THE MORNING LINE

Why Stocks Look Like Hell

[Events in the Middle East have overshadowed my narrow economic critique of President Trump in the commentary below. His alliance with Israel to knock out global jihad’s command structure is likely to change the world in ways no one can predict. It will also test the idea that only military might can secure a lasting peace. RA ]

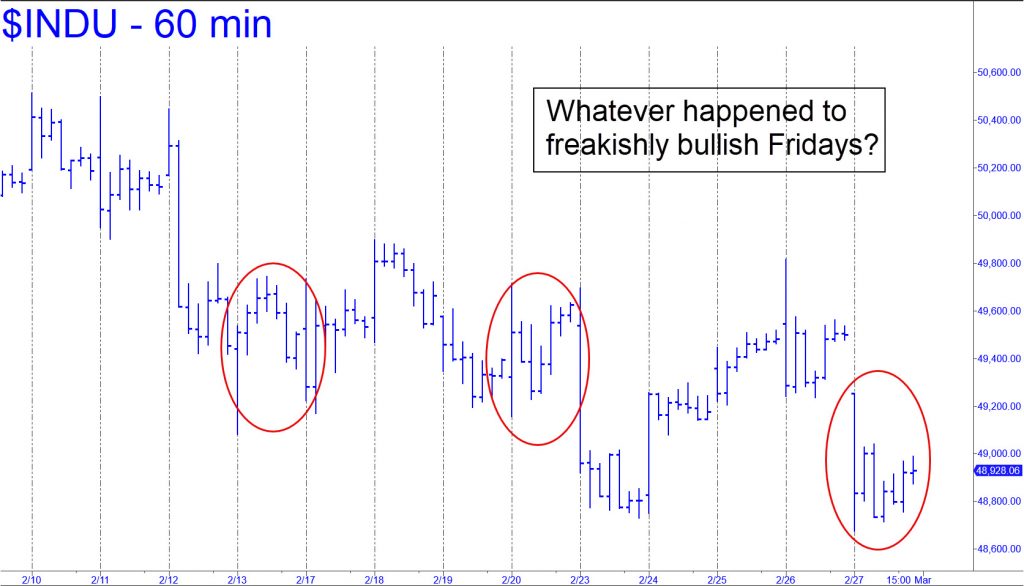

Stocks used to turn feisty toward the end of the week, but as the chart shows, the last few ‘Freaky Fridays’ have been pretty tame. My gut feeling is that this picture of tedium is the calm before the storm, and that stocks are being heavily distributed ahead of a major breakdown. Although I promised a few weeks ago that I wouldn’t mention the words ‘topping process’ again, the alternative would make me sound like a Wall Street shill. The Street’s best and brightest have been flat-out bullish on stocks since the 1929 Crash, having failed to issue a sell signal even on stocks implicated in some of the biggest scandals of the last hundred years. To cite a particularly notorious example, many of them were gung-ho on the shares of Equity Funding until the moment regulators halted trading in the stock one day in March 1973. Read about it here.

So why have shares been unable to develop a head of steam on Fridays, when irrational exuberance has typically been highest? There are two likely reasons. For one, the AI Bubble has popped. This occurred without much fanfare on January 29, when Microsoft shares dove $60, or 12%, overnight. The shills initially took this for a one-off event, an ‘adjustment’ in the share price of a big company they felt was heavily over-invested in AI. Rick’s Picks saw it as the beginning of the end for AI mania and said so in a commentary out that weekend. Trillions of dollars of valuation have since leaked from the ‘lunatic sector’ (aka the Magnificent Seven) and other stocks, but the deflation is likely to grow much worse before the bloodletting ends.

The second reason shares are acting so punk is that Trumpmania is over. The President effectively killed it with a State of the Union speech last week that bragged about how the economy is going great guns, and how he crushed the inflation caused by his sock-puppet predecessor, ‘Joe Biden’. Any middle-class American who heard the speech recognized it for what it was: more dubious hype than fact. Workers and small-business owners are struggling harder than ever to stay afloat, but inflation is crushing them anyway. And although the cost of eggs, gas and some other staples may have fallen since Trump took office, prices for all the big-ticket items are soaring out of control: health insurance, automobiles, homes, tuition, property insurance, you name it.

