THE MORNING LINE

Was China’s Kung Fu Moon-Shot Real?

Robot demonstrations are notorious for going comically awry. Seat Robby at a staged dinner and he will stab himself in the eye with a forkful of make-believe mashed potatoes. Have him put a butter dish back in the refrigerator and he’ll slam the door on his head. So what, then, are we to make of this video, which showcases China’s latest entry in the global competition to build robots that are more human?

Stunning, isn’t it? This is a kung-fu ballet, performed by acrobatic children and a troupe of robots who move with the gracefulness of dancers at the barre. When they abruptly shift gears, vaulting into ten-foot-high somersaults, they land squarely on the rubberized balls of their feet, perfectly balanced. Even more impressive is that there are a dozen of them doing these elaborately choreographed moves in perfect synchronicity.

Search Google for a skeptical take on all this and you have to call up a fifth page of results to find anyone who doubts the video is real. Ever the skeptic, my instinct is to disregard all the oohs and ahhs and focus on the doubters, just as many of us do with product reviews on Amazon. Here’s a jibe on X from an observer who supposedly witnessed a similar demonstration in Shenzen a month earlier: “The [robots were] slow, shaky and could barely shuffle, let alone do any of this. This isn’t the first time [Chinese manufacturer) Unitree has used CGI to fake capability.”

“13 Billion Views”

So who’s telling the truth? It’s an important question, since the video reportedly has attracted 13 billion views so far. That’s according to Chinese news sources, but does the outside world have any reason to trust them? The country’s leaders have a strong incentive to show off the nation’s technological prowess, especially when it is not a nuclear missile glowering at the world from Tiananmen Square. The kung fu demonstration was a very big deal in the world of technology, and if the video was not enhanced, the robots’ performance would be on a par with America’s moonshot in 1969 with Apollo 11.

Even Musk concedes that China is “kicking ass” in humanoid robotics. However, as we went to press, he had not commented publicly on the kung-fu demonstration, which was televised during China’s recent Spring Festival Gala. If the video turns out to have been undoctored, he’ll have his work cut out for him. Is there a cage-fight-of-the-century on the horizon?

Rick's Free Picks

$SIH26 – March Silver (Last:84.57)

I posted a moderately bearish note in Silver in the chat room Friday, but by day’s end the little monster was threatening to trash my logic. The March contract was on ‘mechanical’ short signals in two different time frames, one big, the other small, and things could have gone either

$TNX.X – Ten-Year Note Rate (Last:4.086%)

Last week’s decline in 10-Year rates was the biggest since September, catalyzed by Fed easing of 25 basis points. The chart implies there could be a further fall to as low as 3.706%, but I have my doubts. In fact, the steep slide triggered a ‘mechanical ‘buy’ at 4.073% that

$AAPL – Apple Computer (Last:264.59)

I restored AAPL to the core list last week with reservations. The company is a dim also-ran in the AI race, having only recently found a partner in Google, the creator of Gemini. There is also the chance Musk will eventually make iPhones obsolete. He keeps insisting that Starlink has

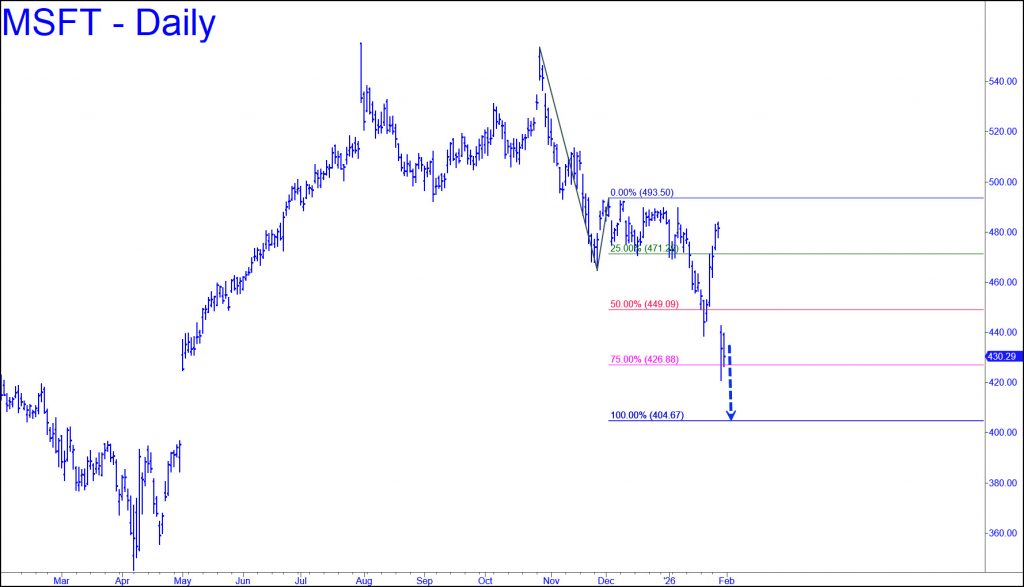

MSFT – Microsoft (Last:400.81)

A further fall to the 404.67 target would represent at 27% decline since the stock sputtered out in October at 553.72, just an inch shy of new record highs. The pattern doesn’t quite qualify as an ominous, island-reversal top, but it doesn’t take a chartist to feel the weight of

Rick's work has been featured in

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others