Friday's subdued rally had more than a faint whiff of distribution about it. DaBoyz had shorts on the run in the early going, with the Dow up about 230 points in the first hour. But instead of reaming bears a new orifice as we might have expected, the erstwhile Masters of the Universe struggled merely to maintain altitude and eventually had to close the broad averages well off their intraday highs. If you took a short position over the weekend there were some encouraging signs. For one, AAPL hit a 283.97 rally target that Rick's Picks has been drum-rolling since March, when the stock was selling for around 180. The actual high at 283.54 occurred on a dubious spike just ahead of the opening bell. The upthrust turned into a bull trap when AAPL sold off $5 intraday and never recovered. The high stands to be a potentially important one for the bull market, since AAPL is the most popular stock in institutional portfolios. If it has hit a ceiling, then so has the stock market. Rally Outrunning Earnings The second encouraging sign for those who faded the rally was a top in the E-Mini S&Ps at 3229.50 that missed the Hidden Pivot rally target shown in the chart by a single tick. It had been sent out to subscribers the night before. Will these coinciding, fleeting peaks mark an important top? We could find out soon if shares head south on Monday and the decline gains momentum as the holiday-shortened week wears on. But even if new record highs are coming, a correction at this point would be constructive, since it would quell feverish buying that has driven equity prices much higher without any corresponding growth in earnings. _______ UPDATE (Dec 23, 6:30 p.m.): The rally is stuck in

Free

Boredom Could Stoke a Friday Rally

– Posted in: FreeThe stock market's week has been so tedious, even with an impeachment, that we shouldn't be surprised if something happens to cause traders to emerge from their coma. A compelling trendline that I've mentioned here before implies the surprise would likely be to the upside, since the Dow Industrials would need to rise 500 points to reach it. The actual number is 28,692, and wouldn't that be a shocker! Most unexpected of all would be for this to happen following a slow start. If the opening looks weak, as in 'stage-managed', don't be afraid to take a small speculative stake in some cheap out-of-the-money calls in the FAANGs, TSLA, MMM or MSFT.

No Way Bulls Can Shrug Off Boeing AND FedEx

– Posted in: FreeWhen the Dow Industrials gained 100 points the other day as Boeing was getting clobbered, I compared it to a runner with a broken foot sprinting 100 meters in under 11 seconds. Bulls looked nearly as impressive on Wednesday, hanging tough while FedEx shares were getting the stuffing knocked out of them. The stock was down $17, or nearly 10 percent, but if this unnerved institutional traders, you couldn't tell from the tape. DaBoyz actually managed to levitate Boeing by $4.50 -- no small feat when you consider that the aircraft manufacturer's worries are as big as FedEx's. Indeed, there would appear to be no relief in sight for either company. It will take FedEx years to build a ground-delivery system capable of handling e-commerce orders without becoming increasingly dependent on Amazon's already formidable network. There is no jackpot at the other end, either, since home deliveries of small packages will be much less lucrative than the business-to-business shipping at which FedEx has long excelled. Max-Out in January As for Boeing, it will stop building its biggest-selling jetliner, the 737 Max, in the wake of two crashes that killed 346 passengers. The company announced it would halt the Max assembly line in January, but no one can say for certain when or even whether production will resume. Can the stock market continue to rampage with two of America's most important companies on the ropes? Probably not. In the last few days, the bull market's steep trajectory has gone flat as DaBoyz gingerly attempt do distribute as much stock as they can before pulling the plug. I still foresee a bullish year ahead for stocks, in large part because Trump is looking more and more like a two-term president. But that doesn't mean we won't see a very nasty correction between

Boeing’s Troubles Could Cool Bull Fever

– Posted in: FreeConsidering how Boeing shares got pulped on Monday, the Dow's 100-point gain was nothing short of stunning. It was akin to a sprinter with a broken foot running the 100-meter dash in under 11 seconds. During the bull run of the last ten years, DaBoyz all but perfected the art of rotating money from one sector to another so that there was almost never weakness across-the-board. They appeared to preserve their stellar record on Monday, pumping up ten Dow stocks by $1 or more while Boeing shares were falling nearly 5%. Now that's rotation! It suggests that the aircraft manufacturer's institutional sponsors have resigned themselves to a long slog before they can turn the stock around. They had shaken off an onslaught of horrendous headlines since May, holding the stock in a $50 range while customers decided whether to curtail orders for a 737 Max aircraft that crashed twice within a five-month period, killing 346 people. The company announced over the weekend that it plans to suspend production of the jetliner, its biggest seller. This will cut quarterly cash flow in half to around $2 billion and supposedly knock 0.3 of a percentage point from annualized U.S. GDP. This is a very big deal, and it seems almost certain to cool the bullish fever that has gripped Wall Street since early October. The yellow flag is out, and we'll be watching the intraday charts diligently for signs of a top. Stay closely tuned to Rick's Picks if you care. _______ UPDATE (Dec 17, 7:45 p.m.): The stock closed unchanged after being down more than $6 in the early going. This was very impressive, and it demonstrates the all but unlimited buying power that can be summoned to defend Boeing's share price come hell or high water. It also hints at

