Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's Free Picks

$ESH26 – March E-Mini S&P (Last:664550)

Yet another punk Friday suggests that the longest bull market in history is running out of gas. Considering that the war with Iran is a mop-up operation at this point, and that global jihad has suffered an extraordinary setback, the stock market should be celebrating. Instead, the S&P mini-futures couldn’t

$$TNX.X – 10-Year Note Rate (Last:4.21%)

Rates on the 10-Year Note came within a hair on Friday of lows not seen since October. My suggestion is to enjoy it while it lasts, since the intraday bottom closely coincided with a Hidden Pivot target at 3.952%. The actual low was 3.956%, which was near enough to consider

$SIH26 – March Silver (Last:89.135)

It took buyers all of three days to gnaw through heavy resistance at the 90.165 midpoint Hidden Pivot of the pattern shown. Adding to the challenge was the 92.015 peak recorded on Feb 4. It had served as a stop-loss for a ‘mechanical’ short from 10 points lower that I

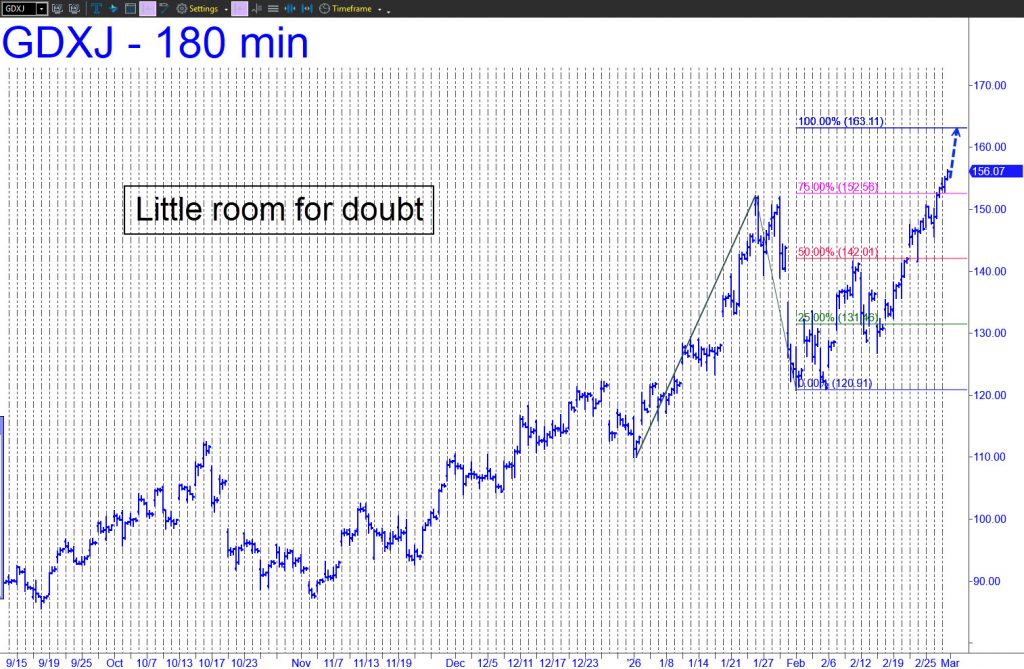

$GDXJ – Junior Gold Miner ETF (Last:136.17)

GDXJ had a constructive week, exceeding p2=152.56 just days after shredding the midpoint Hidden Pivot resistance at 142.01. This one-two punch has all but guaranteed more upside in the days ahead to at least D=163.11. Given the clarity of the pattern, there is almost certain to be tradeable resistance there.

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

Zuckerberg’s Huge Branding Problem

[Your editor is taking a busman’s holiday in San Francisco. Although trading touts will update as usual and I’ll be active in the chat room, this commentary and the next come from the archive. You can judge for yourself whether they were sufficiently on-target to still be relevant. RA]

Stocks looked leaden as the week ended, adding to the impression that the aging bull market is topping. The Dow tacked on a perfunctory 104 points, or 0.22%, and it wasn’t pretty. There was little life in the lunatic sector (aka ‘the Magnificent Seven’), which until recently could be relied on to celebrate its wildest flights of fantasy on Fridays. The biggest winner in the bunch was META, which rose 1.80% on news that Zuckerberg is having second thoughts about his all-in bet on a metaverse.

If you’re unfamiliar with the term, it refers to a virtual world in which users interact online through avatars. Zuckerberg evidently thought there were hundreds of millions of us, if not billions, eager to escape the pain and drudgery of day-to-day life. He was so certain about this that he changed the name of his company in 2021 from Facebook to Meta. But after sinking $70 billion into the concept, there has been precious little payback. Even more troubling to investors is that there are no obvious ways to make back what has been spent already, nor to recoup any further sums Meta might pour into the idea.

Counting on Investors’ Stupidity

To cover up this boo-boo, and to avoid being thought clueless, Zuckerberg did what any muckety-muck CEO in the digital world would have done: a twisting somersault onto the AI bandwagon. “AI is the most important technology we are working on,” he said, evidently hoping investors have forgotten that he spent the last four years taking pains to separate the supposed;y lucrative potential of metaverse from the vague and so-far profitless promises of AI. This latest statement to the press was a smart move if you believe that the $10 gain recorded by META on Friday was the beginning of a lasting rally. More likely is that it will be reversed on Monday or Tuesday, adding to the disillusionment that has been weighing on the broad averages for the last few months.

Meanwhile, Facebook is stuck with a moniker and a concept that are perceived as dead on arrival. Although Zuckerberg is known as a smooth talker, watching him try to extricate himself from this memic trap promises to be entertaining. Faced with a branding problem that is not merely tricky but potentially fatal, he doesn’t dare return to the name ‘Facebook’, since that would be admitting failure and the stupidity of his biggest-ever idea. But if he changes the company’s name a second time to some as-yet-unclaimed, nebulous variant of AI, he will look like a flake. My guess is that he will stick with Meta, forever associating himself with a virtual Edsel. Like Johnny Cash’s boy named Sue, Zuckerberg will have to work three times as hard to be taken seriously, particularly by his billionaire cohort who are already well aloft in their splendiferous AI hot-air balloons.

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others