A week of all-but-insufferable tedium produced no moves up or down sufficient to trigger the 'mechanical' trade we'd set out to do. Both possibilities remain viable nonetheless, but it may require a high state of alertness early in the session if this trade is going to work at all. Otherwise, we can remain fixated on the unambitious target at 4588.50 -- not only as a lodestar for long positions, but as a place to get short if we've made a few bucks on the way up. _______ UPDATE (Sep 8, 8:42 p.m.): We've seen some potentially serious weakness materialize over the last two days while waiting for what seemed like a juicy short at 4588.50. The target must be regarded nonetheless as a good bet to be reached, since every rally target we've used over the last decade has been achieved. Regardless, bulls have looked pretty sickly lately, failing to lift this gas-bag to new highs after getting stopped out four times on the hourly chart. This suggests that shorts ahead of the weekend will enjoyable a favorable breeze, at least for a while. ______ UPDATE (Sep 9, 9:39 p.m.): My post in the chat room early in today's session caught the day's gratuitous hump perfectly, although the warning elicited no discernible interest. If you've come to the room to trade and make money, then by all means please let me know -- and don't be shy.

Rick Ackerman

GCZ21 – December Gold (Last:1799.00)

– Posted in: Current Touts Rick's Picks

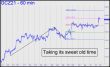

Gold ground tediously higher last week, using a five-day consolidation at p=1816 to launch a relatively measly $18 rally on Friday. We'll continue to use the 1850.60 target shown (a slight adjustment from earlier) as a minimum upside projection, but don't look for the uptrend to blow it away, given the week-long dirge at the midpoint pivot. If gold shocks by doing just that, you can use the 1916.20 target of this bigger, rABC pattern to inform your trades. Since it is a reverse-bullish pattern, with 'C' below 'A', it should work nicely for 'mechanical' setups. ______ UPDATE (Sep 8, 8:01 a.m.): Far from shocking us with a strong follow-through rally, gold plummeted, as it so often does, for no good reason. Let's avert our eyes for the time being, lest we start to believe this frustrating price-action actually means something.

SIZ21 – December Silver (Last:23.99)

– Posted in: Current Touts Rick's Picks

The bullish 'reverse' pattern shown is equivalent to the one given in the gold tout just above. It shows promise for 'mechanical' bids not only because the pattern itself is less visible to the riff-raff than a conventional ABC, but also because the bombed-out low (c) will cause most traders to think the rally is corrective. I do myself, but that wouldn't stop me from leveraging the pattern to get long if price action sets up the trade the way we require. The precise stall at p could also prove useful, since it augurs a tradeable pullback from 'D' precisely if the target is reached. _______ UPDATE (Sep 8, 8:56 p.m.): Let's shift our sights south, since the futures tripped a theoretical sell signal today. The more promising trade will entail bottom-fishing with rABC if the downtrend hits p=23.05, so stay tuned.

China’s Reforms Point the Way for Capitalism

– Posted in: Free Rick's Picks The Morning LineChina is easy to hate, since their leadership is at heart a bunch of double-dealing, lying commie rats. (And yes, the evidence is more than a little persuasive not only that they unleashed a deadly virus on the world, but that they took clandestine steps to protect themselves from it before going public with the bad news). There is nonetheless something to admire and even envy in the way China's leaders have been going about economic reform. For starters, Xi Jinping has declared war on tech companies perceived as having little to contribute to China's goal of economic, geopolitical, financial and cultural dominance. Not coincidentally, most of the targeted companies are in the same businesses as America's hottest firms: consumer goods, advertising, real estate, ride-sharing, finance, gaming and entertainment. Xi's denying Chinese firms in these sectors access to U.S. capital markets is akin to Biden's issuing a fatwah against glorified ad agencies like Google and Facebook, banning Twitter for incitement and casting out the moneylenders at Morgan Stanley. The CCP's clean-up campaign took an interesting -- some might say promising -- turn last week when they banned effeminate men from TV. It remains to be seen how a generation of children will fare in the relative absence of yin-saturated popular culture, but if it eventually produces a Chinese John Wayne, the West will face an even tougher adversary down the road. Terminal-Stage Consumerism It's not simply a matter of targeting the kinds of companies we associate with America's terminal-stage consumerism, income inequality and decadence. The CCP's reforms are also designed to shift investment capital toward industries positioned to provide a brighter economic future for the Chinese people, and to grow an economically robust middle class. This policy implicitly rejects and rebukes an American-style capitalism that has atrophied to the point

Betting on a Top in AAPL

– Posted in: Short TakesAAPL and QQQ are a micron from hitting MAJOR 'D' targets simultaneously. The QQQ chart is in the current tout. The AAPL chart is here: https://bit.ly/38wCGn3 I'd suggest Oct 1 135/140/145 put 'flies, paying no more than 0.30, but lowering the bid by a penny for each 20-cent rise above 153.90. That's where you should start trying to buy the spread (eight times, officially). If you can leg in for under 0.20 at any time over the next two weeks, put it on 50x.

