Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's Free Picks

$TNX.X – 10-Year Note Rate (Last:3.962%)

Rates on the 10-Year Note came within a hair on Friday of lows not seen since October. My suggestion is to enjoy it while it lasts, since the intraday bottom closely coincided with a Hidden Pivot target at 3.952%. The actual low was 3.956%, which was near enough to consider

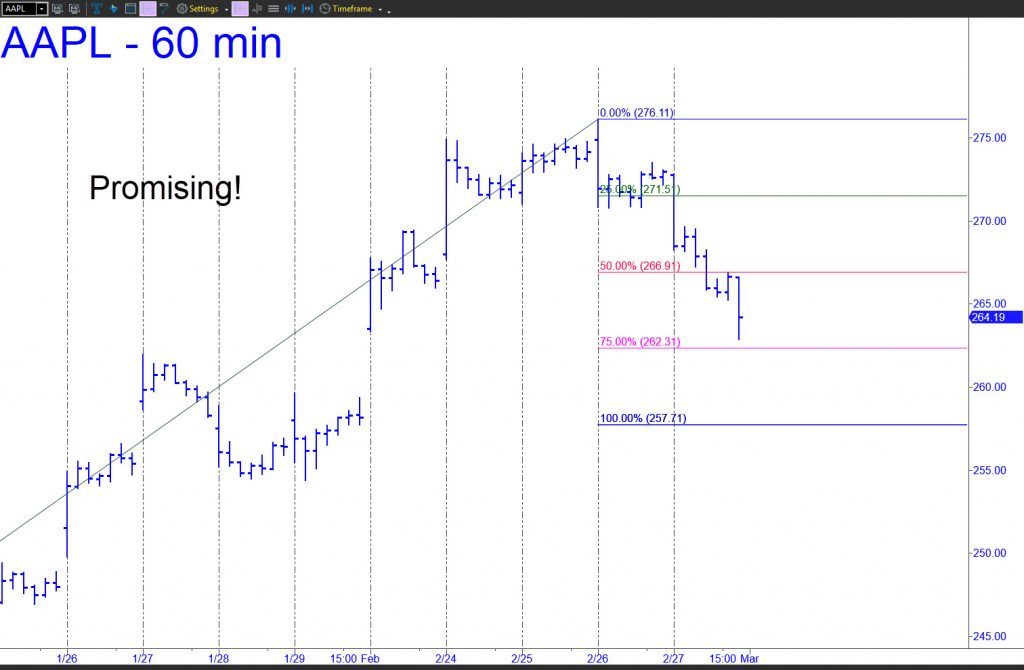

$AAPL – Apple Computer (Last:260.25)

Bottom-fishing at the 257.71 target of this pattern looks so promising that I hate to queer its magic with this semi-public ad. The target looks likely to be reached because the stock never poked above p=266.91 after first penetrating it on the way down. Still, the failure to bounce precisely

$SIH26 – March Silver (Last:89.135)

It took buyers all of three days to gnaw through heavy resistance at the 90.165 midpoint Hidden Pivot of the pattern shown. Adding to the challenge was the 92.015 peak recorded on Feb 4. It had served as a stop-loss for a ‘mechanical’ short from 10 points lower that I

$GDXJ – Junior Gold Miner ETF (Last:136.71)

GDXJ had a constructive week, exceeding p2=152.56 just days after shredding the midpoint Hidden Pivot resistance at 142.01. This one-two punch has all but guaranteed more upside in the days ahead to at least D=163.11. Given the clarity of the pattern, there is almost certain to be tradeable resistance there.

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

Why Stocks Look Like Hell

[Events in the Middle East have overshadowed my narrow economic critique of President Trump in the commentary below. His alliance with Israel to knock out global jihad’s command structure is likely to change the world in ways no one can predict. It will also test the idea that only military might can secure a lasting peace. RA ]