Under the circumstances, an exuberant leap to new highs seems most unlikely for the broad averages. The Dow Industrials have eased somewhat after head-butting 50,000 for a few days. DaBoyz are waiting for a news catalyst to drive a short-covering panic. This is the primary force powering all big rallies, the only source of buying strong enough to push stocks past previous peaks and thick layers of supply. If your imagination tells you what bullish news will cause this to happen, then you should be buying stocks hand-over-fist now, not even waiting for a significant dip. I must confess, however, that I am out of ideas. There are plenty of things that could go wrong, though, and the interview I did Friday on This Week in Money discusses them in detail. Click here to access it.

Rick's Free Picks

$TNX.X – 10-Year Note Rate (Last:3.962%)

Rates on the 10-Year Note came within a hair on Friday of lows not seen since October. My suggestion is to enjoy it while it lasts, since the intraday bottom closely coincided with a Hidden Pivot target at 3.952%. The actual low was 3.956%, which was near enough to consider

$SIH26 – March Silver (Last:89.135)

It took buyers all of three days to gnaw through heavy resistance at the 90.165 midpoint Hidden Pivot of the pattern shown. Adding to the challenge was the 92.015 peak recorded on Feb 4. It had served as a stop-loss for a ‘mechanical’ short from 10 points lower that I

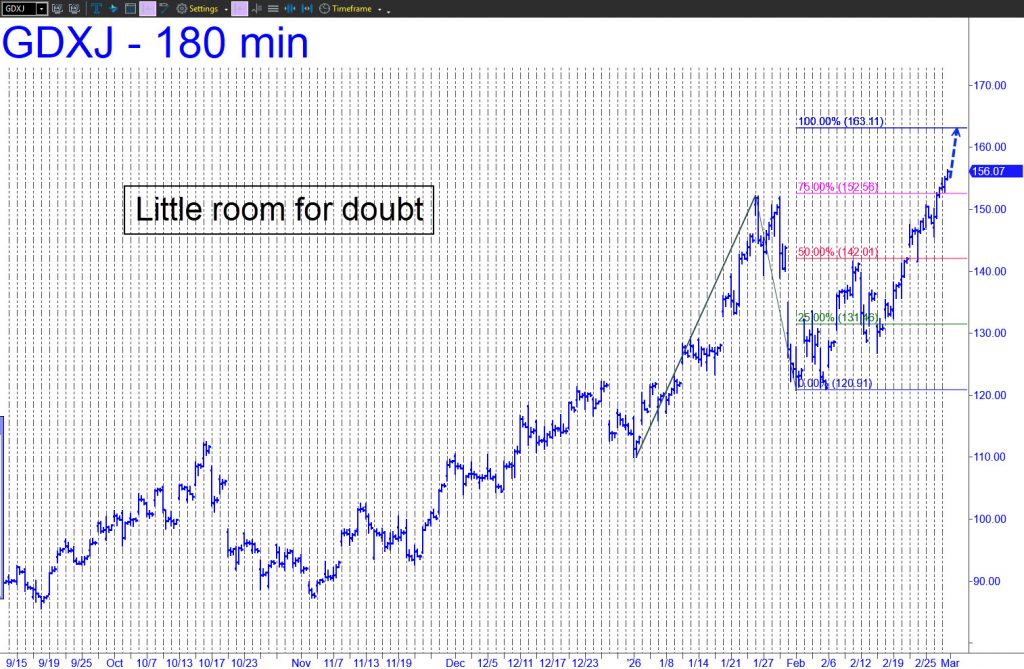

$GDXJ – Junior Gold Miner ETF (Last:156.07)

GDXJ had a constructive week, exceeding p2=152.56 just days after shredding the midpoint Hidden Pivot resistance at 142.01. This one-two punch has all but guaranteed more upside in the days ahead to at least D=163.11. Given the clarity of the pattern, there is almost certain to be tradeable resistance there.

$AAPL – Apple Computer (Last:264.59)

I restored AAPL to the core list last week with reservations. The company is a dim also-ran in the AI race, having only recently found a partner in Google, the creator of Gemini. There is also the chance Musk will eventually make iPhones obsolete. He keeps insisting that Starlink has

Rick's work has been featured in

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others