend on how bulls fare pushing past a minor Hidden Pivot resistance at 62.22, and another at 65.68 (60-min, A=56.42 on 4/9). If both of

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

The Huge AI Story May Not Be Quite Huge Enough

The S&Ps and Nasdaq hit record highs last week, a surreal milestone that only the Wall Street toadies at Bloomberg and the Wall Street Journal who fabricate the news could take seriously. These are the same folks who bestowed the name ‘Magnificent Seven’ on a bunch of high-flying stocks whose short-squeeze histrionics qualify them for membership in a stock-market Hall of Shame. Portfolio managers, who surely know better, are go-along buyers at these heights and will remain so until a tsunami of redemptions bends them to the impending reality of massive deflationary write-downs when the Everything Bubble bursts.

That reality darkened last week with news that the U.S. economy shrunk at an annualized rate of 0.5 percent in the first quarter. Perennially giddy investors would seem to be betting either that the recession that probably already has begun will be short, or that the statistic itself is a meaningless outlier caused by the world-class uncertainties of Trump’s tariff policies.

A popular explanation for the staying power of the bull market against a backdrop of global storm clouds, geopolitical mayhem and economic sclerosis is that AI will save us from…everything. As the story has it, artificial intelligence will boost worker productivity, improve outcomes from brain surgery, make steering wheels obsolete, turn $20-an-hour paralegals into Clarence Darrows, and lay to rest the arguments of Talmudic scholars. In unfortunate reality, the driving force behind AI is its ability to put people out of work, particularly white-collar employees whose jobs have been untouched so far by robotics.

Can Joe Six-pack Deliver?

That raises the question of how lunatic-sector companies that have invested trillions of dollars in AI development, and who say they plan to invest much, much more, can ever hope to recoup their money, let alone multiply it voluminously as they seem to expect. To state the question another way, what additional goods and services can they possibly sell us to generate untold trillions of dollars in new revenues? Since houses and cars have gone out of reach for the broad middle class, and because AI will put enough people out of work to make the affordability problem even broader and deeper, you have to wonder how we consumers will be able to satisfy the insatiable greed of Mark Zuckerberg, Bill Gates, Sam Altman, Reed Hastings, Jeff Bezos, Larry Page et al. The GDP pie is only so big, and if cutting into Taylor Swift’s share of it is part of their plan, they are in for the fight of their lives.

One could argue that healthcare is the most significant area of the economy where job cuts are unnecessary for AI to create value. Indeed, if AI provides an economical way to construct robust hearts, lungs and pancreas with a 3-D printer, or leads us to a cure for cancer, the economic benefits would be enormous. But they would come mostly in the form of savings, rather than from any vast new sales by providers. Unfortunately for the megacapitalists, any savings, no matter how large, would not remotely suffice to reward the lot of them together with a sustainable growth-stock multiple. But unsustainable growth that need only be imagined? We’ve got a cosmic surfeit of that now, so enjoy it while it lasts. [AI hubris was the focus of my recent interview with Howe Street’s Jim Goddard. Click here to access it.]

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others