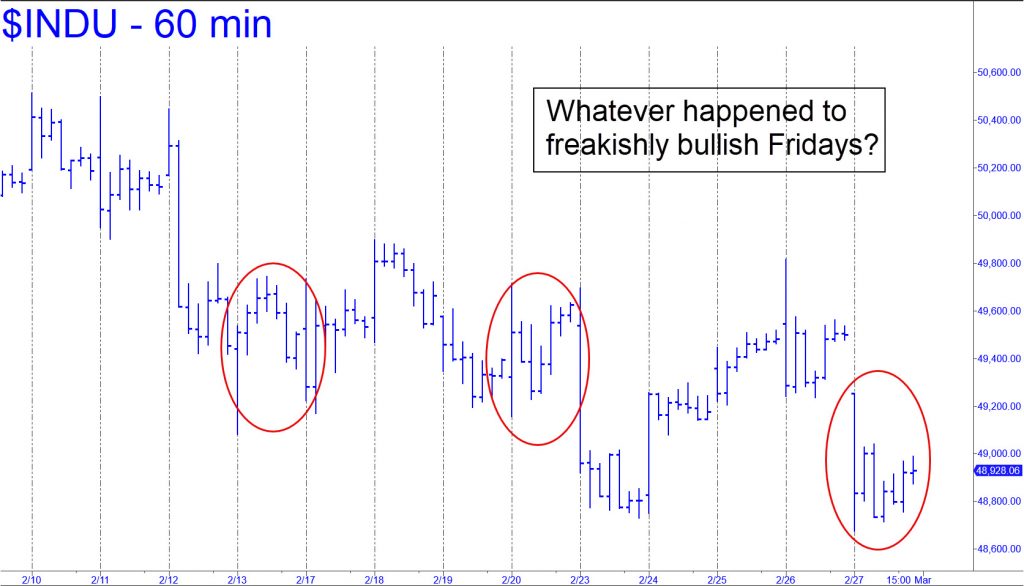

Stocks used to turn feisty toward the end of the week, but as the chart shows, the last few ‘Freaky Fridays’ have been pretty tame. My gut feeling is that this picture of tedium is the calm before the storm, and that stocks are being heavily distributed ahead of a major breakdown. Although I promised a few weeks ago that I wouldn’t mention the words ‘topping process’ again, the alternative would make me sound like a Wall Street shill. The Street’s best and brightest have been flat-out bullish on stocks since the 1929 Crash, having failed to issue a sell signal even on stocks implicated in some of the biggest scandals of the last hundred years. To cite a particularly notorious example, many of them were gung-ho on the shares of Equity Funding until the moment regulators halted trading in the stock one day in March 1973. Read about it here.

So why have shares been unable to develop a head of steam on Fridays, when irrational exuberance has typically been highest? There are two likely reasons. For one, the AI Bubble has popped. This occurred without much fanfare on January 29, when Microsoft shares dove $60, or 12%, overnight. The shills initially took this for a one-off event, an ‘adjustment’ in the share price of a big company they felt was heavily over-invested in AI. Rick’s Picks saw it as the beginning of the end for AI mania and said so in a commentary out that weekend. Trillions of dollars of valuation have since leaked from the ‘lunatic sector’ (aka the Magnificent Seven) and other stocks, but the deflation is likely to grow much worse before the bloodletting ends.

The second reason shares are acting so punk is that Trumpmania is over. The President effectively killed it with a State of the Union speech last week that bragged about how the economy is going great guns, and how he crushed the inflation caused by his sock-puppet predecessor, ‘Joe Biden’. Any middle-class American who heard the speech recognized it for what it was: more dubious hype than fact. Workers and small-business owners are struggling harder than ever to stay afloat, but inflation is crushing them anyway. And although the cost of eggs, gas and some other staples may have fallen since Trump took office, prices for all the big-ticket items are soaring out of control: health insurance, automobiles, homes, tuition, property insurance, you name it.

Under the circumstances, an exuberant leap to new highs seems most unlikely for the broad averages. The Dow Industrials have eased somewhat after head-butting 50,000 for a few days. DaBoyz are waiting for a news catalyst to drive a short-covering panic. This is the primary force powering all big rallies, the only source of buying strong enough to push stocks past previous peaks and thick layers of supply. If your imagination tells you what bullish news will cause this to happen, then you should be buying stocks hand-over-fist now, not even waiting for a significant dip. I must confess, however, that I am out of ideas. There are plenty of things that could go wrong, though, and the interview I did Friday on This Week in Money discusses them in detail. Click here to access it.

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others