Watch Wall Street Celebrate Britain’s Election

– Posted in: FreeNow comes yet another investable idea to drive the bull market in the months ahead: Donald Trump's reelection bid looks stronger than ever. His odds jumped following last week’s election in Great Britain. So decisively did voters rebuke Labor’s hard-left candidate for prime minister, Jeremy Corbyn, that it can be safely assumed that neither of his socialist comrades in the U.S. — Bernie Sanders and Elizabeth Warren — has a prayer of becoming president. And because America is not quite ready for a gay couple in the White House, Pete Buttigieg, another a man of the far left whose track record as mayor of South Bend, Indiana, stinks, will not win either. That leaves Joe Biden, a white male whom party activists find deeply offensive; and another white male, Michael Bloomberg, a multibillionaire who is even less likely to get nominated by the wack-jobs currently in charge of the Democratic party. Cue up Hillary, an increasingly likely hail-Mary nominee who will be no more appealing to the average voter come November than she was in 2016. Dow 30,000 Ahead! Last week's shift in election odds will be all that bulls need to push the Dow above 30,000. It stood at 28,136 on the close Friday, up just a few points. This was more impressive than it seemed, since the stock market was bucking heavy ‘buy the rumor, sell the news' headwinds. The news was that the U.S. and China had concluded the initial phase of a trade deal and that they would start working on phase two right away. (There was no immediate confirmation from China, but that seemed not to concern bulls or, for that matter, short-covering bears.) It is logical to assume that the stock market will not get nearly as much boost from Trump tweets concerning nebulous

AAPL – Apple Computer (Last:291.45)

– Posted in: Current Touts Free

The chart refreshes an old rally target, a major Hidden Pivot at 283.97 that we've been using to stay unemotionally on the right side of the trend since last spring. The target still looks likely to be reached, presumably before Christmas. With Aramco hitting $2 trillion following its recent IPO, AAPL became the world's second most valuable company. Even so, it remains the most important bull-market bellwether, since no portfolio manager can be without it and because the company can do no wrong in their eyes. But I'd be very surprised if it spears the target on the first try, since this Hidden Pivot is so clear and compelling. We'll plan on getting short if and when the stock gets there, but if it happens later in the week than a Tuesday, options expiring the following week will be the play. Buy the first put strike at which the options are trading for less than 1.00. _______ UPDATE (Dec 17, 8:35 p.m. EST): Just one more inch! Bid 0.30 for eight Jan 3 265 puts, day order, but only if the stock has not traded above 284.15. Be prepared to lose it all, since this is a very speculative bet that seeks to precisely intercept a steep rally. ______ UPDATE (Dec 18, 11:04 p.m.): Leave the bid in for another day, but don't pay up. _______ UPDATE (Dec 22): If at least two subscribers report buying puts when AAPL topped on Friday at 283.54, I'll establish a tracking position. Meanwhile, if the stock goes any higher without a correction, it would shock me. _______ UPDATE (Dec 23, 6:12 p.m.): The stock has hung up at the target, creating uncertainty no matter how you've decided to play it. The puts traded within a penny of the 0.30 bid I'd suggested, so

GCG20 – February Gold (Last:1593.40)

– Posted in: Current Touts Free

Thursday's fleeting upthrust tripped a theoretical buy signal at the green line. Ordinarily it would be easy to overlook or ignore it, since buy signals since late August have come to naught. However, gold's price action has been so tedious and frustrating in the interim that we should take extra care to avoid missing the turn when it comes, especially since the impulsive thrust that occurred last summer was so powerful and promising. Most immediately, we'll use p=1529.50 as a minimum upside objective and trade it aggressively. In practice, this will mean looking for rABC and 'mechanical' setups in charts of small degree. Stay tuned to the Trading Room if you're interested. _______ UPDATE (Dec 23, 6:22 p.m. EST): The futures are headed most immediately to 1497.30 (60-min, A=1459.80 in 12/2 at 4:00 a.m.; B=1491.60 (12/12). I expect a stall, possibly tradeable, within two ticks of the target. But if buyers blow past it, that would shorten the odds of reaching p=1529.50, my current minimum objective in a larger pattern. ________ UPDATE (Dec 26, 12:45 a.m.): Buyers handled the 1497.30 resistance with ease, all but clinching more upside to the p=1529.50 target noted above. It was first broached here 11 days ago with Feb Gold trading nearly $40 lower. An easy push through it would shift our attention to the pattern's 'D' target at 1605.90. This number seemed like pie-in-the-sky when the buy signal triggered on December 12, but it is growing less farfetched by the day. ________ UPDATE (Dec 31, 4:43 a.m.): The futures have hit 1529.00 tonight, effectively fulfilling the target given above. A two-day close above this Hidden Pivot resistance, or an intraday spike to around 1538, would shorten the odds of a further rally to 1605.90. ______ UPDATE (Jan 5, 10:24 p.m.): Tensions with Iran have