ESU21 – Sep E-Mini S&P (Last:4526.25)

– Posted in: Current Touts Rick's Picks

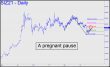

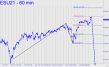

A secondary (p2) Hidden Pivot at 4515.56 remains all but certain to be achieved, as advertised in the chat room Friday. You can use this target and the pattern that produced it with confidence, given the way short-covering impaled p=4459 on the way up, then used it later to base. The pattern is sufficiently gnarly to obscure p2, and that's why I've suggested shorting there, either with a 'camouflage' set-up or a tight rABC. D=4571.50 is likely to work equally well if and when ES gets there. This seems probable, again because of the decisive push past p on the first attempt. The chart is tongue-and-cheek, a hopeful projection of a p2 reversal such as the world has never seen before. As always, our goal is not to nail the Mother of All Tops, but to get short in an opportune place with little at risk, and to be holding a partial position for a potential four-bagger. _______ UPDATE (Aug 30, 11:39 a.m.): This morning's lunatic leap through p=4525.38 has all but guaranteed more upside to at least the D=4588.50 target shown in this chart. Since a one- or two-level pullback seems unlikely, any 'mechanical' set-ups to get long will need to come from the smaller ABC that began with A= 4473.75 at 10:00 a.m. Friday on the hourly chart. ______ UPDATE (Aug 31, 7:30 p.m.): I like either of the two 'mechanical' possibilities shown in this chart: long or short, depending on what is offered us. Shoot for a one-level ride regardless, since price action looks too turgid at the moment to deliver anything more dramatic.

BRTI – CME Bitcoin Index (Last:47,040)

– Posted in: Current Touts Free Rick's Picks

Bertie took off after I pulled the 'mechanical' bid at the green line, rebuking me for the unpardonable sin of gutlessness. Even so, I won't start the new week feeling remorseful, since this vehicle has been very good to us whenever we've employed 'mechanical' bids on nasty pullbacks. This one simply wasn't nasty enough or we'd have elected the trade. Looking just ahead, bulls will face supply of geometrically increasing density above 50,000, although that will only slow the rally down somewhat, not reverse it decisively. 'Mechanical' buying opportunities are spent for the time being, although a pullback to the red line after p2=50,875 has been touched (but not exceeded by much) could be bought with a 46,953 stop-loss and a target at D=53,228. _______ UPDATE (Sep 2, 8:01 p.m.): The yo-yos and algos seem to be working "our" HP levels to death. Look at how studiously Bertie has avoided touching every line relevant to what would have become winning 'mechanical' trades. (We passed up one such trade ourselves when a pullback missed the green line by a millimeter on Aug 26). I am going to have to be more careful about whom I admit to the Wednesday tutorial sessions, since I don't want Goldman and Morgan Stanley riff-raff learning how we keep two steps ahead of their trading computers and math whizzes. _______ UPDATE (Sep 7, 10:01 p.m.): No sooner do I mention that the wack-jobs who flog this hoax have "figured out" ABCD levels and begun to use them ineffectually, than it dives 19% in the blink of an eye from within an inch of a too-clear 'D' target they'd fallen in love with. The news-media geniuses who pretend to make sense of such things embarrassed themselves as usual with an account that tied the plunge to El

IWM – Russell 2000 ETF (Last:223.91)

– Posted in: Current Touts Free Rick's Picks

In the Trading Room on Friday, "Statman" spotlighted a breakout in this vehicle, waking me from a long slumber. His breakout indicator probably differs from mine, since I'm focused on an intraday high that exceeded mid-July's 226.81 'external' peak by all of 22 cents, or about a tenth of one percent. But a breakout is a breakout, and so I've redrawn the chart to show what could happen if IWM is in fact beginning a big move in a very sneaky way. You can butterfly one-month calls near the 245 strike if that is your style, but we'll also look for intraday opportunities to board the underlying, provided there is a good show of interest in the chat room. (If you are new to Rick's Picks and butterfly spreads, use your account dashboard to access a free recorded lesson on how to do these spreads in our idiosyncratic, super-leveraged way.) _______ UPDATE (Sep 7, 10:06 p.m.): So far, price action has been garbage, with no even remotely interesting buying opportunities in more than a week._______ UPDATE (Sep 8, 9:02 p.m.): I've lost interest in attempting a 'mechanical' buy if IWM returns to x=217.06, since it would amount to 'sloppy fifths'.

GCZ21 – December Gold (Last:1820.50)

– Posted in: Current Touts Rick's Picks

I've grown so skeptical of gold's rallies that I didn't even mention the textbook 'mechanical' buy the December contract triggered last week on the pullback to the green line. It was worth $5,000 to anyone who bought there, and more power to you if you did without waiting for me to confirm. Since the pattern has worked so nicely for bulls, let's use D=1829.60 as a minimum upside objective. If that Hidden Pivot is decisively exceeded, the new target would be 1851.50, calculated by shifting B-C up a rung. Either target is worth shorting if you've made money on the way up, but I'd risk no more than $80 per contract with a 'camouflage' set-up or rABC.

SIU21 – September Silver (Last:23.97)

– Posted in: Current Touts Free Rick's Picks

Short covering on Powell's speech ripped through midpoint resistance at 23.83 with such force that there can be little doubt the 24.35 target will be reached. A swoon to the green line (23.56), however unlikely, can be bought 'mechanically', provided the futures have traded no higher than 24.20 first. A red-line bid would be expert play, but I'll leave it up to you -- and an extra note of caution if it triggers Sunday night. As always, a decisive move past D would imply a larger uptrend is at work with a correspondingly higher target. ______ UPDATE (Sep 1, 7:27 p..m): I'll go about three inches out on a limb with a prediction that December Silver will achieve the 24.70 target of this pattern sometime soon. It hasn't quite reached the 24.35 bigger-picture target of the pattern referenced above, but it has nonetheless pushed past the midpoint Hidden Pivot of a lesser one, This is mildly bullish, as the chart tries to make clear. ______ UPDATE (Sep 2, 11:23 p.m.): So much for giving silver the slight benefit of the doubt. After penetrating 'p' to the upside, the December contract scuddled sideways for a while and then dove on the opening. It did not penetrate the 'C' low of the bullish pattern, but it did trigger a 'mechanical' buy at x=24.00 that I had not recommended; nor will I ahead of a three-day weekend.