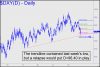

DXY – NYBOT Dollar Index (Last:97.80)

– Posted in: Current Touts Free

I've been steadfastly bullish on the dollar for years, in part because a strong dollar is congruent with the deflationary endgame that seems likely when the stock-market bubble bursts. Even so, it's conceivable we could see an inflationary blip along the way, especially under a president who seems determined to weaken the dollar to help U.S. manufacturers. The intermediate-term chart (inset) therefore bears watching, since it could provide us with evidence that the dollar weakness since early October is about to intensify. Despite Friday's robust bounce from the trendline, I expect a relapse to reach the target. If it breaches it, and especially if the downtrend goes on to exceed June's low at at 95.84, that would be the first yellow flag we've seen in the greenback since August 2017.______ UPDATE (Jan 1, 3:50 p.m. EST): Yesterday's low slightly exceeded the 96.40 target shown in the chart. (I somehow failed to mention this target in the tout when I published it two weeks ago.) The bounce so far has been fleeting and feeble, hinting of still lower prices to come. ______ UPDATE (Jan 7, 10:38 p.m.): Heightened tensions with Iran have given the dollar good reason to rally, and yet it is barely getting any loft from the 96.40 Hidden Pivot noted above. This is plainly bearish and will remain so unless the crisis escalates significantly. _______ UPDATE (Jan 13, 5:55 p.m.): DXY's rally has lengthened modestly since the 96.40 bottom was in, but bulls will need to surpass 97.94, where a small 'external' peak was recorded Dec 2 on the hourly chart, for the uptrend to gain credibility. _______ UPDATE (Jan 24, 9:34 a.m.): DXY is just an inch shy of the 97.95 print required to re-energize and extend the bull run from the predicted low at 96.40 low

Time Magazine’s Courageous Choice

– Posted in: FreeIt's hard to predict how investors will react to the big news when stocks start trading on Thursday morning. I am of course referring to the selection of teen climate sensation Greta Thunberg as Time magazine's Person of the Year. This is a bold and courageous choice by the editors, and we can think of only one person in the publishing world who would have had the guts and imagination to try and top it: the late Hugh Hefner. If Hef were still around, we would almost surely be seeing a transgendered person of color featured as Playmate of the Year. What a thrill that would be, watching two legendary has-beens of the publishing world duke it out for top virtue-signaling honors in the Flavor of the Year category. Actually, Playboy will have a chance to one-up Time when Ms. Thunberg celebrates her 18th birthday in two years. Could they get her to pose for a centerfold by offering to donate $50 million dollars to her favorite climate fearmonger? Would anyone be shocked if they tried -- or, if they failed, be surprised when Sports Illustrated makes her an even more salacious offer? ______ UPDATE (Dec 12, 11:35 p.m. EST): Investors have responded to Time's courageous choice with an explosive rally that seems to say "Give us more Greta!!!!" No one in history has won this increasingly misapplied award for two consecutive years, but perhaps Ms. Thunberg will be the first? She will have tough competition, though, if Hillary Clinton should decide to jump into the presidential race, or the Squad stumbles onto a cure for dandruff.

Why the Banking System’s ‘Cough’ in September Spells Trouble

– Posted in: FreeEarlier, I referred to the repo-market flare-up in September as being like the death-foreshadowing cough in the second reel of a melodrama. In a subsequent interview I did with USA Watchdog's Greg Hunter, I noted that it was especially curious that, two months after a short-squeeze on bank reserves spiked overnight rates to 10%, the supposed experts had yet to figure out what caused it. It was hardly comforting that more than a few of them attributed the crisis to the banks' higher-than-usual cash needs at the end of a quarter. This explanation seemed to pass muster at the time, but it was obviously wrong. For in fact, the banks' cash requirements had been precisely knowable weeks earlier. That's how the banksters work -- how they leverage-to-the-max every dime that falls into their greedy, uncalloused hands. They practice a particularly sophisticated version of just-in-time inventory, calculating duration down-to-the-minute and allocating collateral so that it divides faster than E coli. Smart guys. The trouble is, such calculations are almost invariably based on business-as-usual. This time, unfortunately, the game changed unexpectedly. In repo transactions, the lender typically holds collateral in the form of cash reserves or Treasurys. But in September the rentiers held an unusually high proportion of Treasury paper, which created a cash shortage in the banking system. Why did they choose Treasurys over dollars? The un-simple answer is that they were eagerly anticipating front-running the Fed's purchase of Treasurys from the banks. The logic behind this gambit is spelled out in fascinating detail in a think-piece at ZeroHedge. The very troubling insights contained in the article are those of Zoltan Pozsar, arguably the foremost expert in the world on repo markets. Pozsar says that what I've called an ominous cough spells potentially big trouble for the banking system. The article